QUOTE(lilsunflower @ Sep 29 2016, 05:34 PM)

1. Item 4 of the FAQ says no annual fee. Which means no annual fee. Don't worry.

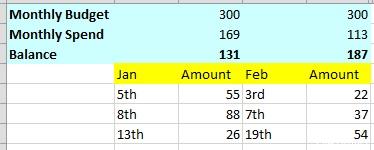

2. Regarding budget. Why not you create a simple Excel sheet (see attached sample which took me 1 minute). Then can easily track

.

3. CIMB Clicks - Typically 1-3 days max to show up.

4. If you're REALLY super worried about exceeding, perhaps you check whether buying a Petronas Gift Card from Petronas qualifies for the cashback. Or you can self-experiment. For example, go to Petronas and buy a gift card for the lowest denomination (don't know how much this is) and pay using your Petronas CC. Once you've bought the card, call CIMB Customer Service and ask them to check your latest transaction and confirm if this will qualify for the cashback.

IF the Gift Card method works and you're really scared to use your CC, then you can just Reload RM300 monthly (or whatever amount you wish) into your Gift Card using your CC. Lock your CC up in a drawer, and just use your Gift Card for petrol.

I personally think that using CC is much much more convenient, but I have set out the above alternative for you to consider.

First of all, I really appreciate your information.

Now, I have more understanding and confidence in using my CC. I'll check out the Petronas Gift Card.

Another question:

I've been told by some people before that If we use CC/Debit Card to fill up for Petrol, the bank will charge RM300 prepayment at first and they will charge the real amount after few working days and return the RM300. Do you mind explaining about this?

Let's say, if on Saturday I fill up RM100 worth of Petrol, bank will deduct RM300 then on Sunday or perhaps the same day I fill up another RM50 worth of Petrol, they will charge another RM300 right? So in total the prepayment is RM600. Is this correct?

This prepayment won't affect my monthly payment right as in I don't need to pay this prepayment even tho the prepayment happens on the day of the statement cycle ?

QUOTE(edwardccg @ Sep 29 2016, 05:51 PM)

There are many useful expense tracking app out there.

I have been using Andro Money to help me keep track of my expenses on bank account & CC for more than 3 years. But it rely on user to key in your expenses

https://play.google.com/store/apps/details?...y.android&hl=enfor cashback, i created one google sheet online for input the amount spend and having the sheets formula to calculate effective cashback and quota.

This sounds great. I will check this out. We have our phones with us all the time hence I think this should be a good method to keep track unless we forget to key in.

Thank you for the information!

Sep 29 2016, 10:02 AM

Sep 29 2016, 10:02 AM

Quote

Quote

0.0236sec

0.0236sec

0.80

0.80

6 queries

6 queries

GZIP Disabled

GZIP Disabled