Outline ·

[ Standard ] ·

Linear+

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

gooroojee

|

Dec 11 2022, 06:35 PM Dec 11 2022, 06:35 PM

|

|

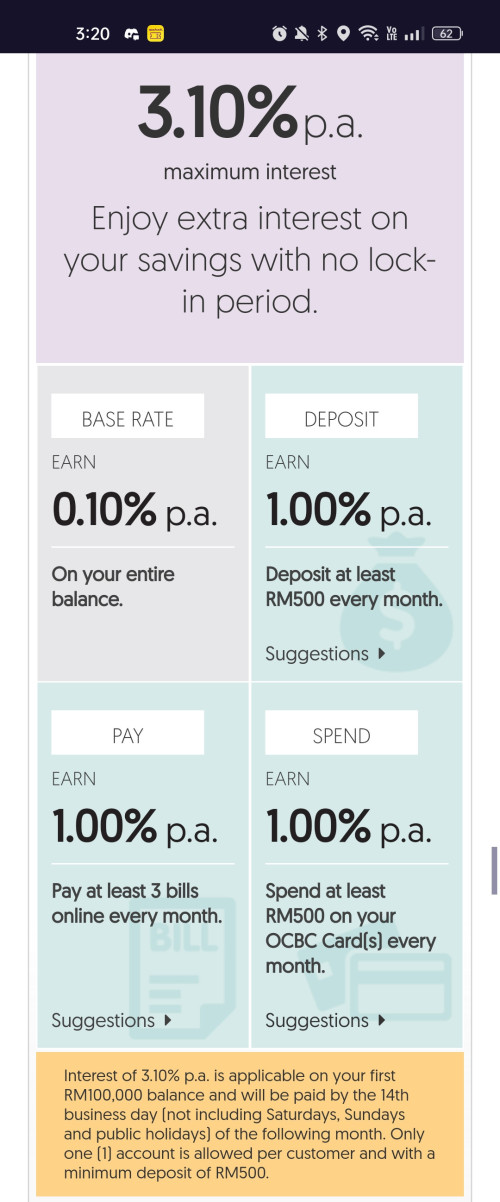

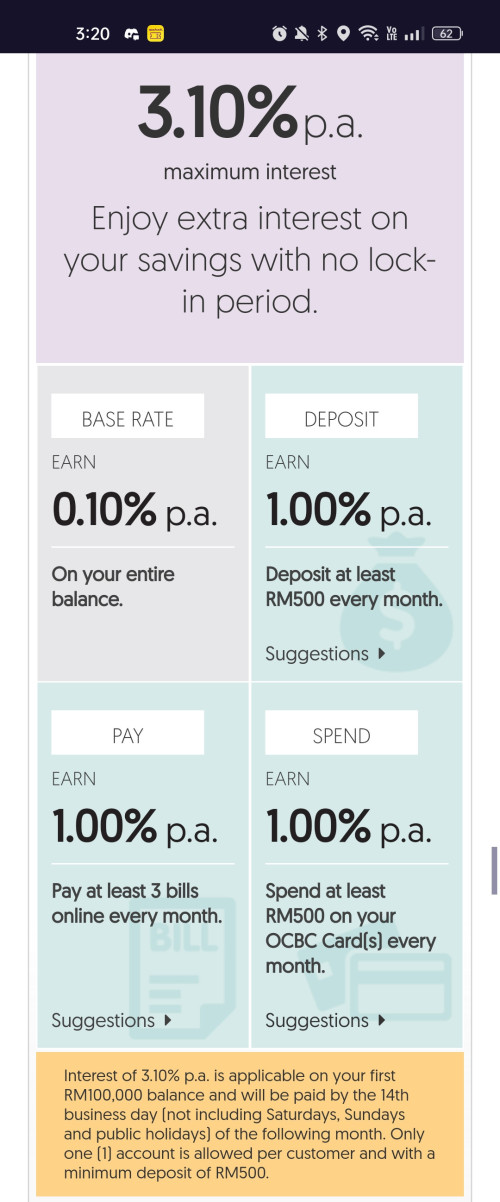

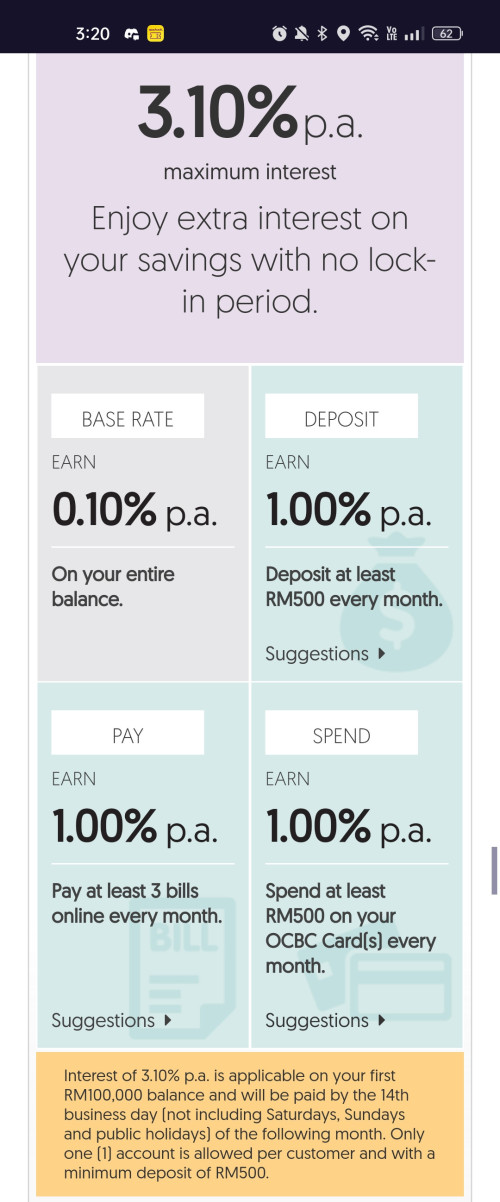

QUOTE(DragonReine @ Nov 29 2022, 03:21 PM) Can do pre-approval online but still need to go to branch to officially verify and open account. The savings interest is conditional, not "passive" like MBSB wise saver, if you don't hit all 3 of the spend/save/pay monthly goals you will not get good interest rate.  RM8 yearly for ATM debit card annual fee. With the promotion now the 3.1% goes up to 3.4% for three months... and then up to 3.89% if you invest in unit trusts starting at rm500. |

|

|

|

|

|

gooroojee

|

Dec 13 2022, 05:48 PM Dec 13 2022, 05:48 PM

|

|

QUOTE(leo_kiatez @ Dec 13 2022, 11:51 AM) How to purchase rm500 unit trust online to get the extra 0.49% interest for 360acount? QUOTE(xander2k8 @ Dec 13 2022, 03:49 PM) OCBC app got function to buy unit trust but very selected to choose from and most of it are underperforming 🤦♀️ so forget about it just go for the 3 pillars is more than enough If you had RM100k in the bank and you can increase it's interest rate by 0.49% by buying a tiny amount of UT, the performance of the UT becomes rather inconsequential ... unless it's a total loss. |

|

|

|

|

|

gooroojee

|

Dec 13 2022, 10:57 PM Dec 13 2022, 10:57 PM

|

|

QUOTE(xander2k8 @ Dec 13 2022, 10:41 PM) Have you factored in the sales charges it is at minimum 1.88% everytime you invest not mentioned annual management fee Penny wise pound foolish when you actually throwing away money to the bank 3 times more of what you gain 🤦♀️ Sales charge is only 1.88% of the rm500, vs. 0.49% gain on rm100,000. Please do your math and and prove how it is inferior. |

|

|

|

|

|

gooroojee

|

Dec 13 2022, 11:10 PM Dec 13 2022, 11:10 PM

|

|

QUOTE(xander2k8 @ Dec 13 2022, 11:04 PM) It is provided only if everyone has 100k Even if it is 50k you are just breaking even paying 4% in sales charges and fees over 6000 on ut yearly 🤦♀️ It is just silly over rm250 in gain yearly for 0.49% for 100k while your UT is losing way more than that 🤦♀️ You're twisting numbers to justify your incorrect statement. The scenario is UT of rm500 (not rm6,000) to gain extra 0.49% on a rm100k savings deposit (which btw isn't rm250). Why would anyone invest more than rm500? The numbers speak for themselves. |

|

|

|

|

|

gooroojee

|

Dec 19 2022, 12:16 PM Dec 19 2022, 12:16 PM

|

|

PSA:

0.49% bonus interest is for first month only so if you have RM100k it is an additional rm40.83.

Buying rm500 in UT with published 1.88% sales charge is RM9.40. No redemption fees.

|

|

|

|

|

|

gooroojee

|

Dec 28 2022, 05:35 PM Dec 28 2022, 05:35 PM

|

|

QUOTE(teslaman @ Dec 28 2022, 04:54 PM) What's 2.1% ? |

|

|

|

|

|

gooroojee

|

Dec 28 2022, 06:59 PM Dec 28 2022, 06:59 PM

|

|

QUOTE(confusedway @ Dec 28 2022, 05:40 PM) You're talking about the Flex account. This thread is about the 360 account, which currently is at 3.4% conditional rate. From your link, go one step up, you'll see all the accounts available in OCBC - https://www.ocbc.com.my/personal-banking/accounts/index.html |

|

|

|

|

|

gooroojee

|

Dec 30 2022, 11:21 PM Dec 30 2022, 11:21 PM

|

|

QUOTE(contestchris @ Dec 30 2022, 11:13 PM) 3.4% for new accounts under their 90th anniversary promotion, for 3 months. Then it goes back to 3.1% |

|

|

|

|

Dec 11 2022, 06:35 PM

Dec 11 2022, 06:35 PM

Quote

Quote 0.0895sec

0.0895sec

0.83

0.83

7 queries

7 queries

GZIP Disabled

GZIP Disabled