How does one generate positive cash flow using balance transfer ? I am curious.

Credit Cards Balance Transfer (BT) Plans V4 - Banks Offer List, Credit card debt consolidation

Credit Cards Balance Transfer (BT) Plans V4 - Banks Offer List, Credit card debt consolidation

|

|

Jan 21 2017, 03:25 PM Jan 21 2017, 03:25 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

1,757 posts Joined: May 2011 |

How does one generate positive cash flow using balance transfer ? I am curious.

|

|

|

|

|

|

Feb 27 2017, 06:45 PM Feb 27 2017, 06:45 PM

Return to original view | Post

#2

|

Senior Member

1,757 posts Joined: May 2011 |

I have a query. If one spends a huge amount on a credit card in that month , and he HAS the ability to pay off the amount , is there any way at all BT will help him/her make extra cash ?

|

|

|

Feb 27 2017, 08:46 PM Feb 27 2017, 08:46 PM

Return to original view | Post

#3

|

Senior Member

1,757 posts Joined: May 2011 |

QUOTE(lilsunflower @ Feb 27 2017, 07:26 PM) Yes, many of us have the ability to pay off the lump sum, but choose to BT at 0% to alleviate cash flow and earn interest, or invest the cash, or pay off loans etc. Thanks for that info. What about credit score ? Is it affected if there is application of BT? What if , midway , one wants to apply for another premier credit card ? Will it be affected ?For example, I choose to pay my kid's RM30k school fees as a lump sum to get a 3% discount. So that saves me RM900 upfront. Then, I applied for MBB 12 month 0% BT (during the promotion), and pay only 2500 per month. Month 1 I put 30k in 1 month FD and earn 3% - save RM75 Month 2 I put 27.5k - save RM68.75 Continue doing this for 12 months, so your interest savings get smaller as you repay your FD. This method is also very safe as it locks up your money so you will definitely have enough to repay the principal. You can search my previous posts on this thread to see my other explanations about BT strategies for further details. However, this is just sharing my experience, and what you choose to do is your choice and risk. Rule of thumb is to ensure you understand what you're doing when you enter into any financial transaction, as well as risks, including inability to repay on time. |

|

|

Feb 27 2017, 09:59 PM Feb 27 2017, 09:59 PM

Return to original view | Post

#4

|

Senior Member

1,757 posts Joined: May 2011 |

QUOTE(lilsunflower @ Feb 27 2017, 08:59 PM) People have reported that it affects credit score, because it is effectively a loan, and hence reduces your disposable income. Thanks, from what you are saying , seems that you are a pretty high income earner .However, there are many factors which contribute to credit score, and this is just one. Credit scores are like medical reports - very subjective and depending on individual circumstances. Based on MY personal experience, I was easily approved for two 7 figure mortgages while heavily maximising BT on 3 credit cards (PBB, Aeon and MBB). I have also never been rejected for any credit card, and currently hold 14 principal credit cards with high CL. Based on this, I believe that there are other factors which contributed to my overall good credit score. If you have had problems in the past with getting loans or credit cards, I suggest you stay clear from BT. However if you have never been rejected for cards and also have been awarded very high credit limits, then it may be safer. Also, ask your banker to do a pre assessment (based on your income and financial commitments). They will be able to tell you if it's likely to affect you. Ultimately it depends on their assessment and the amounts involved Anyway, for now , I am just gonna check with my banker. The best avenues for BT , from what you are saying would be from PBB,AEON and MBB? I will be spending heavily in the next few months for wedding preparations, that's why I would like to know. I am mainly using SCB cashback gold MC and HLB Essential CC. My HLB CC awarded me RM 50K CL and SCB awarded me RM72K CL. |

|

|

Jun 24 2017, 02:23 PM Jun 24 2017, 02:23 PM

Return to original view | Post

#5

|

Senior Member

1,757 posts Joined: May 2011 |

So would it have been possible , if let's say if the egia rate wasn't gonna be restructured, to BT More than CC outstanding balance , and then by transferring the extra amount into savings account , to put that amount into egia?

This post has been edited by drbone: Jun 24 2017, 02:23 PM |

|

|

Jun 29 2017, 10:32 AM Jun 29 2017, 10:32 AM

Return to original view | Post

#6

|

Senior Member

1,757 posts Joined: May 2011 |

|

|

|

|

|

|

Aug 17 2017, 07:45 PM Aug 17 2017, 07:45 PM

Return to original view | Post

#7

|

Senior Member

1,757 posts Joined: May 2011 |

|

|

|

Aug 17 2017, 07:49 PM Aug 17 2017, 07:49 PM

Return to original view | Post

#8

|

Senior Member

1,757 posts Joined: May 2011 |

QUOTE(cybpsych @ Aug 17 2017, 04:52 PM) yes possible. Able to apply for the PBB BT via PBB online banking?i've tried it with PBB online banking. screenshot the main cc page, make sure got your name and cc number (if possible). i even highlighted outstanding amount + authorized amount (not yet posted) attach the screenshot as part of the documents to be submitted via email. If via email is it via custsvc@publicbank.com.my ? |

|

|

Mar 22 2018, 11:56 AM Mar 22 2018, 11:56 AM

Return to original view | Post

#9

|

Senior Member

1,757 posts Joined: May 2011 |

Applied for HLB BT today too.

|

|

|

Apr 18 2018, 05:31 PM Apr 18 2018, 05:31 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

1,757 posts Joined: May 2011 |

QUOTE(wongmunkeong @ Apr 18 2018, 11:08 AM) HLB Balance Transfer 12 months 0% usage update Was just planning to transfer into casa. Wasted. Hope another option opens up.I just did another round, min $15K BT was required BUT the $ not transferable to savings ac, as per what was shared last month+/- for the $15K required ie. there was no selection and the default was just to: credit card luckily i "owe" other bank's credit card, "pre-pay" next month or two heheh (coz apparently HLB's offer ends 30th April) |

|

|

Apr 19 2018, 03:03 PM Apr 19 2018, 03:03 PM

Return to original view | Post

#11

|

Senior Member

1,757 posts Joined: May 2011 |

|

|

|

Apr 19 2018, 05:04 PM Apr 19 2018, 05:04 PM

Return to original view | Post

#12

|

Senior Member

1,757 posts Joined: May 2011 |

QUOTE(celaw @ Apr 19 2018, 03:58 PM) I can't take leave this week. Could you update whether able to proceed for eCCRIS or not after going to AKPK Melaka Branch (Jalan Munshi Abdullah right?) Yes it’s at Jln Munshi. The building opposite AmBank. When I spoke to the officer , she told me that it can be processed. However will update here. |

|

|

May 12 2018, 06:20 AM May 12 2018, 06:20 AM

Return to original view | Post

#13

|

Senior Member

1,757 posts Joined: May 2011 |

|

|

|

|

|

|

Aug 25 2018, 10:08 AM Aug 25 2018, 10:08 AM

Return to original view | Post

#14

|

Senior Member

1,757 posts Joined: May 2011 |

am trying to print out public bank's form but from the printout, on the first page, the signature portion does not get printed. Anyone else having the same issue?

|

|

|

Aug 27 2018, 11:51 PM Aug 27 2018, 11:51 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

1,757 posts Joined: May 2011 |

|

|

|

Jan 16 2019, 10:09 AM Jan 16 2019, 10:09 AM

Return to original view | IPv6 | Post

#16

|

Senior Member

1,757 posts Joined: May 2011 |

|

|

|

Jun 25 2024, 10:30 AM Jun 25 2024, 10:30 AM

Return to original view | IPv6 | Post

#17

|

Senior Member

1,757 posts Joined: May 2011 |

QUOTE(guy3288 @ Jun 22 2024, 11:15 AM) Sure but You're a legend bro . Wondering though , how do you loop them around ? Let's say your total BT amount from various banks , for 1 year is RM 500 K , you still need to pay monthly , amount of about RM 41 K + . I looped them around, the various banks are paying each other month after month till the music stops one day....then i take out my money lor Interest free bank money Takkan mahu reject.. The banks are waiting for customers to spend and spend and unable to pay back then is their time to slaughter us back How do you use this as an advantage? Or do you have a steady flow of passive income of about RM 41K + , from somewhere else , to ensure that the monthly amount is paid off? This post has been edited by drbone: Jun 25 2024, 10:36 AM |

|

|

Jun 26 2024, 04:43 PM Jun 26 2024, 04:43 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

1,757 posts Joined: May 2011 |

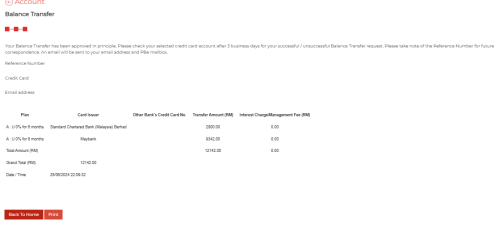

QUOTE(guy3288 @ Jun 25 2024, 02:10 PM) i think the BT game is best explained below Thanks for this info. Public Bank , is usually strict about transferring extra cash from the card (after BT) into CASA . I've tried before , via customer service hotline , and when they knew about the BT , they did not allow the transfer. However , after another call , it was allowed.for real life scenario, you can use my data to understand better. Credit card statement due date and amount paid by BT 1)24.5.24 PBB RM4243 paid by Aeon BT 13.5.24 2)28.5.24 PBB RM6202 paid by Aeon BT 16.5.24 3)30.5.24 Aeon RM9335 paid by UOB BT 25.5.24 4)6.6.24 SCB RM1972 paid by UOB 29.5.24 5)9.6.24 Alliance RM5800 paid by UOB BT 27.5.24 6)10.6.24 UOB RM4070 paid by PBi BT 5.6.24 7)15.6.24 RHB RM7953 paid by Aeon BT 7.6.24 8))15.6.24 RHB RM6140 paid by PBi BT 7.6.24 9)21.6.24 PBB RM15645 paid by Aeon 18.6.24 10)24.6.24 PBB RM2978 paid by Aeon 23.6.24 11)28.6.24 PBB RM3907 paid by Aeon 18.6.24 i have 42 active cards to pay monthly. sure must have spare cash ready dont want to be charged fees if BT failed or late Ever had this problem? |

|

|

Jun 28 2024, 11:46 AM Jun 28 2024, 11:46 AM

Return to original view | Post

#19

|

Senior Member

1,757 posts Joined: May 2011 |

QUOTE(guy3288 @ Jun 26 2024, 05:47 PM) My BT cannot finish, outstanding forever there Thanks for this info. Unable to retrieve info about Hong Leong easy cash option.as long as got credit , i take them all allowed BT is 80% available CR, to squeeze more upto 95% split like this.   i dont withdraw from excess, not easy, also i have too many outstandings no excess better you take easy cash from MBB and HLB direct cash into your Savings. |

|

|

Apr 2 2025, 02:47 PM Apr 2 2025, 02:47 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

1,757 posts Joined: May 2011 |

How strict is Public Bank to transfer excess payment for credit card into savings account , once balance transfer from Affin Bank is completed?

|

| Change to: |  0.0355sec 0.0355sec

0.29 0.29

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 04:06 AM |