QUOTE(zstan @ Aug 24 2020, 11:24 AM)

Im eyeing for pharmaniaga. They are still below 5 years ago price.STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Aug 24 2020, 12:20 PM Aug 24 2020, 12:20 PM

Return to original view | Post

#1

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

|

|

|

|

|

|

Feb 16 2021, 12:58 PM Feb 16 2021, 12:58 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

Any stocks to recommend to hold for 3-5 years from current price? Im mainly buy fund guy. However, fund abit hardly to double or triple due to diversed risk. But looking forward share like genting & airasia to hold.

|

|

|

Feb 16 2021, 01:10 PM Feb 16 2021, 01:10 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

QUOTE(HereToLearn @ Feb 16 2021, 01:06 PM) SOME recovered to pre-covid level, but then dropped back, except PBBANK and HLBBANK, recovered and dropped back but still higher than pre-covid Mind to share? There are still some out there that are below pre-covid with extremely attractive valuation. About pharmaniaga, any chance to get hyped due to vaccine distribution or already priced in? |

|

|

Feb 23 2021, 10:55 AM Feb 23 2021, 10:55 AM

Return to original view | Post

#4

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

|

|

|

Oct 10 2021, 03:51 PM Oct 10 2021, 03:51 PM

Return to original view | Post

#5

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

|

|

|

Oct 11 2021, 10:17 AM Oct 11 2021, 10:17 AM

Return to original view | Post

#6

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

Genting group or genM better potential?

|

|

|

|

|

|

Oct 17 2021, 10:30 AM Oct 17 2021, 10:30 AM

Return to original view | Post

#7

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

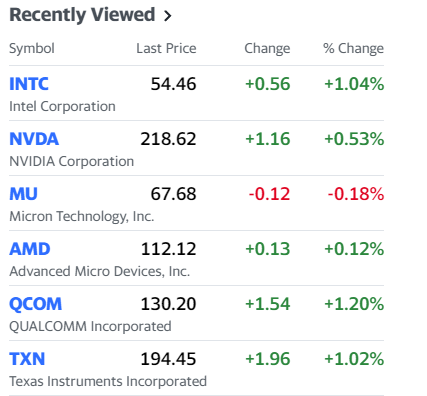

QUOTE(Boon3 @ Oct 16 2021, 09:37 AM) HereToLearn The qualcom seem like a good buy. Strong support at $123. Other tech stocks seem overvalued thosince I had searched those stocks via yahoo finance, I can easily refer back at a quick glance... the prices during that 'divergence'.. 1. Intel stock closing price on 6th Oct = 53.98 2. NVIDIA stock closing price on 6th Oct = 207 3. Micron tech stock closing price on 6th Oct = 69.94 4. AMD stock closing price on 6th Oct = 103.64 5. Qualcom stock closing price on 6th Oct = 128.06 6. Texas Ins stock closing price on 6th Oct = 194.39 prices right now...  |

|

|

Oct 17 2021, 01:33 PM Oct 17 2021, 01:33 PM

Return to original view | Post

#8

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

QUOTE(Boon3 @ Oct 17 2021, 12:53 PM) Thanks for your opinion but I dunno how to answer you... You only trade bursa? Why you dont trade US stock?I don't even trade in any US stocks. I was just using those stocks as an example to highlight the risks of basing one's trading on indicators such as 'macd divergence on an index' as a selling signal. |

|

|

Oct 17 2021, 01:46 PM Oct 17 2021, 01:46 PM

Return to original view | Post

#9

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

QUOTE(icemanfx @ Oct 17 2021, 10:58 AM) As crypto whales are holding a large proportion of crypto currency, crypto currency price movement is largely dictated by them. like in bursa, most #retailers will end in losses at the end. 1. Agreed. Every market, almost most retailer lose money. But they have to lose in order for smart money to earn. on btc mining, it seem current cost to mine one btc is about us$20k of electricity. micro miners are likely to deplete their cash for electricity bill before seeing reward. like all non productive speculative assets, bubble will burst when fewer people buy. 2. Local miner, they assume the electricity is free. If you know what I mean. They are smart not to have loose end tied to them. Syndicate. |

|

|

Mar 12 2025, 04:50 PM Mar 12 2025, 04:50 PM

Return to original view | Post

#10

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

Not normal for KLSE to go down -2.50% a day right?

|

| Change to: |  1.4004sec 1.4004sec

0.25 0.25

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 04:34 PM |