QUOTE(ProxMatoR @ Jan 28 2020, 02:11 PM)

guys. do the maths.

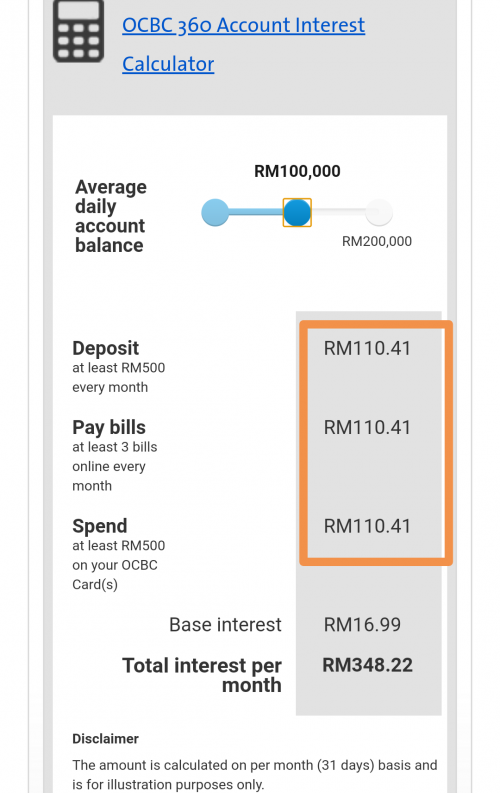

calculate the daily average for the month by having 400k for 7 / 8 days only.

QUOTE(zenquix @ Jan 28 2020, 03:00 PM)

ProxMatoR is basically saying dumped 400k for the shortened period (7-8 days) to earn the equivalent interest of 100k placed for the full month.

300k can be withdrawn on the first of the next month.

This however has not considered the opportunity cost of the 300k k

OK now I got it, thanks for the info. Learn new things today.

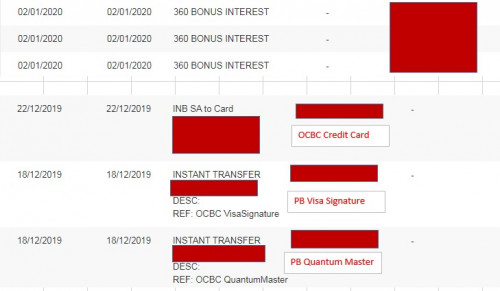

Total average balance = 400k x 8 days = 3,200,000 (387500 if want to be exact)

Total average balance = 100k x 31 days = 3,100,000

P/S: Sorry my bad, I didn't know he was mentioning putting in short period 7-8 days and withdraw 300k afterwards, not mind reader Charles Xavier.

Jan 5 2020, 06:37 AM

Jan 5 2020, 06:37 AM

Quote

Quote

0.0919sec

0.0919sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled