lol... a lot of bs... and edca might as well go full martingale... lol

fact is a lot of ppl can only dca because waiting for payday... and must buy something... and not financial savvy enough...

anyways...

"Although averaging down offers some aspects of a strategy, it is incomplete. Averaging down is really an action that comes more from a

state of mind than from a sound investment strategy. Averaging down allows an investor

to cope with various cognitive or emotional biases. It acts more as a security blanket than a rational policy.

The problem with averaging down is that the average investor has very little ability to distinguish between a temporary drop in price and a warning signal that prices are about to go much lower.

Proponents of the technique view averaging down as a cost-effective approach to wealth accumulation; opponents view it as a recipe for disaster.

This strategy is often favored by investors who have a long-term investment horizon and a value-driven approach to investing. Investors that

follow carefully constructed models they trust might find that adding exposure to a stock that is undervalued,

using careful risk-management techniques, can represent a worthwhile opportunity over time."

y'all can read it all here...

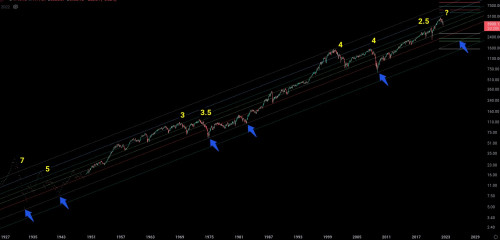

https://www.investopedia.com/terms/a/averagedown.aspDCA in index fund when the market has fallen 40% of the peak, continue to buy until the round bottom is form i think is a good idea

and newbie if not careful with their money, can die too to doing lump sum investment during bull trap period

Jun 24 2022, 01:25 PM

Jun 24 2022, 01:25 PM

Quote

Quote

0.5012sec

0.5012sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled