Attached thumbnail(s)

Fundsupermart.com v14, Happy 牛(bull!) Year

|

|

Jul 24 2016, 11:03 PM Jul 24 2016, 11:03 PM

Return to original view | Post

#1

|

Senior Member

1,311 posts Joined: Jan 2012 |

Hey guys, I am a newbie here. I made some readings about mutual funds and look at some fund reports (or whatever you call it). Here's my current watch list. I wonder anyone here invest in these funds too? I focus on Malaysia market only btw. And if what I pick is not recommended in your opinion, kindly let me know

Attached thumbnail(s)

|

|

|

|

|

|

Jul 26 2016, 01:59 AM Jul 26 2016, 01:59 AM

Return to original view | Post

#2

|

Senior Member

1,311 posts Joined: Jan 2012 |

Guys, I am planning my portfolio to be like this. Please let me know if its contradicting.

Equity: 1. Affin Hwang Select Asia (Ex Japan) Quantum Fund - 5% 2. ESI Global Leaders MY Fund - 10% 3. Arbedeen Islamic World Equity Fund - 15% 4. CIMB Titans - 10% 5. KGF - 10% 6. ESI Small Cap - 10% Bond: 1. RHB Asian Total Return Fund - 10% 2. ESI Bond Fund - 10% 3. RHB Smart Balanced Fund - 10% I am a young guy, having enough emergency fund and can park money for long term. But at the same time, I also fear losing too much money as I learn only a freash grad pay (2k +) |

|

|

Jul 26 2016, 12:51 PM Jul 26 2016, 12:51 PM

Return to original view | Post

#3

|

Senior Member

1,311 posts Joined: Jan 2012 |

QUOTE(dasecret @ Jul 26 2016, 10:57 AM) Since so many are encouraging you to go higher on equity, I thought I should advocate otherwise. Actually that's what I personally do too... >30% cash; and no, I'm not in my 50s Wow wow, thanks for the explanation! One thing that puzzled me is the geographical diversification. Is investing in a malaysia-focused fund and asia fund consider geographical diversification? Instead of just telling you what I think, I'd show you how it looks in the portfolio simulator. Portfolio 2 is what I would go for personally as I do not like global leaders MY fund and I felt that your developed nation exposure is too high. So I've equal weighted the regions equity - Asia 20%; World 20% and Msia 20%; Pure bond funds 15% each and smart balance stay at 10% [attachmentid=7174479] [attachmentid=7174488] note that the portfolio volatility is lower and the 1 year return is higher, of course, 1 could argue that the 3 years returns is higher, but that's the past performance. You should try it out with 100% equity and see how it goes and if you are willing to take the kind of volatility And actually i am thinking of putting more focus on Malaysia only because involving different currency will make things complicated, hence for a non-financial background, I prefer to take things slow and master Malaysia fund first before going global. Is this a good choice? |

|

|

Jul 26 2016, 01:30 PM Jul 26 2016, 01:30 PM

Return to original view | Post

#4

|

Senior Member

1,311 posts Joined: Jan 2012 |

QUOTE(dasecret @ Jul 26 2016, 10:57 AM) Since so many are encouraging you to go higher on equity, I thought I should advocate otherwise. Actually that's what I personally do too... >30% cash; and no, I'm not in my 50s And also, looking back at Global Leaders MY Fund, they are investing in companies like Microsoft, Amazon and Nvidia which i think is going to be very valuable in time to come. May I know, what makes you dislike MY fund? For me i chose that because I believe that everything will be digitalize in the future Instead of just telling you what I think, I'd show you how it looks in the portfolio simulator. Portfolio 2 is what I would go for personally as I do not like global leaders MY fund and I felt that your developed nation exposure is too high. So I've equal weighted the regions equity - Asia 20%; World 20% and Msia 20%; Pure bond funds 15% each and smart balance stay at 10% [attachmentid=7174479] [attachmentid=7174488] note that the portfolio volatility is lower and the 1 year return is higher, of course, 1 could argue that the 3 years returns is higher, but that's the past performance. You should try it out with 100% equity and see how it goes and if you are willing to take the kind of volatility |

|

|

Jul 26 2016, 02:00 PM Jul 26 2016, 02:00 PM

Return to original view | Post

#5

|

Senior Member

1,311 posts Joined: Jan 2012 |

And guys, i am just wondering right, how sure is it that any mutual fund, if purchase and park money inside for long term, guarantees a return? I heard a lot of ppl say that if you invest for long term, mutual fund surely earn money. But i wonder is it possible that one also make constant losses in long term?

|

|

|

Jul 28 2016, 01:05 PM Jul 28 2016, 01:05 PM

Return to original view | Post

#6

|

Senior Member

1,311 posts Joined: Jan 2012 |

Guys, could anyone kindly attach the link of FSM where all the risk ratings are displayed? I once opened it before but couldnt find back already. I remember when I pointed my mouse on the risk rate, it shows the risk scale with 0 being no risk and 10 being highest risk.

|

|

|

|

|

|

Jul 28 2016, 02:52 PM Jul 28 2016, 02:52 PM

Return to original view | Post

#7

|

Senior Member

1,311 posts Joined: Jan 2012 |

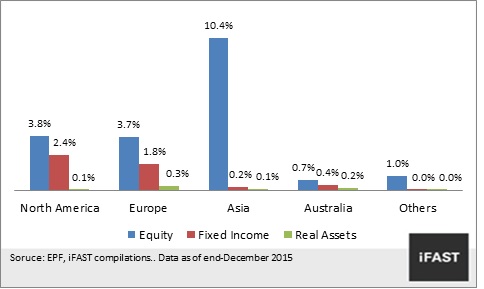

Manage to find an article showing the asset allocation and geographical diversification of our EPF. Does anyone know why our EPF fund manager purchase more bonds in US and EU than in Asia? And why they purchase most of the equities in Asia? |

|

|

Jul 28 2016, 03:57 PM Jul 28 2016, 03:57 PM

Return to original view | Post

#8

|

Senior Member

1,311 posts Joined: Jan 2012 |

QUOTE(T231H @ Jul 28 2016, 03:43 PM) try FUNDS INFO/FUND SELECTOR...it will display...no need to mouse over it to see the risk rating value Well according to the graph, thats the most allocation isnt it? I wonder where the rest of the funds are allocated https://www.fundsupermart.com.my/main/fundi...fundSelect.svdo I have no idea why the FM do the allocation... but, just look at the % allocated for them....so little % (just 10%) compared to what is NOT shown.....like the % in Malaysia alone? ever think of the "concentration risk"? just 10.4% , you mentioned "MOST" equities in Asia? |

|

|

Jul 30 2016, 02:44 AM Jul 30 2016, 02:44 AM

Return to original view | Post

#9

|

Senior Member

1,311 posts Joined: Jan 2012 |

QUOTE(Pink Spider @ Jul 16 2016, 04:08 PM) IMHO for white collar workers at executive level and above, if you don't touch your EPF til retirement, you should be able to retire "comfortably". Are the "" meant to mean the opposite way? Cuz I dont see how EPF is going to support us for a few decades.Ps. Sorry for bringing back old post. I am reading the entire v14 to learn about FSM before buying funds lol |

|

|

Jul 30 2016, 02:44 AM Jul 30 2016, 02:44 AM

Return to original view | Post

#10

|

Senior Member

1,311 posts Joined: Jan 2012 |

Duplicated post

This post has been edited by em0kia: Jul 30 2016, 02:45 AM |

|

|

Jul 31 2016, 02:53 AM Jul 31 2016, 02:53 AM

Return to original view | Post

#11

|

Senior Member

1,311 posts Joined: Jan 2012 |

QUOTE(j.passing.by @ Jul 29 2016, 04:01 PM) If the 760 payment is for 12 months on an investment of 4200, that's a IRR of 416%. hey, feeling curious, how did you get the IRR value?Everyone will be abandoning their UT units... fund houses will go empty... fund managers out of jobs... =========== Btw the previous posts are just out-of-the-box thinking... if anyone actually makes it happen, please don't give me any credit... don't want any tai kor putting a bounty on my head for spoiling their rice bowl. My way of calculation is: RM760 * 12 = RM9120 If invest RM4200, 9120/4200 = 2.17. 416% is like doubling twice right? |

|

|

Aug 4 2016, 10:20 PM Aug 4 2016, 10:20 PM

Return to original view | Post

#12

|

Senior Member

1,311 posts Joined: Jan 2012 |

Braced myself to kickstart my first investment. 100% EQ, planning to park for long term.

50% EI Small Cap 50% Titans |

|

|

Aug 5 2016, 07:49 AM Aug 5 2016, 07:49 AM

Return to original view | Post

#13

|

Senior Member

1,311 posts Joined: Jan 2012 |

QUOTE(Avangelice @ Aug 4 2016, 10:35 PM) Hey, realized that diversification is just pulling my ROI figure down. Since I will be keeping the money and DCA for long term (>5 yrs), i really think 100% EQ is fine. However, will value your opinion too. I did portfolio simulation last night. RHB Smart Balanced is in my watch list, however, replacing it with either Titans/EI Small Cap did not bring down volatility much. So, might as well go for one global equity and one local equity. I am planning to invest RM200-300 on monthly basis. |

|

|

Aug 29 2016, 08:44 AM Aug 29 2016, 08:44 AM

Return to original view | Post

#14

|

Senior Member

1,311 posts Joined: Jan 2012 |

with this promotion SC,

Do you guys think its good to top up equally to both EI Small Cap and Titan? Currently both these take up 50% of my total investment haha |

|

|

Aug 29 2016, 02:16 PM Aug 29 2016, 02:16 PM

Return to original view | Post

#15

|

Senior Member

1,311 posts Joined: Jan 2012 |

QUOTE(nexona88 @ Aug 29 2016, 01:04 PM) Well, i started off with these two funds, hence 50% each. As my first income is coming, I would like to plan on my next move - to purchase new funds or dca on currentone? the reason i chose these two funds is because they both yield 15% ror according to simulator. I knew past performance does not determine the future one, but analogically speaking you wouldnt want to lend your money to a guy who does not have a good track record right. And the two funds are highly recommended. But i value your opinion. in fact, I am following this thread tightly to decide on my next move. |

|

Topic ClosedOptions

|

| Change to: |  0.0820sec 0.0820sec

1.01 1.01

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 12:03 PM |