Outline ·

[ Standard ] ·

Linear+

Credit Cards Balance Transfer (BT) Plans V4 - Banks Offer List, Credit card debt consolidation

|

coolguy99

|

Dec 24 2019, 11:54 AM Dec 24 2019, 11:54 AM

|

|

Guys I am interested to go for the 0% BT but am unsure how does it work as it will be my first time applying.

So for aeon I just submit the application, after approval, aeon will credit the money into my bank account? Or they will directly credit into my credit card account that I am applying to transfer the outstanding from?

And does applying for BT impacts your ccris in any way?

This post has been edited by coolguy99: Dec 24 2019, 11:56 AM

|

|

|

|

|

|

coolguy99

|

Dec 24 2019, 04:50 PM Dec 24 2019, 04:50 PM

|

|

QUOTE(YH1234 @ Dec 24 2019, 02:34 PM) credit into yr credit card acct, the one with outstanding when u submit along with yr app form. aeon insist on outstanding statement from other credit as proof. u may call the bank cs to transfer the fund from credit card acct to saving, some bank allow some not. i believe most foreign bank still fine with such request, pbb used to do a verification with some charges, mentioned concern on money laundry, maybank no, the rest long time never try, need those who did it to update. no idea on ccris. QUOTE(fruitie @ Dec 24 2019, 02:38 PM) BT always credits to other banks' credit cards unless the BT allows bank account (which is very rare but HLB sometimes has it). BT is recorded in CCRIS as it is part of your outstanding. Thanks guys. That means if I utilise the BT from aeon the amount will be recorded as outstanding under my aeon credit card? Will there be any indication that it is for BT? Also for repayment, the outstanding will be broken into 6 installments that I have to pay every month right? |

|

|

|

|

|

coolguy99

|

Jun 25 2025, 08:20 AM Jun 25 2025, 08:20 AM

|

|

First time applying for BT. Can we BT more than the outstanding balance? Once the BT is approved, I assume the money will go straight into the other banks account to settle the outstanding right?

|

|

|

|

|

|

coolguy99

|

Jun 25 2025, 08:27 AM Jun 25 2025, 08:27 AM

|

|

QUOTE(Barricade @ Jun 24 2025, 09:05 PM) I BT to HSBC card. Ask them to transfer to my savings account because I accidentally “overpaid” I'm thinking to do this also. But afraid if my bank reject my request then my money will be stuck in the cc. |

|

|

|

|

|

coolguy99

|

Jun 25 2025, 02:02 PM Jun 25 2025, 02:02 PM

|

|

QUOTE(fruitie @ Jun 25 2025, 12:11 PM) Oh, that's the normal stuff I do with my HLB BT also.  I thought can transfer to CASA. Means the excess amount will remain in your CC account to offset your bills in future months? |

|

|

|

|

|

coolguy99

|

Jun 27 2025, 01:56 PM Jun 27 2025, 01:56 PM

|

|

QUOTE(gooroojee @ Jun 27 2025, 09:44 AM) Just did HLB 0% 6 months BT (card limit withdrawal) to my HLB CASA again, with old BT still outstanding. Because the offer was ending on 30th June. Is it without any fee at all? Thinking to do this too. |

|

|

|

|

|

coolguy99

|

Jun 27 2025, 05:59 PM Jun 27 2025, 05:59 PM

|

|

QUOTE(fruitie @ Jun 27 2025, 04:23 PM) No fee. HLB is one of the best when it comes to BT. They have BT campaigns all the time. Applied HLB BT to my HLB casa. When will the money appear in my HLB account? |

|

|

|

|

|

coolguy99

|

Jul 4 2025, 08:12 AM Jul 4 2025, 08:12 AM

|

|

May I know how the HLB BT repayment works? Just got my first statement after opting in the 6 months BT to Casa. But the statement balance is showing my entire BT amount? Isn’t it supposed to be broken down to 6 months installment?

|

|

|

|

|

|

coolguy99

|

Jul 4 2025, 08:34 AM Jul 4 2025, 08:34 AM

|

|

QUOTE(Optizorb @ Jul 4 2025, 08:21 AM) you will see the min payment amount of 5%.. thats what u need to pay for the first 5 payments.. the 6th and final payment clear everything by the expiry/due date, which is stated on the CC statement I see. I thought it will be spread evenly across all installments (i.e. if I BT 6k for 6 mths, then I have to pay 1k every month). Thanks for the explanation! |

|

|

|

|

|

coolguy99

|

Jul 10 2025, 08:45 AM Jul 10 2025, 08:45 AM

|

|

QUOTE(lovelyuser @ Jul 9 2025, 09:38 AM) https://www.maybank2u.com.my/maybank2u/mala...ds/ezycash.page? This one much better, EasyCash, 6mths 0% repayment, 3.88% upfront fee waived, up to 70% of available credit limit, direct bank into MBB CASA. Wah I think this is new? Last time I checked don't have this promo. |

|

|

|

|

|

coolguy99

|

Jul 10 2025, 10:26 AM Jul 10 2025, 10:26 AM

|

|

QUOTE(virtualgay @ Jul 10 2025, 10:00 AM) just go and check it out on my application page, the notes does not say it is waived tnc after read it is old tnc nothing from the application page say it is waived   Yeah this made me a little hesitant to apply. I remember the last time this campaign was launched the promotion is mentioned in the application page itself. Cannot find this promotion by scrolling through their promotion page as well. Maybe its not officially launched? This post has been edited by coolguy99: Jul 10 2025, 10:28 AM |

|

|

|

|

|

coolguy99

|

Jul 18 2025, 08:18 AM Jul 18 2025, 08:18 AM

|

|

Hong Leong does not allow BT into own account anymore? Just tried to BT but the Hong Leong selection is no longer there.

|

|

|

|

|

|

coolguy99

|

Aug 14 2025, 04:46 PM Aug 14 2025, 04:46 PM

|

|

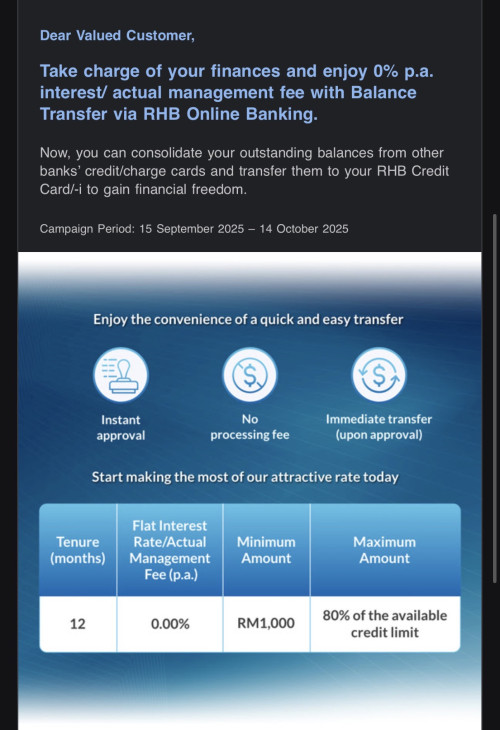

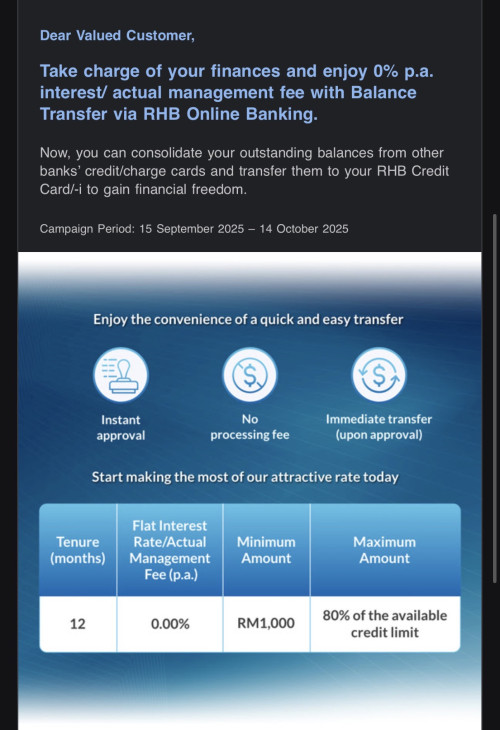

Anyone has heard about rhb cash xcess program? I recently got my new rhb card and they offered this for me. 0% for 12 months. Very tempting. And no fees.

|

|

|

|

|

|

coolguy99

|

Aug 15 2025, 11:34 AM Aug 15 2025, 11:34 AM

|

|

QUOTE(LostAndFound @ Aug 14 2025, 09:29 PM) Yeah new-to-bank for RHB cards gets this one-time benefit. No strings, just pay in full on time and enjoy the interest-free loan. Thank you just got it as well  |

|

|

|

|

|

coolguy99

|

Aug 25 2025, 11:06 AM Aug 25 2025, 11:06 AM

|

|

QUOTE(Human Nature @ Aug 25 2025, 09:56 AM) Applied MBB BT last Saturday. Received the miney to both PBB cards today. Affin not yet received. Should I be concern that I key in wrong number?  Just wait for a bit. Affin takes some time for money to be reflected in the account. |

|

|

|

|

|

coolguy99

|

Sep 20 2025, 07:49 AM Sep 20 2025, 07:49 AM

|

|

QUOTE(apieh23 @ Sep 19 2025, 01:16 PM) RHB is offering 0% BT  Is it easy to apply for a credit card limit increase for RHB CC? |

|

|

|

|

|

coolguy99

|

Oct 15 2025, 06:52 AM Oct 15 2025, 06:52 AM

|

|

QUOTE(Chyan @ Oct 13 2025, 05:06 PM) Does it mean during the 12 months, can pay more than the minimum 5% and settle the balance on the last day (due date)? How about spread out evenly every month? Eg. 2000/12 = 166.67/mth Why is their mechanism so weird?  Good if you manage your cash properly. Else when it comes to the end of the BT you would not be able to pay the lump sum. And bam bank laughing all the way to the bank. |

|

|

|

|

|

coolguy99

|

Nov 10 2025, 09:00 AM Nov 10 2025, 09:00 AM

|

|

This is my first time doing BT from HLB. How can you tell that it is already the last month of your BT and you have to settle the FULL outstanding amount instead of paying the minimum payment?

Is there any way to see this from the web portal?

|

|

|

|

|

|

coolguy99

|

Nov 10 2025, 10:22 AM Nov 10 2025, 10:22 AM

|

|

QUOTE(adbacc @ Nov 10 2025, 09:51 AM) Look under Expiry date on the web In this example its 13/Dec [attachmentid=11521640] This means I need to settle ALL the outstanding before this stated expiry date am i right? Else I will be charged 18% p.a. interest daily after this date. |

|

|

|

|

|

coolguy99

|

Nov 16 2025, 08:26 AM Nov 16 2025, 08:26 AM

|

|

QUOTE(xiaomoon @ Nov 13 2025, 02:01 PM) actually we can pay early right, no need wait until the last date, for hlb bt  Yes I think we can. As long as you pay after that date you should be able to avoid the early settlement fees. |

|

|

|

|

Dec 24 2019, 11:54 AM

Dec 24 2019, 11:54 AM

Quote

Quote

0.0621sec

0.0621sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled