|

ninjawin

|

Jul 7 2016, 02:49 PM Jul 7 2016, 02:49 PM

|

Getting Started

|

QUOTE Yuan Tumbling Again Leaves Investors Unperturbed in Win for PBOC http://www.bloomberg.com/news/articles/201...in-win-for-pbocIf China adjust d rate, MYR will follows Nope. I dont think Banks can afford to cut anymore rates. Look at the FD promos.. Rephrase: Banks in Malaysia only This post has been edited by ninjawin: Jul 7 2016, 02:49 PM |

|

|

|

|

|

ninjawin

|

Jul 8 2016, 01:10 AM Jul 8 2016, 01:10 AM

|

Getting Started

|

QUOTE(AVFAN @ Jul 7 2016, 03:18 PM) can you explain a bit why fd promos determine bank int rates? if gdp is too low, bnm need to loosen to stimulate the economy, cut opr, can the banks keep high rates fd? what about lending rates then? Bank FD promos doing as high as above 4.4% while the rates are getting more attractive. This means that banks are having issues getting cash(liquidity) depositors. Meanwhile bank are giving out majority home loan at 4.45% ?? These are not the effective rates of course but it seems that banks are operating perhaps in very very thin margin or no margin. This is why home loan have very high rejection rates. Yes.. bank can reduce interest rates to stir economy. The last time. BNM only dared to reduce the SRR instead of OPR. Cutting down interest rates will have huge effect of bank's profitability. A few banks are already retreching. This is why a few banks already increased their BR/BLR on their own. Not to mention NPL is increasing in Malaysia at around 2%. 1mdb default is also another issue. Since this company's debt is guaranteed by gov , borrowing cost by our gov may go up due to credit ratings. Just my opinion. |

|

|

|

|

|

ninjawin

|

Jul 8 2016, 11:36 AM Jul 8 2016, 11:36 AM

|

Getting Started

|

QUOTE(AVFAN @ Jul 8 2016, 01:29 AM) does that mean bnm can cut whatever it wants but the banks can simply ignore it? i don't think so.. a lot of loans still tied wif old BLR.. It will be interesting to see BNM reducing interest rates...it's like using steroid. Short term benefits and long effects. |

|

|

|

|

|

ninjawin

|

Jul 9 2016, 09:00 AM Jul 9 2016, 09:00 AM

|

Getting Started

|

QUOTE(AVFAN @ Jul 8 2016, 01:30 PM) tq for response. can u confirm banks NEED to follow bnm if rate cut? ninja seem to think otherwise - banks can ignore bnm, keep same own lending/fd rates. there are things that Banks can do however it will still be effected by major changes in OPR. Some banks have adjusted interest rates on their own a few times this year http://www.baserate.co/public-bank-hong-le...interest-rates/ |

|

|

|

|

|

ninjawin

|

Jul 10 2016, 01:09 PM Jul 10 2016, 01:09 PM

|

Getting Started

|

QUOTE(nexona88 @ Jul 10 2016, 10:37 AM) 3.80 myr is someone's wet dreams  buy USD at 3.80..sell back at 4.1 |

|

|

|

|

|

ninjawin

|

Jul 11 2016, 12:36 AM Jul 11 2016, 12:36 AM

|

Getting Started

|

QUOTE(nexona88 @ Jul 10 2016, 03:01 PM) Good luck  Buy low sell high have some risk.. What if it didn't meteralized.. Lose money lor.. i already earn some last time i guess BE if it happens or just lose a bit....oil falling like sack..at the rate..probably will drag MYR down..anyway just play small small..diversify a bit.. This post has been edited by ninjawin: Jul 11 2016, 12:38 AM |

|

|

|

|

|

ninjawin

|

Jul 12 2016, 08:58 AM Jul 12 2016, 08:58 AM

|

Getting Started

|

QUOTE(wil-i-am @ Jul 11 2016, 05:16 PM) U have a lot of open position? long term effect not here yet |

|

|

|

|

|

ninjawin

|

Jul 20 2016, 04:41 PM Jul 20 2016, 04:41 PM

|

Getting Started

|

QUOTE(wil-i-am @ Jul 20 2016, 11:11 AM) Touching 4.04 a bit today. time to cash out USD at > 4.1 This post has been edited by ninjawin: Jul 20 2016, 04:43 PM |

|

|

|

|

|

ninjawin

|

Jul 21 2016, 10:42 AM Jul 21 2016, 10:42 AM

|

Getting Started

|

QUOTE(AVFAN @ Jul 21 2016, 09:52 AM) n or s is confusing. some people say north when they mean rm getting a bigger no., depreciating. i don't see it going higher than 4.05 so soon. Touched 4.048 on 15m chart today. Dont buy/sell on what u believe in. Buy/sell on what the chart tells you |

|

|

|

|

|

ninjawin

|

Jul 21 2016, 11:01 AM Jul 21 2016, 11:01 AM

|

Getting Started

|

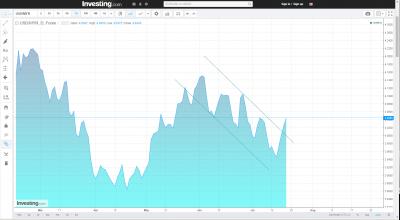

QUOTE(AVFAN @ Jul 21 2016, 10:54 AM) mind to share what is the chart telling u now? actually already touched 4.05 just now.. i think if it opens at 4.068 , the chances of going up is higher. there may also be slight retracement as got some resistance there This post has been edited by ninjawin: Jul 21 2016, 11:03 AM Attached thumbnail(s)

|

|

|

|

|

|

ninjawin

|

Jul 21 2016, 11:14 AM Jul 21 2016, 11:14 AM

|

Getting Started

|

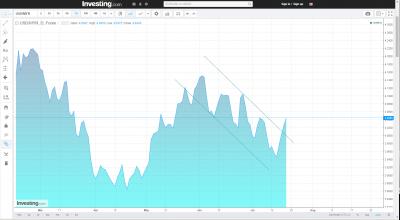

QUOTE(AVFAN @ Jul 21 2016, 11:07 AM) thanks for sharing. but based on that, should one buy or sell usd now? Im keeping till for 4.1 ..it's just my opinion.. i understand my risk and knows what i'll be losing.  Now it's 4.0503 already Attached thumbnail(s)

|

|

|

|

|

|

ninjawin

|

Jul 21 2016, 12:36 PM Jul 21 2016, 12:36 PM

|

Getting Started

|

QUOTE(AVFAN @ Jul 21 2016, 12:30 PM) ya, i hope so. i am not trading fx, just usd equities. 4.1, ok... but i am looking for 4.2x early next year.   seems 4.06 on the way... |

|

|

|

|

|

ninjawin

|

Jul 21 2016, 11:03 PM Jul 21 2016, 11:03 PM

|

Getting Started

|

4.1 , 4.14 if break 4.14 will go upwards

|

|

|

|

|

|

ninjawin

|

Jul 21 2016, 11:54 PM Jul 21 2016, 11:54 PM

|

Getting Started

|

QUOTE(wil-i-am @ Jul 21 2016, 11:16 PM) hahaha..of course i wish it goes higher.. but i do whatever graph tells me to.  i believe 4.1 is quite possible (provided no fundamental change) . Once hit 4.1 it will decide whether it will head north or south again. This post has been edited by ninjawin: Jul 21 2016, 11:58 PM |

|

|

|

|

|

ninjawin

|

Jul 23 2016, 10:17 PM Jul 23 2016, 10:17 PM

|

Getting Started

|

QUOTE(KTCY @ Jul 22 2016, 01:43 AM) dateline ?  No idea.. 4.0782 now..i guess anytime. |

|

|

|

|

|

ninjawin

|

Jul 23 2016, 10:20 PM Jul 23 2016, 10:20 PM

|

Getting Started

|

QUOTE(AVFAN @ Jul 23 2016, 10:48 AM) if data continues to improve, the chance of rate hike will rise thru dec. for now, this factor is probably going to be the most impt for USD-RM. Futures show a 45% chance of the Federal Reserve increasing interest rates by December, compared with 9% at the end of June, after data on retail sales, housing and employment in the U.S. beat economists’ estimates.Do you mean Fed rate hike? Maybe...all the effect from Brexit seems not as bad as expected. US stock all time high. Gold retraced a little..maybe it's not so bad after all |

|

|

|

|

|

ninjawin

|

Jul 24 2016, 03:22 PM Jul 24 2016, 03:22 PM

|

Getting Started

|

QUOTE(wil-i-am @ Jul 24 2016, 01:34 PM) Those who r keen to lock-in gud rate for USD may try tis link as they offer USD/MYR @ 4.044 now http://eforex.com.my/index.phpthis is one scary website. |

|

|

|

|

|

ninjawin

|

Jul 25 2016, 12:13 AM Jul 25 2016, 12:13 AM

|

Getting Started

|

QUOTE(nexona88 @ Jul 24 2016, 03:41 PM) u have use it before?   This is just purely my opinion. The site doesnt seem to have enough authority. It has a DA of 10 and PA of 1 which means that this site is not really well known. https://moz.com/researchtools/ose/ I can't be sure if this site is young. The design also does not seem professional enough for a finance related site. Personally.. I won't spend more than few hundreds on these kind of sites. I will definitely go for COD transaction when dealing with something like these. This post has been edited by ninjawin: Jul 25 2016, 12:18 AM |

|

|

|

|

|

ninjawin

|

Jul 25 2016, 12:25 AM Jul 25 2016, 12:25 AM

|

Getting Started

|

QUOTE(nexona88 @ Jul 25 2016, 12:20 AM) wah didn't know we can "test" the website. thanks for the link... anyhow the website is from Merchantrade Asia, Malaysia’s leading licensed remittance company  and also An Affiliate of Sumitomo Corporation & Celcom Axiata Bhd  ok..then maybe safer..but they could have make it look more authority. just fyi.. maybank2u has DOMAIN AUTHORITY 62 PAGE AUTHORITY 68 so 62 vs 10 is huge difference , PA 0 also doesn't help at all. I will hesitate to put money on somewhere with less than 20 DA. The design also looks like 2 days website. |

|

|

|

|

|

ninjawin

|

Jul 25 2016, 10:05 PM Jul 25 2016, 10:05 PM

|

Getting Started

|

QUOTE(nexona88 @ Jul 25 2016, 12:14 PM) so u mean the higher Domain Authority the better? and also PA? sorry I bit noobie on this kind of thing.. the link u gave to me previously also is very new info to me.. Yes. Google will have 100DA. |

|

|

|

|

Jul 7 2016, 02:49 PM

Jul 7 2016, 02:49 PM

Quote

Quote

0.1028sec

0.1028sec

0.19

0.19

7 queries

7 queries

GZIP Disabled

GZIP Disabled