QUOTE(My_acc @ Jun 5 2016, 12:46 AM)

Hello Members,

I have given my resignation at my Current company... I want to leave the country(Malaysia) immediately as I have my Joining date at my new company in India.... I am really confused with some things.. SOmeone please HELP ME OUT....

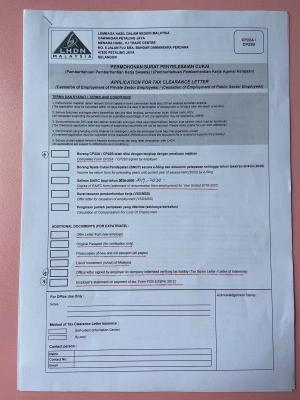

* Is the Tax clearance letter compulsory..

*If yes , then who is responsible to fill and submit the Documents for the TAX CLEARANCE LETTER.. Do i have to personally go to HASIL and submit it or is it the responsibility of the Company to do so....

*after the Documents are submitted to HASIL,, Do I have to wait for the letter or can I leave the Country without the letter and ask my Friend to collect the letter from my Employer

*Where does HASIL deliver the TAX CLEARANCE LETTER... Is it on the email or do they send it through courier, or do I or employer have to go to HASIL and collect it...

Please Reply... ITs URGENT

Im afraid i dont know much but ill try to assist you okay with my limited knowledge...huhuhu...

Basically you need to check with tax office you have your file with...

Ask hr of your company to complete form CP21..nowadays they can fill it online via e-SPC..

You need to have last year EA Form (your hr should have it if ur previous tax matter being manage by company)..ask from them...

Complete this year BE Form and please make a copy for all pages in ur passport for verification purposes...

This letter is a proof that you have clear all money owed to irb before left the country. ..normally hr will hold ypur last salary payment any payment that you should receive from the company before irb issue tax clearance letter...if u have money owed to them, they will deduct and credit you the balance later...

Complete all document and irb shall process it within 14 working days (nowadays is more efficient)..and a week after, if no prob...they will post you the tax clearance letter at your former employer...to notify the balance of amount owing by you to irb in that letter and hr will deduct the amount to be paid accordingly to irb...

This letter normally will affect you for obtaining employment pass...because they want the liability owed by former company and soon by new company is not clashed...

Just do this...

Ask hr whether they already did or fill the CP21 Form

Get your EA Form last year copy(all last year/s)

Fill up this year BE Form

Make a copy for all pages in your passport...

Your friend can collect the letter for you...most important submit document that ive mentioned above and let irb do their job...if u nasib baik..2 weeks can get already...if not one month...

Just do it or else later irb will find you and ask why you didnt do clearance before leaving...

This is from my little knowledge...apologise if not complete process...

This post has been edited by niafaz89: Jun 5 2016, 03:11 AM

Jun 5 2016, 12:46 AM, updated 10y ago

Jun 5 2016, 12:46 AM, updated 10y ago

Quote

Quote

0.0185sec

0.0185sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled