my read is a little different, more like dan's.

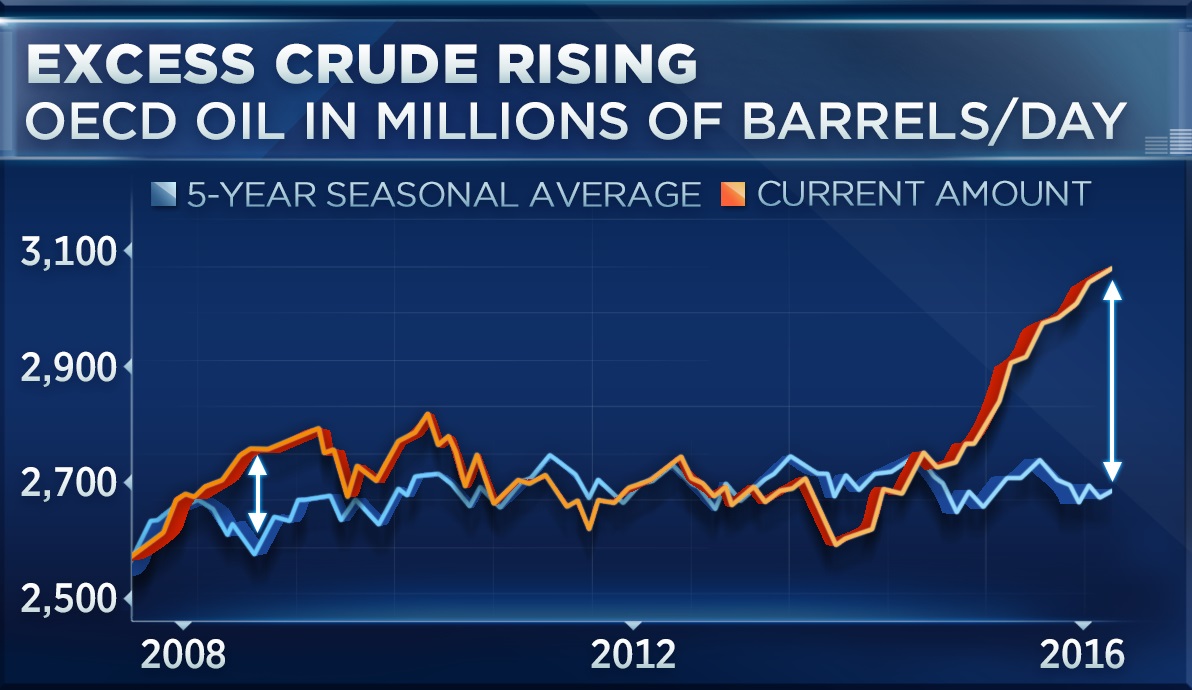

slacks in opec have been picked up by others. strikes, fires, rebels have also contributed to erratic price spikes but all that is over. and there is iran pumping away as #2; new fields in khazakhstan and gulf of mexico coming onstream. there is simply no shortage of oil on the planet at this time.

brexit effects so far are knee-jerk. more safe haven bonds going negative yields says it all - there will be a significant slowdown in uk and the eu - less demand for oil. china's stockpile is filled to the brim, can't buy much more.

growth in india and others is far from enough to pick the slack in china. india can't grow faster in energy consumption industries because of serious lack of water in the subcontinent.

45-46 is not the bottom. i see it diving below at least one more time, and will not cross 52 this year.

so, i will not hold much oil/energy stocks/etf's for now. will just trade accordingly. the correlation crude-dow is still significant.

tonight, unless dow slides again, there should be a chance for wti to touch 46 again. just don't wait too long to settle uwti!

yes, i agree that oil has no shortage, probably at least for the next 5-10 years.

it's just about the question of “where is the bottom", which is a million dollar question. ie. WB thinks 95-100 is Apple's bottom, but many thinks much lower. Anyways, WB made a bad bottom estimation on IBM before, who know.

Jul 8 2016, 02:04 PM

Jul 8 2016, 02:04 PM

Quote

Quote

0.0194sec

0.0194sec

0.71

0.71

6 queries

6 queries

GZIP Disabled

GZIP Disabled