Outline ·

[ Standard ] ·

Linear+

USA Stock Discussion v8, Brexit: What happens now?

|

Medufsaid

|

Feb 5 2022, 09:58 AM Feb 5 2022, 09:58 AM

|

|

crypto didn't have this correlation before. I blame cash-settled bitcoin futures and ETFs like $BITO (first established in Q4 2021) for it

This post has been edited by Medufsaid: Feb 5 2022, 09:59 AM

|

|

|

|

|

|

Medufsaid

|

Feb 16 2022, 01:59 PM Feb 16 2022, 01:59 PM

|

|

ppl can tell you what they think at that 1 given point in time, but no obligation to ping you again if they changed their mind. morning hodl closing bell sell

This post has been edited by Medufsaid: Feb 16 2022, 02:00 PM

|

|

|

|

|

|

Medufsaid

|

Mar 4 2022, 01:51 PM Mar 4 2022, 01:51 PM

|

|

i think this is why

|

|

|

|

|

|

Medufsaid

|

Mar 15 2022, 04:58 PM Mar 15 2022, 04:58 PM

|

|

i'm actually worried (like, 5%-15% more worried than usual) after seeing Hang Seng, that the ukraine crash hasn't properly hit US markets yet.

hopefully i'm wrong

|

|

|

|

|

|

Medufsaid

|

Apr 12 2022, 11:10 AM Apr 12 2022, 11:10 AM

|

|

QUOTE(Lon3Rang3r00 @ Apr 12 2022, 09:18 AM) I wonder how Options can perform during downtrend? my only advice is to monitor them yourself. if your broker isn't able to provide additional data (e.g., breakeven prices after commission for various option strategies), you'll have to create an excel file yourself (i noticed the other posters in the lowyat options thread doing the same too). This post has been edited by Medufsaid: Apr 12 2022, 11:11 AM |

|

|

|

|

|

Medufsaid

|

Apr 12 2022, 11:29 AM Apr 12 2022, 11:29 AM

|

|

market go no where - only selling options can make $ (need to make it clear else one might assume options is a free lunch)

This post has been edited by Medufsaid: Apr 12 2022, 11:46 AM

|

|

|

|

|

|

Medufsaid

|

Apr 12 2022, 10:54 PM Apr 12 2022, 10:54 PM

|

|

what tail risk event? when you have a covered call position and the stock goes to the moon?

|

|

|

|

|

|

Medufsaid

|

Apr 12 2022, 11:05 PM Apr 12 2022, 11:05 PM

|

|

well as long as you don't sell too much calls that can't be covered by your stocks, and you accept that there's a 5% chance your stocks will shoot up and you miss out, it's not unexpected QUOTE(TOS @ Apr 12 2022, 10:48 PM) Told you many times it's "risk premium" yup, options is actually like "insurance". hence, "premium" This post has been edited by Medufsaid: Apr 12 2022, 11:11 PM |

|

|

|

|

|

Medufsaid

|

Apr 13 2022, 10:29 PM Apr 13 2022, 10:29 PM

|

|

he can always DCA into US domicile ETFs as long as it isn't dividend season, then switch over to irish when he has accumulated enough. whether it's worth the hassle would be for him to calculate

This post has been edited by Medufsaid: Apr 13 2022, 10:33 PM

|

|

|

|

|

|

Medufsaid

|

Apr 14 2022, 10:30 PM Apr 14 2022, 10:30 PM

|

|

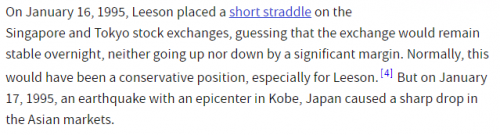

for selling buying options, the mechanism is just like shares. (i'll omit the exercising options part for simplicity) yes as long as there's willing buyer, you can sell as many options as you want (provided you have enough capital for margin), even if it ends up bankrupting you/your bank. google Nick Leeson  This post has been edited by Medufsaid: Apr 14 2022, 10:33 PM This post has been edited by Medufsaid: Apr 14 2022, 10:33 PM |

|

|

|

|

|

Medufsaid

|

Apr 15 2022, 12:24 PM Apr 15 2022, 12:24 PM

|

|

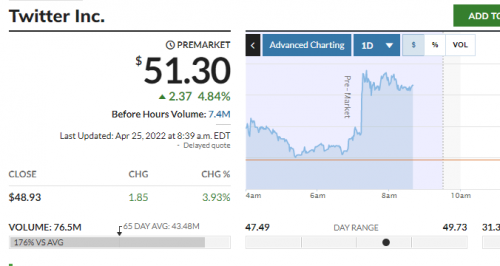

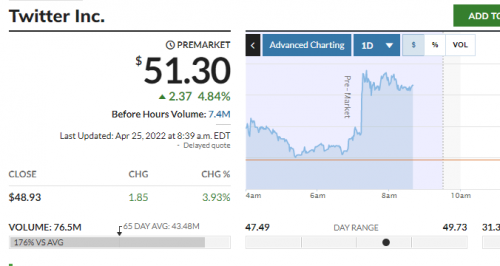

have to wait and see. twitter also fighting back

|

|

|

|

|

|

Medufsaid

|

Apr 19 2022, 09:35 AM Apr 19 2022, 09:35 AM

|

|

or exercised some call options (with an odd strike price)  |

|

|

|

|

|

Medufsaid

|

Apr 19 2022, 11:34 AM Apr 19 2022, 11:34 AM

|

|

a call with a strike price of $2450 is ITM right? Ramjade could've bought a call with that strike price. current stock price is 2559.22. unless you want to imply i hallucinate when i was trading options

This post has been edited by Medufsaid: Apr 19 2022, 11:38 AM

|

|

|

|

|

|

Medufsaid

|

Apr 20 2022, 02:37 PM Apr 20 2022, 02:37 PM

|

|

same goes for FB... market closed already but before can have dinner, already gone 21%

|

|

|

|

|

|

Medufsaid

|

Apr 23 2022, 01:58 AM Apr 23 2022, 01:58 AM

|

|

First time see this "batman" indicator QUOTE(Lon3Rang3r00 @ Apr 22 2022, 11:15 PM) Those with options also will have an eye/notification enabled to inform them if the market shifted close to their strike price, they might need to manually intervene and adjust accordingly to prevent huge losses. the original intention of options (and futures) is to allow big players to sleep better at night (ironic i know) you pay a small fee (called a risk premium) with the expectation of not seeing it again ( total loss, not just huge loss), so that you don't make emotional decisions with your underlying stocks (which would result in a bigger loss than your original premium) if you can't sleep at night playing options, it's bcos you are a retail investor given easy access to it by stock brokers to earn your commission. This post has been edited by Medufsaid: Apr 23 2022, 08:53 AM |

|

|

|

|

|

Medufsaid

|

Apr 24 2022, 11:48 AM Apr 24 2022, 11:48 AM

|

|

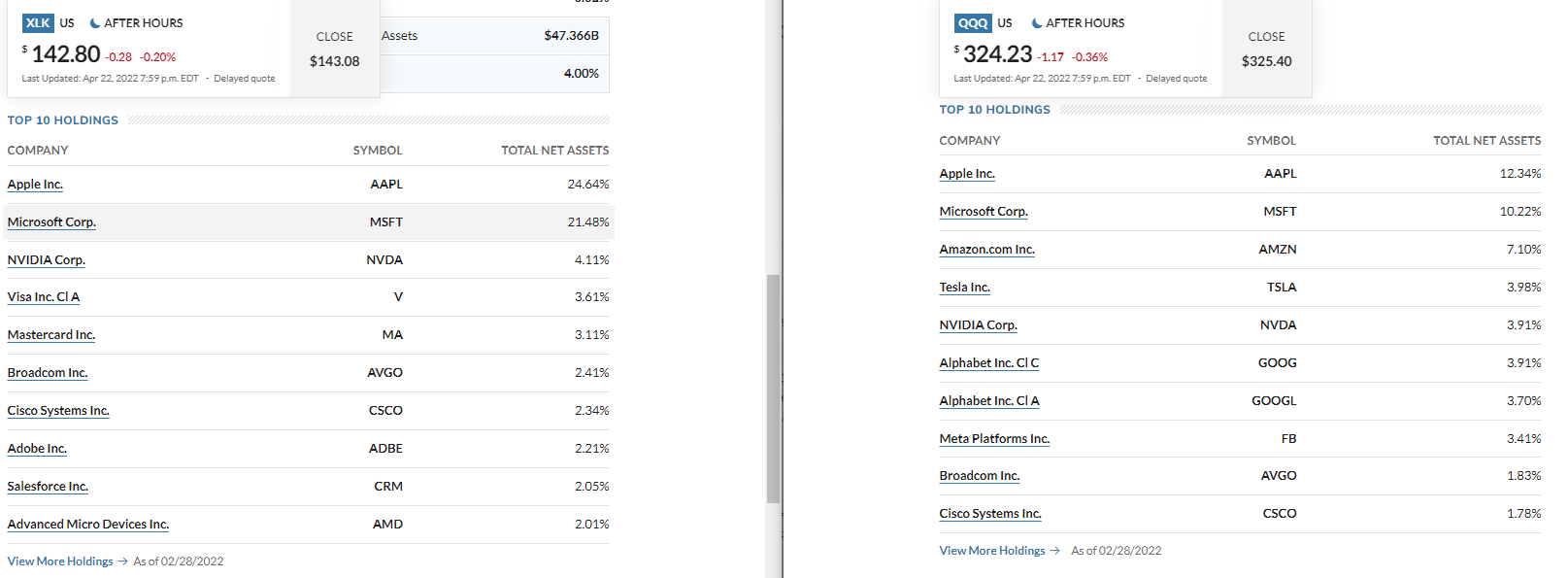

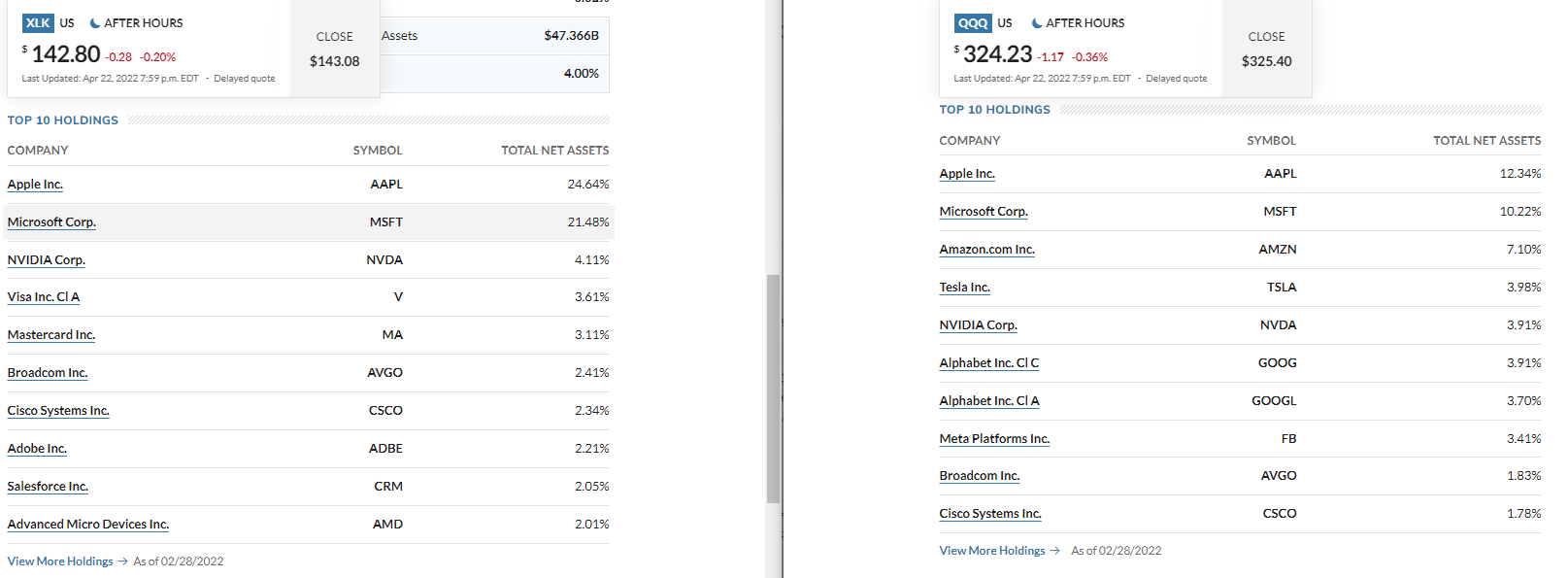

can always QQQ or XLK them  |

|

|

|

|

|

Medufsaid

|

Apr 24 2022, 08:29 PM Apr 24 2022, 08:29 PM

|

|

unless of course you are in an european-style options market where buyers can only cash in on expiration date.

and also, you can buy-to-close (esp if there's a profit) so your stocks isn't necessarily frozen till expiry

This post has been edited by Medufsaid: Apr 24 2022, 08:34 PM

|

|

|

|

|

|

Medufsaid

|

Apr 24 2022, 08:38 PM Apr 24 2022, 08:38 PM

|

|

sell put yea... not sell call

if first weeks drop, there's still a time value of 3 weeks... so it may be more profitable to close the option position rather than exercising

This post has been edited by Medufsaid: Apr 24 2022, 08:53 PM

|

|

|

|

|

|

Medufsaid

|

Apr 25 2022, 08:39 PM Apr 25 2022, 08:39 PM

|

|

Twitter has a new master called Elon  This post has been edited by Medufsaid: Apr 25 2022, 08:40 PM This post has been edited by Medufsaid: Apr 25 2022, 08:40 PM |

|

|

|

|

|

Medufsaid

|

Apr 27 2022, 09:54 AM Apr 27 2022, 09:54 AM

|

|

feels like catching falling daggers season

|

|

|

|

|

Feb 5 2022, 09:58 AM

Feb 5 2022, 09:58 AM

Quote

Quote

0.4192sec

0.4192sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled