QUOTE(whyseej00 @ Apr 25 2020, 06:26 PM)

Lowered rates, effect will cause pensioners and savers suffering in rates. Lower FD rates.Punish savers, encourage loan takers.

STOCK MARKET DISCUSSION V150

|

|

Apr 25 2020, 06:52 PM Apr 25 2020, 06:52 PM

Return to original view | Post

#1

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

|

|

|

|

|

|

Apr 26 2020, 11:16 AM Apr 26 2020, 11:16 AM

Return to original view | Post

#2

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

In the end, retiree and savers being squeezed.

Besides Bank already having funds from Bonds/Sukuk issued some time back as well as relaxed monetary recently - SRR. Of course their profit will fall but then again in current market condition, which Companies will declare dividends and high profit except few industry only. |

|

|

Jul 8 2020, 08:07 PM Jul 8 2020, 08:07 PM

Return to original view | Post

#3

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

QUOTE(foofoosasa @ Jul 8 2020, 07:50 PM) Have u wonder how does lower opr rate affect bank profitability and the 6 months loan deferment? Let's alone the rising default loan. OPR reduce profit but then again Deposits Rate also drop in tandem. With current climate, some would still stick to FD as first defence base.After September, there is signs of further moratorium coming up to offset the supposed rising default loan scenario so that it won’t look so bad after Sept. |

|

|

Jan 31 2021, 06:14 AM Jan 31 2021, 06:14 AM

Return to original view | Post

#4

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

If Shopping Malls suffer in form of lack of shoppers and parking yield, rental need to be cut... so REITs on malls would be impacted.

|

|

|

May 26 2021, 12:12 PM May 26 2021, 12:12 PM

Return to original view | Post

#5

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

DIY model is simple, to take 1 store and increase revenue would be harder than opening another to gain revenue. Assume per store annual revenue is RM3M.

1 store = increase 10% sales would be RM3.3M 1 new store = immediate RM3.0M new income stream Of course that is why I did not go for it during IPO. But then what do I know, price also now higher. |

|

|

May 30 2021, 09:29 AM May 30 2021, 09:29 AM

Return to original view | Post

#6

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

Normally Auditor will try to avoid to raise significant audit findings... if they do so, it must be something amiss and hard to close one eye.

Anyway Auditor is paid by the company, why poke their own boss unless ... This post has been edited by eric.tangps: May 30 2021, 09:29 AM |

|

|

|

|

|

May 30 2021, 10:08 AM May 30 2021, 10:08 AM

Return to original view | Post

#7

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

|

|

|

Jul 4 2021, 07:02 PM Jul 4 2021, 07:02 PM

Return to original view | Post

#8

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

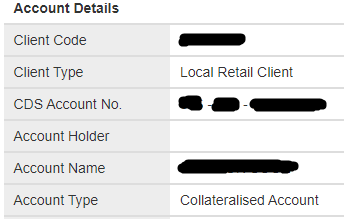

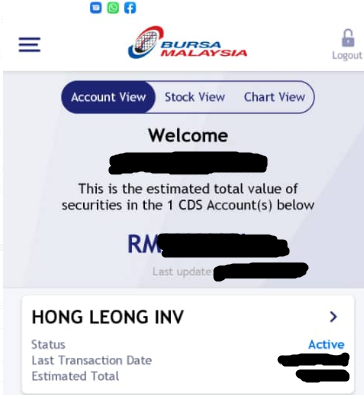

QUOTE(shadow111 @ Jul 4 2021, 04:03 PM) I'm new in trading and currently using HLEbroking. Try check your Banking Online, investment and look for IPO.As per my understanding, I'm having a direct account as it's showing my own name in both HLEbroking and Bursa Anywhere (Please correct me if I'm wrong). I plan to subscribe for the CTOS IPO but I'm not sure how to do this. Can someone please guide me on this? Thanks.   |

|

|

Dec 31 2021, 07:03 AM Dec 31 2021, 07:03 AM

Return to original view | Post

#9

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

|

|

|

Apr 29 2022, 02:54 PM Apr 29 2022, 02:54 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

well Bursa is a casino indeed.

|

|

|

Apr 30 2022, 08:31 PM Apr 30 2022, 08:31 PM

Return to original view | Post

#11

|

Junior Member

640 posts Joined: Apr 2007 From: X-Mansion, Penang |

QUOTE(Boon3 @ Apr 30 2022, 09:46 AM) DD based on financial reports and documents provided.Basically not even analyst would had known on receivable issues since it is vetted by Auditors. Well no one is going after the Auditors who signed off every one of the report year on year. |

| Change to: |  2.6230sec 2.6230sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 03:17 AM |