Just reconfirm with my ocbc banker. Al-amin cannot open 360 account.

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

|

Dec 26 2019, 10:19 AM Dec 26 2019, 10:19 AM

Return to original view | Post

#121

|

Senior Member

2,965 posts Joined: Jul 2014 |

Just reconfirm with my ocbc banker. Al-amin cannot open 360 account.

|

|

|

|

|

|

Dec 26 2019, 10:31 AM Dec 26 2019, 10:31 AM

Return to original view | Post

#122

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(Ancient-XinG- @ Dec 26 2019, 10:20 AM) me too...damn..actually super easy via rp. We could have actually use mobile to surf RP and register directly and get the sms right away to show to banker.The banker never told me that till I tried out after opening account. Mayb bankers all avoid giving us that benefits. |

|

|

Dec 26 2019, 04:44 PM Dec 26 2019, 04:44 PM

Return to original view | Post

#123

|

Senior Member

2,965 posts Joined: Jul 2014 |

|

|

|

Dec 26 2019, 05:04 PM Dec 26 2019, 05:04 PM

Return to original view | Post

#124

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(Ancient-XinG- @ Dec 26 2019, 04:57 PM) owh. nvm. so meaning today I deposited extra, this portion also can get 4.1% rite provided I fulfilled the conditions. can. eg. u deposit today 26th. till 31st. money at bank till 31st is 6 days.you get 6/365*4.1% for the amount u put in, roughly that amount. |

|

|

Dec 27 2019, 08:33 AM Dec 27 2019, 08:33 AM

Return to original view | Post

#125

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(Ancient-XinG- @ Dec 26 2019, 05:52 PM) Of course its prorated ma, takkan u deposit on 31dec 10k, they still calculate 10k interest for you for the month of dec. Like that bank will bankrupt woi.QUOTE(TongCN @ Dec 26 2019, 06:33 PM) Easier way to say is average money per month Ya, I have excel formulated in that way and I tracked it monthly, so far very accurate to 1-5 cents differences.sum up every day last balance and divide by total days of the month and fulfill critiria within the month. E.g. let say i deposit RM10k since day 1 for November till end of November (without add on anymore) meaning (10,000 * 30 / 30) * 4.10% Using excel easier to track and provision ur interest income |

|

|

Dec 27 2019, 08:54 AM Dec 27 2019, 08:54 AM

Return to original view | Post

#126

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(mitkey06 @ Dec 27 2019, 08:34 AM) can I know on when the 4.1% is calculated. As long as you meet all the criteria on the same month, the interests are calculated based on the days of the money you put in your account for the month not the date you fulfill the criteria.e.g. on 15 Jan, all 3 pillars met. the 4.1% calculated fr 1 jan or 15 jan onwards on the ave balance ? |

|

|

|

|

|

Dec 27 2019, 11:08 AM Dec 27 2019, 11:08 AM

Return to original view | Post

#127

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(l4nc3k @ Dec 27 2019, 11:06 AM) New to the account. Nope, cannot do as bill payment for cc. Have to do as "Transfer", now all call as "Duit Now" > select Credit card.Can I know how do we pay other credit cards that can be considered as 'bills', and also other ones like celcom bills etc? I can't find Celcom under the billing section. For other bank credit card, does instant transfer works as 'paying bill' criteria? Thanks. Its instant transfer FOC. |

|

|

Dec 27 2019, 11:21 AM Dec 27 2019, 11:21 AM

Return to original view | Post

#128

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(l4nc3k @ Dec 27 2019, 11:19 AM) Thank you. Saving card cannot consider as bill payment.So saving my credit cards as favorites under the 'Fund Transfer -> Credit Card Payment' section can consider as bill payment? but u make transaction to the saved card, yes, can consider as "Bill Payment" to fulfill the pay bill (1.3%) criteria. Note: paying 3 times same cc consider 1 payment only, to fulfill, need pay 3 different cc. |

|

|

Jan 3 2020, 09:26 AM Jan 3 2020, 09:26 AM

Return to original view | Post

#129

|

Senior Member

2,965 posts Joined: Jul 2014 |

|

|

|

Jan 6 2020, 02:14 PM Jan 6 2020, 02:14 PM

Return to original view | Post

#130

|

Senior Member

2,965 posts Joined: Jul 2014 |

Please use multi quotes.

|

|

|

Jan 7 2020, 10:44 AM Jan 7 2020, 10:44 AM

Return to original view | Post

#131

|

Senior Member

2,965 posts Joined: Jul 2014 |

|

|

|

Jan 8 2020, 05:00 PM Jan 8 2020, 05:00 PM

Return to original view | Post

#132

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(CPURanger @ Jan 8 2020, 04:26 PM) How reliable is OCBC servers ? High chance that when you register your ocbc account, you did ask for online banking facilities. Go to branch and request add h/p and enabling online transaction.Last week I tried to pay RM20 from Debit card for order Bigpay card but Bigpay app shows OCBC temporary unavailable error. End up pay by HLB credit card. Tried another payment for reload TnG app also failed. Today I received Bigpay card, try to topup, same error again. Tried paying for Smart Selangor also failed. I going to apply credit card for my 360 acc and have second thoughts. It really sucks when try to do online payment and it does not work. Does anyone here face disruption when using OCBC debit or credit card ? |

|

|

Jan 9 2020, 08:14 AM Jan 9 2020, 08:14 AM

Return to original view | Post

#133

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(blaze_spirit @ Jan 8 2020, 05:26 PM) Which branch in selangor area to visit if I would like to open a 360 acc? I dont wanna spend 3 hours just to open an account lol subang jaya also not bad. saturday can go. if you are lucky, will be served by leng lui. |

|

|

|

|

|

Jan 13 2020, 05:31 PM Jan 13 2020, 05:31 PM

Return to original view | Post

#134

|

Senior Member

2,965 posts Joined: Jul 2014 |

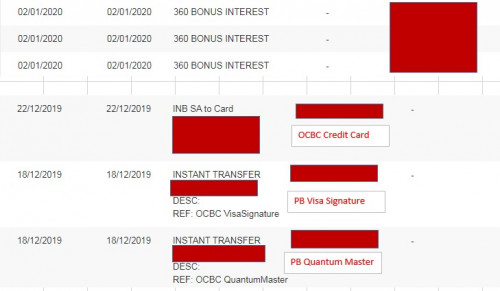

QUOTE(smartfreak @ Jan 13 2020, 04:18 PM) After double checking the bank statement, OCBC CC payment is counted as 1 payments also for paying bills. Yes, cc payment, instant transfer to SA/CA, duitnow, all counted as eligible transaction as bill payment. *Note: Providing not multiple payment to same acc no that consider as 1 payment only. |

|

|

Jan 15 2020, 01:54 PM Jan 15 2020, 01:54 PM

Return to original view | Post

#135

|

Senior Member

2,965 posts Joined: Jul 2014 |

|

|

|

Jan 16 2020, 12:27 PM Jan 16 2020, 12:27 PM

Return to original view | Post

#136

|

Senior Member

2,965 posts Joined: Jul 2014 |

|

|

|

Feb 4 2020, 09:36 AM Feb 4 2020, 09:36 AM

Return to original view | Post

#137

|

Senior Member

2,965 posts Joined: Jul 2014 |

No wonder getting so less interest!! 4.1 --- 3.6%

Damx |

|

|

Feb 5 2020, 08:06 AM Feb 5 2020, 08:06 AM

Return to original view | Post

#138

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(Sumofwhich @ Feb 5 2020, 06:16 AM) I received a call from OCBC after emailing to the original email i mentioned, she told me that my interest is calculated based on 4.1% before 29th and 3.6% on 29th onwards. I hence told her that alot of ppl are getting way much lesser, and she has requested 2-3 business days to get the calculation from another team and will call me back. Definitely not 4.1% before 29th, they give less than that from 1-29th.This post has been edited by avinlim: Feb 5 2020, 08:06 AM |

|

|

Feb 5 2020, 03:32 PM Feb 5 2020, 03:32 PM

Return to original view | Post

#139

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(laishunchiat @ Feb 5 2020, 11:38 AM) Base Interest = (sum of daily amount from jan 1 to jan 28)/28 x 0.2/100 x 28/365 + (sum of daily amount from jan 29 to jan 31)/3 x 0.15/100 x 3/365 After looking back again carefully. I think my case is not. base on the calculation of 100k for a month. we should get 97.xx X 3 for full interests on 1.15% interest.Bonus Interest = (sum of daily amount from jan 1 to jan 31)/31 x 1.15/100 x 31/365 I get mine correct amount For 100k full month on 1.3% we should get RM110.xx X 3 For the month of Jan, for 100k we only get 97.xx. Means interest already calculate base on 1.15% not 1.3% for 29 days and 1.15% for 3 days. OCBC is definitely bullying us. |

|

|

Feb 5 2020, 05:06 PM Feb 5 2020, 05:06 PM

Return to original view | Post

#140

|

Senior Member

2,965 posts Joined: Jul 2014 |

|

| Change to: |  0.0261sec 0.0261sec

0.54 0.54

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 08:02 AM |