Outline ·

[ Standard ] ·

Linear+

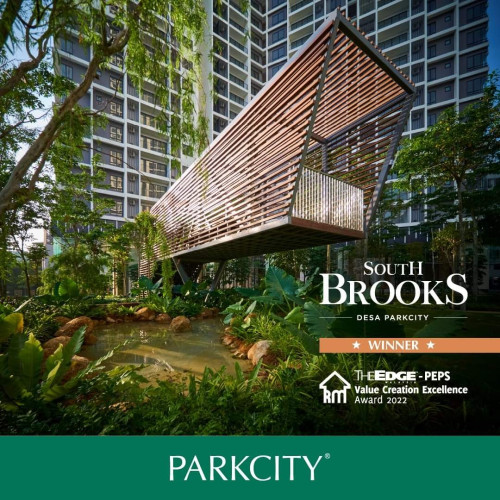

South Brooks @ Desa Parkcity, Launching mid 2017

|

Cavatzu

|

Nov 17 2021, 06:03 PM Nov 17 2021, 06:03 PM

|

|

QUOTE(submergedx @ Nov 6 2021, 09:06 AM) Some say pasar malam baju also can pakai, some will die die go boutique buy tee shirt. Nothing wrong with any choices, lu suka u buy and that's it. Umm this flippant attitude of comparing buying an asset almost a mill to buying a t shirt is exactly why the developers have profiteered over the years and young people taken in by the marketing gloss then duly suffer. No we can’t protect everyone from bad decision making. But this forum does serve as an additional resource to obtain insights and information that doesn’t come from a developer. |

|

|

|

|

|

Cavatzu

|

Aug 18 2022, 11:12 PM Aug 18 2022, 11:12 PM

|

|

QUOTE(mini orchard @ Feb 27 2022, 09:56 PM) All subsale is 'as is basis'. Buyer is deemed to have inspected the property and accept the condition. The DLP is between the developer and the primary purchaser b4 construction and has no connection with subsequent buyer. Read here .... https://www.iproperty.com.my/news/defect-li...-subsale-house/Comprehensive article. Another nail in the coffin for buying subsale unless it’s landed or Lelong. This post has been edited by Cavatzu: Aug 18 2022, 11:13 PM |

|

|

|

|

|

Cavatzu

|

Dec 15 2022, 08:23 AM Dec 15 2022, 08:23 AM

|

|

QUOTE(ManutdGiggs @ Nov 3 2022, 08:53 AM) Is this because it’s the only recently VP project that can sell above SPA price? |

|

|

|

|

|

Cavatzu

|

Dec 15 2022, 09:52 AM Dec 15 2022, 09:52 AM

|

|

QUOTE(ManutdGiggs @ Dec 15 2022, 08:45 AM) The award they won. They seem to be one of the few recently completed projects that is cashflow positive for buyers. Hence the award. |

|

|

|

|

|

Cavatzu

|

Aug 15 2023, 09:02 AM Aug 15 2023, 09:02 AM

|

|

QUOTE(AskarPerang @ Aug 14 2023, 07:19 PM) Really? Could be a really bad orientation unit. The empty ones seem to be going for around 3k+ for a 2 bed and it can hit 4K for fully furnished. Maybe it’s a Covid deal which hasn’t been renewed. |

|

|

|

|

|

Cavatzu

|

Aug 15 2023, 06:51 PM Aug 15 2023, 06:51 PM

|

|

QUOTE(PAChamp @ Aug 15 2023, 04:17 PM) What is the dev selling price? At 2.4k what is the rental yield? This was sold for less than 700 psf. This is still one of the more profitable developments that recently vp. |

|

|

|

|

|

Cavatzu

|

Jan 5 2024, 07:44 AM Jan 5 2024, 07:44 AM

|

|

QUOTE(Longshot @ Jan 5 2024, 06:45 AM) Good morning Boss, Fuiyoooh....lelong also start with rm870psf 💪 I guess with 920 total units, such case will eventually happen If I recall correctly, this unit was sapu quite early, price on launch day was around RM846K due to facing the twin jagung. Actual price could be lower due to the sales package and time of entry. 8th floor is also the facilities deck, so less 1 unit on that floor, less 1 neighbor but more foot traffic. This unit might have a good view of the recent year-end fireworks 😜 Good luck to those who intent to grab. But likely price will go up due to number of bidders Are they pricing this above SPA price? Can they do that? Quite interesting to see what happens when you have a very strong performing development where the market price is above SPA price go to auction. Almost unheard of but this is the test case. |

|

|

|

|

|

Cavatzu

|

Jan 5 2024, 03:15 PM Jan 5 2024, 03:15 PM

|

|

QUOTE(Longshot @ Jan 5 2024, 08:58 AM) Boss, I not familiar with auction procedures and laws but I have seen many older units that are put up for auction at prices way higher than SPA. Maybe should ask Soldier boss....ya Yea of course over a long period of time market price will be more. I meant in terms of recently VP developments they almost always auction at a discount except for rumahwip. This post has been edited by Cavatzu: Jan 5 2024, 03:16 PM |

|

|

|

|

|

Cavatzu

|

Mar 12 2025, 02:05 PM Mar 12 2025, 02:05 PM

|

|

QUOTE(AskarPerang @ Mar 12 2025, 01:54 PM) Another lelong unit check in. Not sure this unit will be called off or not.  First time I see Lelong price way above SPA price. This was about 700 psf during launch isn’t it. This post has been edited by Cavatzu: Mar 12 2025, 02:06 PM |

|

|

|

|

|

Cavatzu

|

Mar 12 2025, 11:49 PM Mar 12 2025, 11:49 PM

|

|

Really curious if this is the start of Australia style property auctions where the intent is to drive up prices between competing buyers in lieu of traditional private bid transactions. It’s also very low effort from the seller/auctionee.

|

|

|

|

|

|

Cavatzu

|

Mar 13 2025, 09:39 AM Mar 13 2025, 09:39 AM

|

|

QUOTE(icemanfx @ Mar 13 2025, 08:12 AM) Many of Aussie poorperly auction bidders are cash buyers. How many cash buyers in kv? Even during the peak of kv poorperly bull run, private auction couldn't take place. What's more in current market sentiment. Not true. Yes there’s some competition between property investors and actual home buyers. The problem is and always has been low supply and high demand. The bar has raised in Australia - you either need generational wealth, prior investments, or dual income. It’s very very hard to buy as an individual. |

|

|

|

|

Nov 17 2021, 06:03 PM

Nov 17 2021, 06:03 PM

Quote

Quote

0.0828sec

0.0828sec

1.19

1.19

7 queries

7 queries

GZIP Disabled

GZIP Disabled