Outline ·

[ Standard ] ·

Linear+

Fundsupermart.com v14, Happy 牛(bull!) Year

|

kimyee73

|

Jun 24 2016, 09:28 PM Jun 24 2016, 09:28 PM

|

|

QUOTE(pisces88 @ Jun 24 2016, 03:24 PM) need to review whole portfolio tonight. Stocks also took a beating already. ouch....  My stock pre-market already down 2.5%, market is opening in like 1 mins. 4 mins after the bell, down 5% already. Luckily my gold and silver stocks are providing support, else worse. This post has been edited by kimyee73: Jun 24 2016, 09:34 PM |

|

|

|

|

|

pisces88

|

Jun 24 2016, 09:38 PM Jun 24 2016, 09:38 PM

|

|

QUOTE(kimyee73 @ Jun 24 2016, 09:28 PM) My stock pre-market already down 2.5%, market is opening in like 1 mins. 4 mins after the bell, down 5% already. Luckily my gold and silver stocks are providing support, else worse. next monday will be worse?  -500 points already on DJ |

|

|

|

|

|

T231H

|

Jun 24 2016, 09:48 PM Jun 24 2016, 09:48 PM

|

|

QUOTE(Vanguard 2015 @ Jun 24 2016, 02:11 PM) What a great buying opportunity for long term investors. UK unexpectedly exited EU. Gold will rise, sterling dropping, worldwide share markets dropping in knee jerk reaction..... Wah... what to buy in FSM? Recommendations???

You asked this afternoon...FSM replied just now....  The UK has voted to leave the European Union. How Should Investors React? https://www.fundsupermart.com.my/main/resea...-Wreck-It--7220 |

|

|

|

|

|

Kaka23

|

Jun 24 2016, 10:50 PM Jun 24 2016, 10:50 PM

|

|

Wah... now i pening, which funds to top up...  |

|

|

|

|

|

aoisky

|

Jun 24 2016, 11:12 PM Jun 24 2016, 11:12 PM

|

|

QUOTE(Kaka23 @ Jun 24 2016, 10:50 PM) Wah... now i pening, which funds to top up...  Time to topup |

|

|

|

|

|

drew86

|

Jun 24 2016, 11:47 PM Jun 24 2016, 11:47 PM

|

Getting Started

|

With funds being priced by forward pricing, wouldn't selling off Titans now be a wee bit too late?

This post has been edited by drew86: Jun 24 2016, 11:50 PM

|

|

|

|

|

|

Kaka23

|

Jun 24 2016, 11:54 PM Jun 24 2016, 11:54 PM

|

|

QUOTE(drew86 @ Jun 24 2016, 11:47 PM) With funds being priced by forward pricing, wouldn't selling off Titans now be a wee bit too late? If next week still drop and drop.. selling today ok la..  |

|

|

|

|

|

_azam13

|

Jun 25 2016, 07:10 AM Jun 25 2016, 07:10 AM

|

Getting Started

|

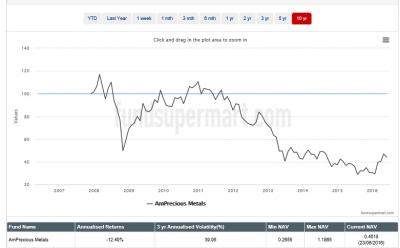

Bought AmPrecious Metals before Brexit, thinking that even if Britain remains, the global sentiment will revert back to "global growth slowdown". You know, all that China-debt fuelled growth plus weaker than expected US economic data. Then Brexit happened. Things unexpectedly went my way. Now I have to think when to sell AmPrecious.

Now that Brexit is set to happen, there's also the risk that other parties in the EU might also seek their own version of exits, and Scotland is likely to seek to leave UK to pursue its own membership in the EU. Thoughts?

|

|

|

|

|

|

wil-i-am

|

Jun 25 2016, 07:59 AM Jun 25 2016, 07:59 AM

|

|

QUOTE(Kaka23 @ Jun 24 2016, 10:50 PM) Wah... now i pening, which funds to top up...  Gud time for shopping? |

|

|

|

|

|

aoisky

|

Jun 25 2016, 08:14 AM Jun 25 2016, 08:14 AM

|

|

DJIA down -610.32 every region going into deep red

|

|

|

|

|

|

SUSDavid83

|

Jun 25 2016, 09:05 AM Jun 25 2016, 09:05 AM

|

|

Time to top up GTF!

|

|

|

|

|

|

vincabby

|

Jun 25 2016, 09:46 AM Jun 25 2016, 09:46 AM

|

|

QUOTE(_azam13 @ Jun 25 2016, 07:10 AM) Bought AmPrecious Metals before Brexit, thinking that even if Britain remains, the global sentiment will revert back to "global growth slowdown". You know, all that China-debt fuelled growth plus weaker than expected US economic data. Then Brexit happened. Things unexpectedly went my way. Now I have to think when to sell AmPrecious. Now that Brexit is set to happen, there's also the risk that other parties in the EU might also seek their own version of exits, and Scotland is likely to seek to leave UK to pursue its own membership in the EU. Thoughts? it is as you said! domino effect across the board. Are we seeing the death of EURO itself or a hurdle for them to further greatness. We will never know. Just have to sit tight and ride or quit game for now. |

|

|

|

|

|

_azam13

|

Jun 25 2016, 10:05 AM Jun 25 2016, 10:05 AM

|

Getting Started

|

QUOTE(T231H @ Jun 25 2016, 01:59 AM) amprecious metal...NOT my cup of tea  Haha that one picture can explain lots of things and provide different perspectives.. whats your angle? |

|

|

|

|

|

T231H

|

Jun 25 2016, 10:15 AM Jun 25 2016, 10:15 AM

|

|

QUOTE(_azam13 @ Jun 25 2016, 10:05 AM) Haha that one picture can explain lots of things and provide different perspectives.. whats your angle? both long term and short terms.... long term...not a trend liked by a long term investor.... short term....it is already jumped up 70% since 22 Jan 2016 ... will it go up?...yes... I think but only short term...just like what I think will happens to the stock markets.....they call it knee jerk reactions. will I take the chance to make some extra profits during this short period of time while people knee jerked? NO.....if I wanted to take chances in this short term.....I would do it with a 49% chances of winning my 100% bets, ...by "naik bukit genting" This post has been edited by T231H: Jun 25 2016, 10:27 AM |

|

|

|

|

|

_azam13

|

Jun 25 2016, 10:39 AM Jun 25 2016, 10:39 AM

|

Getting Started

|

QUOTE(T231H @ Jun 25 2016, 02:15 AM) both long term and short terms.... long term...not a trend liked for a long term investor.... short term....it is already jumped up 70% since 22 Jan 2016 till 23 June 2016... will it go up?...yes... I think but only short term...just like what I think will happens to the stock markets.....they call it knee jerk reactions. I also don't plan to hold on to it for long.. It's just that I think that its a waste if I don't take advantage of it if I think its going to perform, even in the short term.. I only put about 17% of my asset in it. The rest is in bonds. I'm comfortable with the current risk profile. Not much great news for gold to go down from now on. I'm thinking that the potential for upside is greater than downside. |

|

|

|

|

|

T231H

|

Jun 25 2016, 11:07 AM Jun 25 2016, 11:07 AM

|

|

QUOTE(_azam13 @ Jun 25 2016, 10:39 AM) I also don't plan to hold on to it for long.. It's just that I think that its a waste if I don't take advantage of it if I think its going to perform, even in the short term.. I only put about 17% of my asset in it. The rest is in bonds. I'm comfortable with the current risk profile. Not much great news for gold to go down from now on. I'm thinking that the potential for upside is greater than downside. good option....17% in am precious : 83% in Bond....(80% defenders 20% attacking commandos) but some people would say t is a waste of opportunity, for not taking FULL opportunity if one were to know that the potential outcome for upside is greater than downside with just 17%...if the ROI is 10% up...it just add 1.7% in the ROI of the portfolio  |

|

|

|

|

|

_azam13

|

Jun 25 2016, 11:18 AM Jun 25 2016, 11:18 AM

|

Getting Started

|

QUOTE(T231H @ Jun 25 2016, 03:07 AM) good option....17% in am precious : 83% in Bond....(80% defenders 20% attacking commandos) but some people would say t is a waste of opportunity, for not taking FULL opportunity if one were to know that the potential outcome for upside is greater than downside with just 17%...if the ROI is 10% up...it just add 1.7% in the ROI of the portfolio  haha you're actually right! I just started investing money, so my risk appetite isn't there yet. I'm still young and just started working, maybe I should've taken more risk  |

|

|

|

|

|

TakoC

|

Jun 25 2016, 12:01 PM Jun 25 2016, 12:01 PM

|

|

What's THE bond fund these days?

Used to be AmDynamic.

|

|

|

|

|

|

vincabby

|

Jun 25 2016, 01:25 PM Jun 25 2016, 01:25 PM

|

|

is there any 'safe haven assets' available to buy in fundsupermart? last i remember the funds here for gold also includes their running costs and not solely on how much the gold is. Therefore, it does not follow the ups and downs of gold price strictly.

|

|

|

|

|

Jun 24 2016, 09:28 PM

Jun 24 2016, 09:28 PM

Quote

Quote

0.0317sec

0.0317sec

0.25

0.25

6 queries

6 queries

GZIP Disabled

GZIP Disabled