QUOTE(Cookie101 @ Feb 8 2020, 12:17 PM)

Very short and concise but needs little bit more info.

Changes too place immediately after two days of notice without fulfilling the conditions of 21 days notice and effect retrospectively. Need timeline layout. And the disagreement

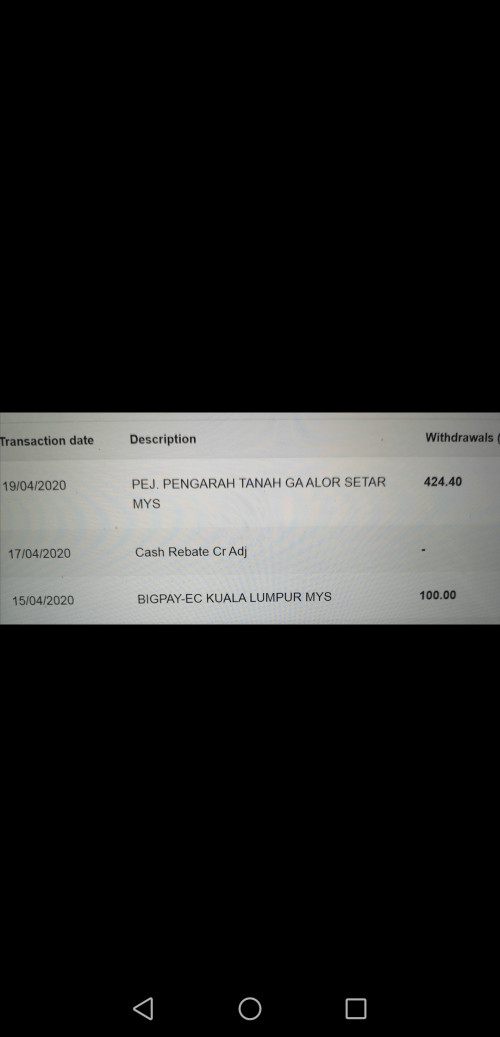

Also based on my calculations the interest is incorrect for jan.

And to include interest breakdown calculations which differs from the given.

Just my 2 cents. But I’m still awaiting my RM for updates next week 😝

I malas to do the calculations, just wanna voice out the bank's unfair practice and put them in the spotlight Changes too place immediately after two days of notice without fulfilling the conditions of 21 days notice and effect retrospectively. Need timeline layout. And the disagreement

Also based on my calculations the interest is incorrect for jan.

And to include interest breakdown calculations which differs from the given.

Just my 2 cents. But I’m still awaiting my RM for updates next week 😝

Feb 8 2020, 10:22 PM

Feb 8 2020, 10:22 PM

Quote

Quote

0.1078sec

0.1078sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled