QUOTE(ozak @ Aug 29 2024, 01:04 AM)

QUOTE(danmooncake @ Aug 29 2024, 02:10 AM)

Managed to get +8% in betweenCover abit for Nvidia

USA Stock Discussion v8, Brexit: What happens now?

|

|

Aug 29 2024, 08:45 AM Aug 29 2024, 08:45 AM

Return to original view | IPv6 | Post

#21

|

Senior Member

1,441 posts Joined: Oct 2017 |

|

|

|

|

|

|

Aug 29 2024, 09:50 PM Aug 29 2024, 09:50 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

1,441 posts Joined: Oct 2017 |

NVDA by end of the day in green may not be a surprise

|

|

|

Sep 4 2024, 08:04 PM Sep 4 2024, 08:04 PM

Return to original view | Post

#23

|

Senior Member

1,441 posts Joined: Oct 2017 |

Will we see NVDA below 90 in this month?

Should dispose all holding stocks then reenter after Sept? This post has been edited by kembayang: Sep 4 2024, 08:39 PM |

|

|

Sep 4 2024, 09:54 PM Sep 4 2024, 09:54 PM

Return to original view | Post

#24

|

Senior Member

1,441 posts Joined: Oct 2017 |

|

|

|

Sep 5 2024, 09:38 PM Sep 5 2024, 09:38 PM

Return to original view | Post

#25

|

Senior Member

1,441 posts Joined: Oct 2017 |

|

|

|

Sep 9 2024, 05:36 PM Sep 9 2024, 05:36 PM

Return to original view | Post

#26

|

Senior Member

1,441 posts Joined: Oct 2017 |

So target SQQQ for this month?

|

|

|

|

|

|

Sep 10 2024, 12:39 AM Sep 10 2024, 12:39 AM

Return to original view | IPv6 | Post

#27

|

Senior Member

1,441 posts Joined: Oct 2017 |

|

|

|

Sep 11 2024, 09:12 PM Sep 11 2024, 09:12 PM

Return to original view | Post

#28

|

Senior Member

1,441 posts Joined: Oct 2017 |

|

|

|

Sep 11 2024, 09:28 PM Sep 11 2024, 09:28 PM

Return to original view | Post

#29

|

Senior Member

1,441 posts Joined: Oct 2017 |

|

|

|

Sep 11 2024, 10:47 PM Sep 11 2024, 10:47 PM

Return to original view | IPv6 | Post

#30

|

Senior Member

1,441 posts Joined: Oct 2017 |

QUOTE(ozak @ Sep 11 2024, 09:53 PM) Mean inflation drop and the fed target is 2.0%. But core is still hot at 0.3% expecting 0.2%. Tomorrow can know PPI. It also confirm the coming interest cut. But not sure 25bps or 50bps. QUOTE(theochew @ Sep 11 2024, 10:00 PM) to cut interest rate 0.5 gonna trigger fear of a possible recession. Thanks for the explanationon the other hand, not cutting will hurt the economy. 0.25 cuts is the mid ground. Therefore, investors want the cpi to be as close to the expected cpi as possible in order for feds to cut 0.25 Still a hill for me to learn So regardless it's 25 or 50 cuts, it does not favour the sharks in short term? |

|

|

Sep 12 2024, 01:45 AM Sep 12 2024, 01:45 AM

Return to original view | IPv6 | Post

#31

|

Senior Member

1,441 posts Joined: Oct 2017 |

Today market such a big U turn.

So this month is a green month, history in making? |

|

|

Sep 12 2024, 02:05 AM Sep 12 2024, 02:05 AM

Return to original view | IPv6 | Post

#32

|

Senior Member

1,441 posts Joined: Oct 2017 |

NVDA such big market cap move 6%

Never seen this happen on MSFT |

|

|

Sep 12 2024, 12:31 PM Sep 12 2024, 12:31 PM

Return to original view | Post

#33

|

Senior Member

1,441 posts Joined: Oct 2017 |

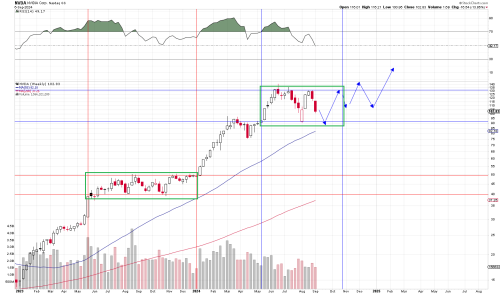

QUOTE(theochew @ Sep 12 2024, 11:22 AM)  it’s important to remember that NVDA is one of the most fundamentally sound companies on the NASDAQ-100 and that this is all temporary market related volatility. At $100 a share, NVDA isn’t far from its eventual lows. Whether the market bottoms this week with inflation or after the fed on the ensuing week shouldn’t haven any bearing on anyone’s investment strategy. Not if you take a long-term approach to investing as every good investor ought to do. Anything short of that is straight up gambling. This brings me to my next point. Here’s why it’s critically important to always maintain a long-term time horizon when investing. Nvidia’s stock price has largely now caught up with its earnings growth. This is not to say that the stock can’t move substantially higher. Of course it can and it will. But what that does mean is that we’re unlikely to see the same types of stock gains that NVDA saw this past year and we’re probably going to see periods of consolidation more often now. In fact, like many companies of NVDA’s size and scope, there’s a tendency for the stock to go through consolidation phases to allow the P/E ratio to shrink a bit. Nvida (NVDA) already went through one such phase when it traded between $40-50 for nearly 6-months in 2023. I believe Nvidia (NVDA) has entered a second such phase and will probably trade between $90 and $150 for a while now. Take a look at this NVDA weekly chart below. Notice the consolidation period between June 2023 and January 2024. Compare that period to today. Though the scope is greater today, the periods are very similar and occur during similar periods, seasonally. [excerpt from this piece 9/9/24] https://rb.gy/l98alc it helps a noob investor like me & hope it helps those who are interested in this stock long term. most likely blackwell will boost it out from the consolidation period probably around Q1 2025 report. Or maybe Q4 2024 earning guidance Sounds like a greener September |

|

|

|

|

|

Sep 19 2024, 05:30 PM Sep 19 2024, 05:30 PM

Return to original view | IPv6 | Post

#34

|

Senior Member

1,441 posts Joined: Oct 2017 |

QUOTE(danmooncake @ Sep 19 2024, 04:09 AM) and.. 2 more cuts by end of the year. WTF! QE... here we come again. This will reignite inflation again. QUOTE(gashout @ Sep 19 2024, 04:10 AM) Time to reenter market for bullrun?No more September bearish curse? This post has been edited by kembayang: Sep 19 2024, 07:58 PM |

|

|

Sep 20 2024, 12:06 AM Sep 20 2024, 12:06 AM

Return to original view | IPv6 | Post

#35

|

Senior Member

1,441 posts Joined: Oct 2017 |

QUOTE(danmooncake @ Sep 13 2024, 11:06 PM) NVDA struggling to get back to above 120s... It just hang right below 120 till this momentLooks like 4th attempt..since June high. Is there such thing as quad top? This will be interesting.. Next week, we all know what's going to happen. Could be another roller coaster ride after Powell announcement. |

|

|

Sep 25 2024, 08:03 AM Sep 25 2024, 08:03 AM

Return to original view | Post

#36

|

Senior Member

1,441 posts Joined: Oct 2017 |

|

|

|

Sep 26 2024, 09:19 AM Sep 26 2024, 09:19 AM

Return to original view | Post

#37

|

Senior Member

1,441 posts Joined: Oct 2017 |

Micron great QR Post & midnight market all tech look green This post has been edited by kembayang: Sep 26 2024, 09:24 AM hondaracer liked this post

|

|

|

Sep 26 2024, 09:40 AM Sep 26 2024, 09:40 AM

Return to original view | Post

#38

|

Senior Member

1,441 posts Joined: Oct 2017 |

|

|

|

Sep 27 2024, 12:58 AM Sep 27 2024, 12:58 AM

Return to original view | IPv6 | Post

#39

|

Senior Member

1,441 posts Joined: Oct 2017 |

danmooncake and ozak liked this post

|

|

|

Oct 4 2024, 08:50 PM Oct 4 2024, 08:50 PM

Return to original view | Post

#40

|

Senior Member

1,441 posts Joined: Oct 2017 |

US Sep. Non-Farm Payrolls +254000 Vs +140000 Forecast, Prior +159000; US Sep. Unemployment Rate 4.1% Vs 4.2% Forecast, Prior 4.2% Can consider allin noien liked this post

|

| Change to: |  0.9111sec 0.9111sec

0.73 0.73

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 04:56 PM |