QUOTE(howszat @ Sep 7 2016, 10:06 PM)

Sorry I forgot about the Inter-Fund Switching since didn't do it before. Fundsupermart.com v15, 基金超市第十五章 - Rise the Dragon

Fundsupermart.com v15, 基金超市第十五章 - Rise the Dragon

|

|

Sep 7 2016, 10:38 PM Sep 7 2016, 10:38 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

|

|

|

Sep 7 2016, 10:47 PM Sep 7 2016, 10:47 PM

|

Senior Member

2,932 posts Joined: Sep 2007 |

Just a note that if you have funds from other non-FSM fund houses, you can also "switch" to FSM for zero costs.

Just sell your say, Public Mutual fund, email your PM redemption slip to FSM, and you can buy the equivalent amount of FSM fund for Zero sales charge. No, I don't work for FSM, thanks. |

|

|

Sep 7 2016, 11:36 PM Sep 7 2016, 11:36 PM

Show posts by this member only | IPv6 | Post

#143

|

Senior Member

10,001 posts Joined: May 2013 |

Just rec'd EISCF 1H2016 AR today

Based on recent small/mid cap meltdown in Bursa recently, they hold United U-Li share ony |

|

|

Sep 8 2016, 02:17 AM Sep 8 2016, 02:17 AM

|

Junior Member

311 posts Joined: Mar 2010 |

QUOTE(Ramjade @ Sep 7 2016, 10:31 AM) Fyi, I did not report anyrhing and most of what I post here get reported anyway. Being kedekut is the way to go sifus. There's a difference between being cheap and being frugal. Let you have lots of extra cash when your peers habis duit at the end of the month. Especially when you cannot print money or have unlimited amount of money. Quite dangerous to mistake one for the other. QUOTE(adele123 @ Sep 7 2016, 03:51 PM) Likelihood of a fire sale diminishing lor. Was actually hoping for a rate hike... Short term pain for long term gain. |

|

|

Sep 8 2016, 09:13 AM Sep 8 2016, 09:13 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(lukenn @ Sep 8 2016, 02:17 AM) There's a difference between being cheap and being frugal. IMHO - not cheap nor frugal la, VALUE hunter (worth vs cost of services/items) Quite dangerous to mistake one for the other. Likelihood of a fire sale diminishing lor. Was actually hoping for a rate hike... Short term pain for long term gain. Hard to reprogram views to look at value instead of at price or cost eg. until now (since my 20s) i've been trying to de-program momma (she's a stock "investor") like PBBank, Nestle, LPI VS low priced stocks look at Nestle, PBBank, LPI at the peak of 2007 VS end 2009 (right after worldwide credit crisis) VS now |

|

|

Sep 8 2016, 04:38 PM Sep 8 2016, 04:38 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(lukenn @ Sep 8 2016, 02:17 AM) Likelihood of a fire sale diminishing lor. Was actually hoping for a rate hike... Short term pain for long term gain. Do not fight against inertia aka Newton's second law of motion. What is in motion will continue to be in motion unless met with an opposing force. So if the trend is going uptrend, ride on its coattail. If going downtrend, do not catch a falling knife. Xuzen |

|

|

|

|

|

Sep 8 2016, 04:51 PM Sep 8 2016, 04:51 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(xuzen @ Sep 8 2016, 04:38 PM) Do not fight against inertia aka Newton's second law of motion. What is in motion will continue to be in motion unless met with an opposing force. Law of inertia is Netwon's first law; not second lawSo if the trend is going uptrend, ride on its coattail. If going downtrend, do not catch a falling knife. Xuzen |

|

|

Sep 8 2016, 05:07 PM Sep 8 2016, 05:07 PM

|

All Stars

33,617 posts Joined: May 2008 |

QUOTE(xuzen @ Sep 8 2016, 04:38 PM) Do not fight against inertia aka Newton's second law of motion. What is in motion will continue to be in motion unless met with an opposing force. As you already said it, law of inertia it's only for for case of without opposing force.So if the trend is going uptrend, ride on its coattail. If going downtrend, do not catch a falling knife. Xuzen In reality, friction or opposing force is always present. One friction force, for example, is the business fundamentals. As price moves further away from business fundamentals, the opposing force will push it back. Sorry for the intrusion .... That's why people believe in the opposing forces are always in play ..... This post has been edited by puchongite: Sep 8 2016, 05:11 PM |

|

|

Sep 8 2016, 05:08 PM Sep 8 2016, 05:08 PM

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

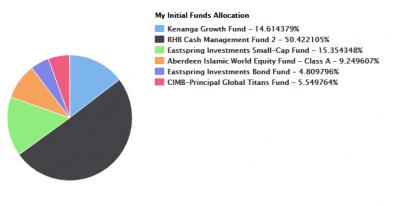

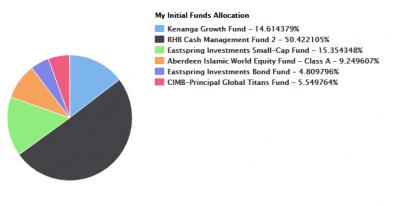

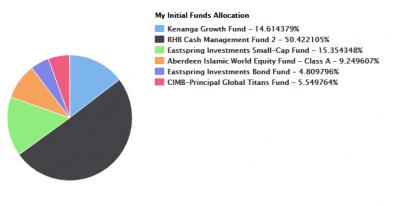

Hello...Take a look at my current allocations (ignore the cash management fund I suppose) Am I already too diversified? I'm 34, have about RM800 / month to invest and have a goal of 8% average by the time I retire. Should I look at China / India / Emerging markets as another avenue? I worried spread too thin based on my monthly capabilities. |

|

|

Sep 8 2016, 06:59 PM Sep 8 2016, 06:59 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(lee82gx @ Sep 8 2016, 05:08 PM)

Hello...Take a look at my current allocations (ignore the cash management fund I suppose) Am I already too diversified? I'm 34, have about RM800 / month to invest and have a goal of 8% average by the time I retire. Should I look at China / India / Emerging markets as another avenue? I worried spread too thin based on my monthly capabilities. |

|

|

Sep 8 2016, 07:10 PM Sep 8 2016, 07:10 PM

Show posts by this member only | IPv6 | Post

#151

|

Senior Member

3,968 posts Joined: Nov 2007 |

Ulicorp inching up = my UT going up weeeeee

|

|

|

Sep 8 2016, 08:36 PM Sep 8 2016, 08:36 PM

|

Junior Member

103 posts Joined: Nov 2009 |

QUOTE(lee82gx @ Sep 8 2016, 05:08 PM)

Hello...Take a look at my current allocations (ignore the cash management fund I suppose) Am I already too diversified? I'm 34, have about RM800 / month to invest and have a goal of 8% average by the time I retire. Should I look at China / India / Emerging markets as another avenue? I worried spread too thin based on my monthly capabilities. minimal top up of rm500 can cause your portfolio to be unbalanced. even if you top up Aberdeen once every 2 months, that's rm500/rm1600, 30% of your entire portfolio |

|

|

Sep 8 2016, 08:54 PM Sep 8 2016, 08:54 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

deleted

This post has been edited by T231H: Sep 8 2016, 08:55 PM |

|

|

|

|

|

Sep 8 2016, 09:13 PM Sep 8 2016, 09:13 PM

|

Senior Member

1,055 posts Joined: Nov 2015 |

|

|

|

Sep 8 2016, 09:24 PM Sep 8 2016, 09:24 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(David3700 @ Sep 8 2016, 09:13 PM) Sifu, for Asia Pac, any good one to recommend ? According to FSM...the "better" one is as per the listI am desperate to look for some good one since my current portfolio return is not up to expectation. https://www.fundsupermart.com.my/main/resea...tormaincode=All click on the name of the fund,....it will link you to the reasons why they says it is the "better" one. just NOT sure if that selections can "HELPS" you to improves your current portfolio returns.... I just know that, having a more globally diversified portfolio can helps to minimize some single country focus fund risk. btw, what is your expected portfolio returns? how long have you been invested? what is your portfolio compositions and in what % currently? |

|

|

Sep 8 2016, 10:14 PM Sep 8 2016, 10:14 PM

|

Senior Member

1,055 posts Joined: Nov 2015 |

QUOTE(T231H @ Sep 8 2016, 09:24 PM) According to FSM...the "better" one is as per the list Below is my portfolio, composition, return and duration :https://www.fundsupermart.com.my/main/resea...tormaincode=All click on the name of the fund,....it will link you to the reasons why they says it is the "better" one. just NOT sure if that selections can "HELPS" you to improves your current portfolio returns.... I just know that, having a more globally diversified portfolio can helps to minimize some single country focus fund risk. btw, what is your expected portfolio returns? how long have you been invested? what is your portfolio compositions and in what % currently? 1. Kenanga Asia Pacific Total Return Fund : 5% : 2.6% : 6 mths 2. CIMB Principal Asia Pacific Dynamic Income Fund : 5% : 2.6% : 12 mths 3. Affin Hwang Select Income Fund : 10% : 2.2% : 6 mths 4. Affin Hwang Select Asia (Ex Japan) Quantum Fund : 5% : 12.0% : 12 mths 5. Kenanga Growth Fund : 25% : (1.4%) : 12 mths 6. East Spring Investment MY Focus Fund : 5% : (3.9%) : 12 mths 7. CIMB Principal Global Titan Fund : 5% : (3.0%) : 12 mths 8. TA European Equity Fund : 30% : (0.7%) : 6 mths 9. East Spring Growth Fund : 10% : (5.7%) : 8 mths My expected return is must be better than term deposit of 4%. But most seems below expectation. Sifu, any advise ? () denotes negative This post has been edited by David3700: Sep 8 2016, 10:15 PM |

|

|

Sep 8 2016, 10:27 PM Sep 8 2016, 10:27 PM

Show posts by this member only | IPv6 | Post

#157

|

Junior Member

151 posts Joined: Apr 2013 |

QUOTE(David3700 @ Sep 8 2016, 10:14 PM) Below is my portfolio, composition, return and duration : Hey, I'm just a beginner here. Not sifu.1. Kenanga Asia Pacific Total Return Fund : 5% : 2.6% : 6 mths 2. CIMB Principal Asia Pacific Dynamic Income Fund : 5% : 2.6% : 12 mths 3. Affin Hwang Select Income Fund : 10% : 2.2% : 6 mths 4. Affin Hwang Select Asia (Ex Japan) Quantum Fund : 5% : 12.0% : 12 mths 5. Kenanga Growth Fund : 25% : (1.4%) : 12 mths 6. East Spring Investment MY Focus Fund : 5% : (3.9%) : 12 mths 7. CIMB Principal Global Titan Fund : 5% : (3.0%) : 12 mths 8. TA European Equity Fund : 30% : (0.7%) : 6 mths 9. East Spring Growth Fund : 10% : (5.7%) : 8 mths My expected return is must be better than term deposit of 4%. But most seems below expectation. Sifu, any advise ? () denotes negative From what I see, most profit is around 3%. If that's the case, isn't it better to put in FD ? |

|

|

Sep 8 2016, 10:34 PM Sep 8 2016, 10:34 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(David3700 @ Sep 8 2016, 10:14 PM) Below is my portfolio, composition, return and duration : as pointed out earlier by some forummers....many of the champions of past few years had not been doing well this year...1. Kenanga Asia Pacific Total Return Fund : 5% : 2.6% : 6 mths 2. CIMB Principal Asia Pacific Dynamic Income Fund : 5% : 2.6% : 12 mths 3. Affin Hwang Select Income Fund : 10% : 2.2% : 6 mths 4. Affin Hwang Select Asia (Ex Japan) Quantum Fund : 5% : 12.0% : 12 mths 5. Kenanga Growth Fund : 25% : (1.4%) : 12 mths 6. East Spring Investment MY Focus Fund : 5% : (3.9%) : 12 mths 7. CIMB Principal Global Titan Fund : 5% : (3.0%) : 12 mths 8. TA European Equity Fund : 30% : (0.7%) : 6 mths 9. East Spring Growth Fund : 10% : (5.7%) : 8 mths My expected return is must be better than term deposit of 4%. But most seems below expectation. Sifu, any advise ? () denotes negative ex, KGF, EIMYF = M'sia focused....are good example of that this year..... yr Asia Pac = 10% Euro = 30% Developed Mkts = 5% M'sia = 50% at 50% and with M'sia mkts not performing well this year...thus yr portfolio affected. looks like Asia Pac funds are running well this few months..... if you believe FSM,...try this to see how it should be allocated? Star Ratings For The Various Markets https://www.fundsupermart.com.my/main/resea...tarRatings.svdo https://www.fundsupermart.com.my/main/artic...pdf_Summary.pdf if you had 50% in M'sia the last few years..."huat abit liao".... |

|

|

Sep 8 2016, 10:37 PM Sep 8 2016, 10:37 PM

Show posts by this member only | IPv6 | Post

#159

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

Sep 8 2016, 10:41 PM Sep 8 2016, 10:41 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(jayzshadower @ Sep 8 2016, 10:27 PM) Hey, I'm just a beginner here. Not sifu. YES, that is why UTs investment is not for everyone....From what I see, most profit is around 3%. If that's the case, isn't it better to put in FD ? if he had that in 2015 that will be another story..... Equities investment is volatile and returns fluatuates....who know how it will go.... but if in FD one can know is about 3.5%..... |

|

Topic ClosedOptions

|

| Change to: |  0.0288sec 0.0288sec

0.25 0.25

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 07:56 AM |