Outline ·

[ Standard ] ·

Linear+

USA Stock Discussion v8, Brexit: What happens now?

|

Cubalagi

|

Mar 23 2023, 11:34 AM Mar 23 2023, 11:34 AM

|

|

QUOTE(annoymous1234 @ Mar 23 2023, 10:51 AM) No rates cut! Yet market is still stubborn. It will be a rude awakening for the market when they finally realise how serious they FED is to fight inflation Even last night can see Fed seriousness goyang already. Just early this month, Powel was talking tough like want to hike 50bps. Now only do 25bps. |

|

|

|

|

|

Cubalagi

|

Mar 23 2023, 11:41 AM Mar 23 2023, 11:41 AM

|

|

QUOTE(Boon3 @ Mar 23 2023, 11:37 AM) Bungkus lah. On the brighter side, Yell made him look good....!!! So can raising rates bring down the soaring energy prices? Can, if it can cause a financial crisis and deep recession. |

|

|

|

|

|

Cubalagi

|

Mar 24 2023, 07:22 PM Mar 24 2023, 07:22 PM

|

|

European banks are very red today.

Financial crisis continuing?

|

|

|

|

|

|

Cubalagi

|

Mar 25 2023, 02:10 PM Mar 25 2023, 02:10 PM

|

|

QUOTE(icemanfx @ Mar 25 2023, 12:29 PM) US fed is mandated by the u.s congress to keep inflation rate low. there is little tools available to rein in inflation. They can try things like reduce govt spending Or maybe push for less conflict? But I guess these are impossible |

|

|

|

|

|

Cubalagi

|

Apr 3 2023, 12:32 PM Apr 3 2023, 12:32 PM

|

|

QUOTE(Boon3 @ Apr 3 2023, 12:26 PM) https://www.cnbc.com/2023/04/02/saudi-arabi...utput-cuts.html» Click to show Spoiler - click again to hide... « .... they are making the first move, cutting when the cowboi shale oil is indicating the boom is over ..... and so the oil prices rocketed !!! ( Yelling and Pow Bow gonna increase more rates   ) and yeah .... some earlier comments ...... Something important to pay attention to..... No one long black gold ?  Small position only Waiting for recession. |

|

|

|

|

|

Cubalagi

|

Apr 3 2023, 12:58 PM Apr 3 2023, 12:58 PM

|

|

QUOTE(Boon3 @ Apr 3 2023, 12:43 PM) Buy for recession? That's rather weird reason (for me)... No, u misunderstand. I would prefer a bigger position. But Im currently holding a small position because scared of recession. Waiting for better entry time to add more. |

|

|

|

|

|

Cubalagi

|

Apr 6 2023, 08:00 AM Apr 6 2023, 08:00 AM

|

|

QUOTE(icemanfx @ Apr 6 2023, 01:33 AM) The biggest threat to the world economy is elevated oil price for extended periods. Contemporary history shows, high oil price lead to worldwide economic recession. The biggest threat is the war expanding.eg use of nukes or China got involved. This post has been edited by Cubalagi: Apr 6 2023, 08:02 AM |

|

|

|

|

|

Cubalagi

|

Apr 6 2023, 11:34 AM Apr 6 2023, 11:34 AM

|

|

QUOTE(Davidtcf @ Apr 6 2023, 09:43 AM) hope China is not stupid not to launch a war against Taiwan. US will definitely help out Taiwan which results in a big war. Maybe other countries will join in too. Whole world economy will go haywire that time if this happens. Many people thought that Russia wouldnt be stupid enough to attack Ukraine too. And who would imagine governments doing a lockdown in 2020? Whole world economy did go haywire. |

|

|

|

|

|

Cubalagi

|

Apr 7 2023, 12:05 AM Apr 7 2023, 12:05 AM

|

|

QUOTE(icemanfx @ Apr 6 2023, 08:44 PM) Historically, CCP will not hesitate to engage in foreign conflict when facing domestic discontent. They will also not hesitate to go to war if some red line has been crossed. |

|

|

|

|

|

Cubalagi

|

Apr 12 2023, 03:53 PM Apr 12 2023, 03:53 PM

|

|

QUOTE(TOS @ Apr 12 2023, 09:04 AM) Pity the Asian rich. WSJ MARKETS Credit Suisse’s Risky-Bond Wipeout Hurts Asia’s Rich Private bankers from UBS, other international banks had pushed AT1 securities to their wealthy clients https://www.wsj.com/articles/credit-suisses...share_permalinkYet another proof that private bankers job is to leech on your wealth, not to make you even richer  Higher risk higher returns. AT1 bonds were giving attractive interest rates. And now after this CS default, even more attractive. Eg HSBC USD AT1 now is yielding10.xx % pa. I think it peaked at 13% last month. Very tempting. This post has been edited by Cubalagi: Apr 12 2023, 03:54 PM |

|

|

|

|

|

Cubalagi

|

May 10 2023, 12:14 AM May 10 2023, 12:14 AM

|

|

QUOTE(ChAOoz @ May 7 2023, 12:56 AM) Berkshire annual share holder meeting happening now. One thing that strike me is that Buffett and Munger commentary of commercial real estate (CRE) tied to the possible dangers that Oaktree had just mentioned. Time to do a cassandra bet  ? Whats a cassandra bet? |

|

|

|

|

|

Cubalagi

|

May 10 2023, 01:48 PM May 10 2023, 01:48 PM

|

|

QUOTE(dwRK @ May 10 2023, 08:57 AM) is a metaphor from greek mythology... associated with doom and gloom... e.g., "don't be a cassandra" same like the name karen... now associated with entitled and obnoxious behavior Ooo..meaning I hv been a cassandra since last year. 😉 About the time Putin invaded last year. |

|

|

|

|

|

Cubalagi

|

Oct 21 2023, 09:24 AM Oct 21 2023, 09:24 AM

|

|

QUOTE(danmooncake @ Oct 20 2023, 07:47 AM) Hey guys, I think opportunity coming again... looking at the 200ma for SP500.  Already breach..so u buy? |

|

|

|

|

|

Cubalagi

|

Oct 21 2023, 09:29 AM Oct 21 2023, 09:29 AM

|

|

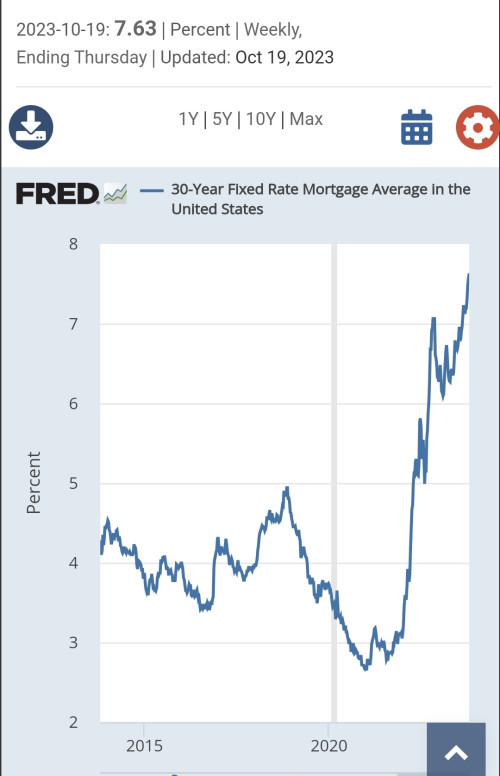

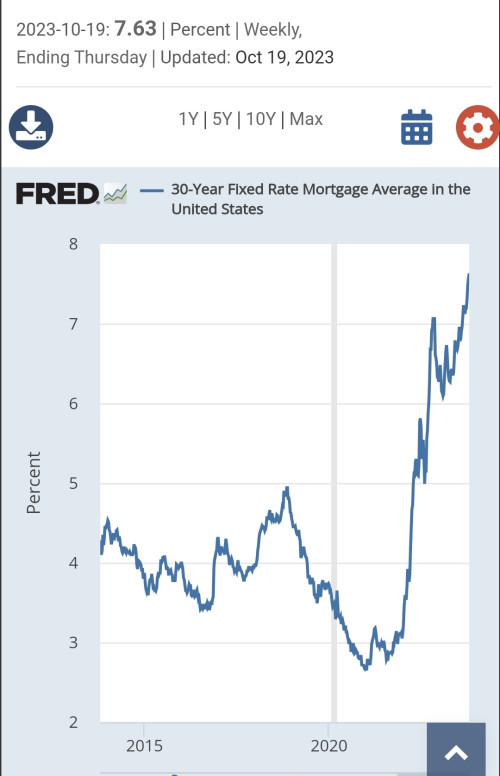

US mortgage rate now at 7.63%.  The reason why US housing market hasnt collpased is that most ppl have these 30 year fixed interest mortgages and have locked in at lower rates during the last 10+ years. This post has been edited by Cubalagi: Oct 21 2023, 09:29 AM |

|

|

|

|

|

Cubalagi

|

Nov 5 2023, 09:48 AM Nov 5 2023, 09:48 AM

|

|

QUOTE(ozak @ Nov 3 2023, 09:31 PM) Unemployment rate up 3.9%. Previous 3.8% Bad news is good news. I will wait for bad news to be bad news before piling in. |

|

|

|

|

|

Cubalagi

|

Nov 5 2023, 03:21 PM Nov 5 2023, 03:21 PM

|

|

QUOTE(ozak @ Nov 5 2023, 10:26 AM) Already miss the train? Unless the inflation going up and another hike. I dont think there is much train to miss. Not when I can get 5% interest in USD deposits. This post has been edited by Cubalagi: Nov 5 2023, 03:21 PM |

|

|

|

|

|

Cubalagi

|

Nov 6 2023, 04:46 PM Nov 6 2023, 04:46 PM

|

|

QUOTE(cybermaster98 @ Nov 6 2023, 02:08 PM) Thats peanuts considering where the stock market was in Nov 2022 vs now. I dont really care about Nov 22 to now. I more interested in now to Nov 2024. If u can tell me the stock market return for that period I much appreciate. This post has been edited by Cubalagi: Nov 6 2023, 04:47 PM |

|

|

|

|

|

Cubalagi

|

Nov 6 2023, 05:21 PM Nov 6 2023, 05:21 PM

|

|

QUOTE(Hansel @ Nov 6 2023, 05:19 PM) Yeah,... I did also put into USD FD and stretched out as far as possible,... But I must also carry in my mind,... the Reinvestment Risk. When my FD matures and the US REITs and shares have all run-up,.. I'm stuck. Thats why i prefer money market than FD..can liquidate anytime. |

|

|

|

|

|

Cubalagi

|

Nov 13 2023, 10:03 AM Nov 13 2023, 10:03 AM

|

|

QUOTE(cybermaster98 @ Nov 7 2023, 02:03 AM) Not in the game of predicting market moves so that would be a dumb question. But im not invested in the US stock market for 5% gains and so far ive been on a good run for years with Big Tech. You can either choose to listen or you can follow your own path but just avoid coming up with some excuse in 2024 when you see the market outperforming your 5% money market return. Thats the risk Im accepting. If Im wrong, I will earn "only" 5% or so. If Im right, I will be able to buy stocks cheaper (hopefully much cheaper) than what they are now. Just to be clear, I do have equities exposure now, only its much smaller. I didnt buy any stocks this year, only sold some. If there is a Christmas/NY rally, I likely will sell a bit more. Last time I bought any was in Sept 22, but I already started to be more defensive even earlier, when the Ukr war started. |

|

|

|

|

|

Cubalagi

|

Apr 4 2025, 08:10 PM Apr 4 2025, 08:10 PM

|

|

|

|

|

|

|

Mar 23 2023, 11:34 AM

Mar 23 2023, 11:34 AM

Quote

Quote

0.4353sec

0.4353sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled