» Click to show Spoiler - click again to hide... «

Only this is widely available for lay-person. J-alpha ratio, you sendiri kena kira, if you can get the fund beta available w.r.t. its benchmark.

» Click to show Spoiler - click again to hide... «

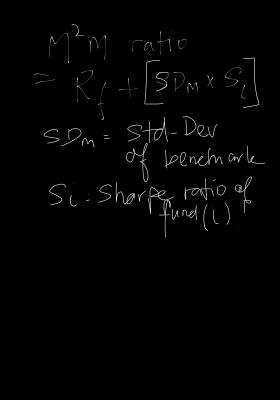

M2M formula bukan macam ni wor. Let me go back to my old notes and recheck the formula. IIRC the above macam tak betul aje!

» Click to show Spoiler - click again to hide... «

My own formula.

» Click to show Spoiler - click again to hide... «

No, I don't use their benchmark. For me, I choose AIF because risk / return for AIF is better than Ponzi 2.0. Next question you will ask, but AIF ROI is so low, how to carry makan right? Hence if you notice, my portfolio is made up of AIF which is stable and boring, but supplemented by a US fund (TA GTF) plus India. These are the Viagra booster. So, when one is constructing a portfolio, one needs to strategize. Algozen™ helps me in this department by finding the sweet-spot, the Goldilocks' point. The point where the risk and return are just optimized.

Xuzen

This post has been edited by xuzen: Oct 17 2016, 04:17 PM

Oct 17 2016, 04:15 PM

Oct 17 2016, 04:15 PM

Quote

Quote

0.0228sec

0.0228sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled