https://www.bloomberg.com/news/articles/202...pping-forecasts

QUOTE

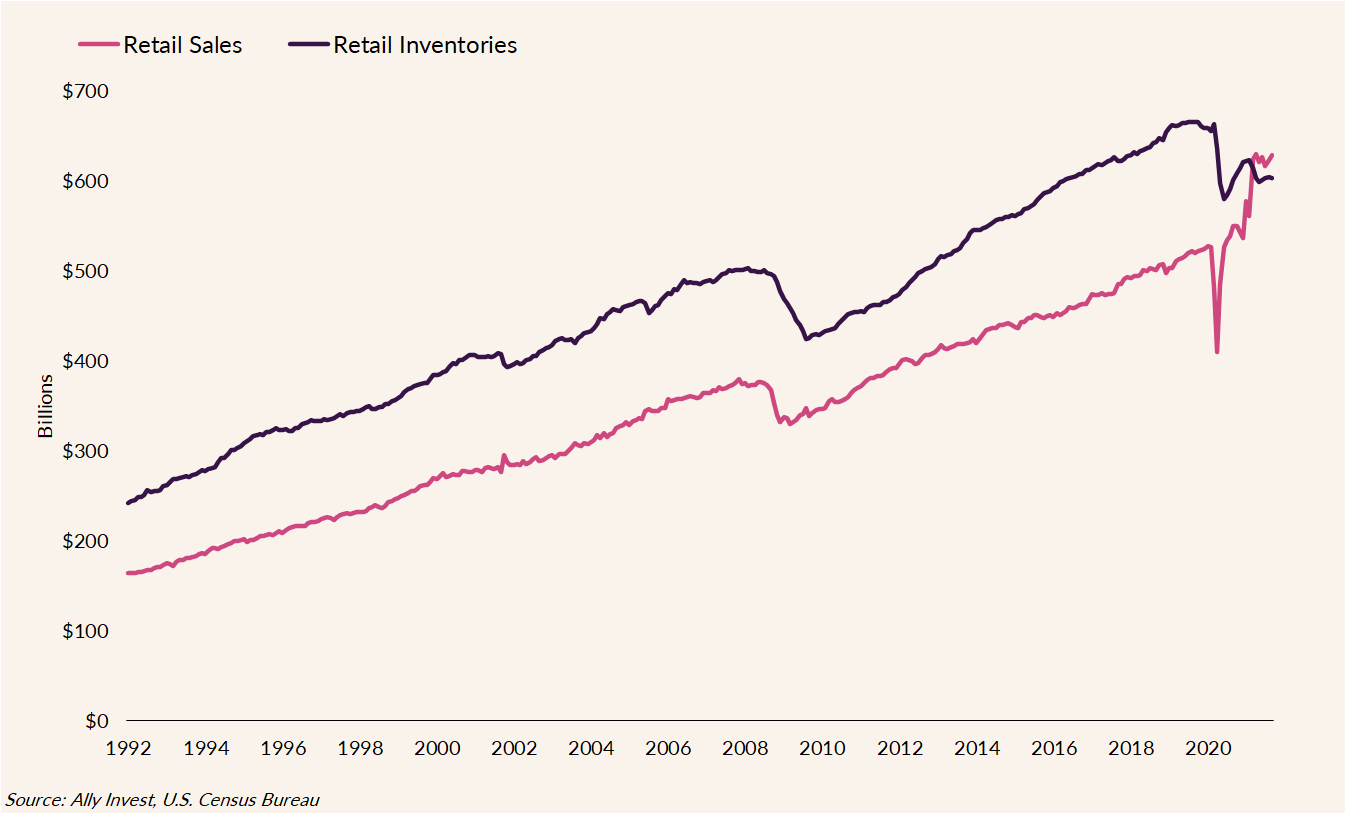

U.S. retail sales rose in October for a third month, signaling households continue to spend even with the fastest inflation in decades.

The value of overall retail purchases increased 1.7% last month, the most in seven months, following an upwardly revised 0.8% advance in September, Commerce Department figures showed Tuesday. Excluding gas and motor vehicles, sales gained 1.4% in October. The figures aren’t adjusted for price changes.

The median estimate in a Bloomberg survey of economists called for a 1.4% advance in overall retail sales. Stock futures wavered while the 10-year Treasury yield fluctuated and the dollar was little changed.

The broad-based gain in spending highlights how elevated savings and rising wages have helped Americans sustain a robust pace of merchandise spending. Though total retail sales are well-above pre-pandemic levels, a recent inflation-driven collapse in consumer sentiment risks a future tempering in demand.

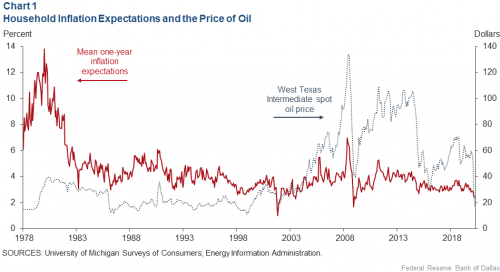

U.S. prices are rising at the fastest pace in 30 years as businesses pass on growing labor and input costs to customers, but it’s hard to tell just how much that’s impacting demand since the figures aren’t adjusted for inflation. Inflation-adjusted consumer spending data for October will be released next week.

The value of overall retail purchases increased 1.7% last month, the most in seven months, following an upwardly revised 0.8% advance in September, Commerce Department figures showed Tuesday. Excluding gas and motor vehicles, sales gained 1.4% in October. The figures aren’t adjusted for price changes.

The median estimate in a Bloomberg survey of economists called for a 1.4% advance in overall retail sales. Stock futures wavered while the 10-year Treasury yield fluctuated and the dollar was little changed.

The broad-based gain in spending highlights how elevated savings and rising wages have helped Americans sustain a robust pace of merchandise spending. Though total retail sales are well-above pre-pandemic levels, a recent inflation-driven collapse in consumer sentiment risks a future tempering in demand.

U.S. prices are rising at the fastest pace in 30 years as businesses pass on growing labor and input costs to customers, but it’s hard to tell just how much that’s impacting demand since the figures aren’t adjusted for inflation. Inflation-adjusted consumer spending data for October will be released next week.

Nov 16 2021, 10:27 PM

Nov 16 2021, 10:27 PM

Quote

Quote

0.4537sec

0.4537sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled