Outline ·

[ Standard ] ·

Linear+

STOCK MARKET DISCUSSION V150

|

Yggdrasil

|

Aug 7 2020, 08:48 PM Aug 7 2020, 08:48 PM

|

|

QUOTE(ComingBackSoon @ Aug 7 2020, 08:36 PM) I lost 97% of my investment value in Sapura. That was my first tuition fee in the share market. Thank god I dont have lots of money in 2015 and dont even know what averaging down even mean. Ouch. How much you invested if you don't mind sharing? I saw someone share that she lost RM150k on some other penny stock that went from RM0.30 to RM0.15. |

|

|

|

|

|

Yggdrasil

|

Aug 8 2020, 11:37 AM Aug 8 2020, 11:37 AM

|

|

QUOTE(un.deux.trois @ Aug 8 2020, 11:24 AM) I’m stuck with Adventa too haha. Entered at 3.99. Are you gonna sell Adventa on Monday? QUOTE(lauwenhan @ Aug 8 2020, 11:34 AM) Nah, I got trapped at 4.8. Steps to make money: 1) When you want to buy, tell people you want to sell 2) When you want to sell, tell people you want to buy/hold   This post has been edited by Yggdrasil: Aug 8 2020, 11:38 AM This post has been edited by Yggdrasil: Aug 8 2020, 11:38 AM |

|

|

|

|

|

Yggdrasil

|

Aug 8 2020, 11:58 AM Aug 8 2020, 11:58 AM

|

|

QUOTE(lauwenhan @ Aug 8 2020, 11:41 AM) You wanna gaduh is it? Got trapped got trapped la. Want me to show portfoilio? sell at paper loss 20k is it? Mood already pretty bad. lyn/bursastreetbets  Chill la. If you're willing to gamble then you need to suck it up if make huge loss. If make big big, you keep quiet and happy  I hope your loss doesn't affect others. I know someone who lost few hundred thousands gambling in stock market. RM20k is nothing. He used to give his wife RM2,000 for monthly expenditure. After losing huge, he suddenly start complaining RM2,000 monthly expenditure for food is too high. Then, want cut to RM800. Little does she know that her husband lost huge. Losses also sweep under carpet pretend don't know. Gamble responsibly  |

|

|

|

|

|

Yggdrasil

|

Aug 8 2020, 09:33 PM Aug 8 2020, 09:33 PM

|

|

QUOTE(ratloverice @ Aug 8 2020, 09:16 PM) Not really trying to buy as soon as the market opens. It’s just that rakuten trade often freezes in the first hour, so I would like to agak2 what I will be seeing on a particular day 😂 Banks sell first before letting you sell  |

|

|

|

|

|

Yggdrasil

|

Aug 8 2020, 10:12 PM Aug 8 2020, 10:12 PM

|

|

QUOTE(lauwenhan @ Aug 8 2020, 09:51 PM) Ask people to sell so you can buy MonkaS For what? If I want gamble I already bought when it was at a low. When high I sell.  https://forum.lowyat.net/index.php?showtopi...post&p=95976421 https://forum.lowyat.net/index.php?showtopi...post&p=95976421Also, https://forum.lowyat.net/index.php?showtopic=4929259&hl=Collect first don't tell othersThis post has been edited by Yggdrasil: Aug 8 2020, 10:36 PM |

|

|

|

|

|

Yggdrasil

|

Aug 9 2020, 04:04 PM Aug 9 2020, 04:04 PM

|

|

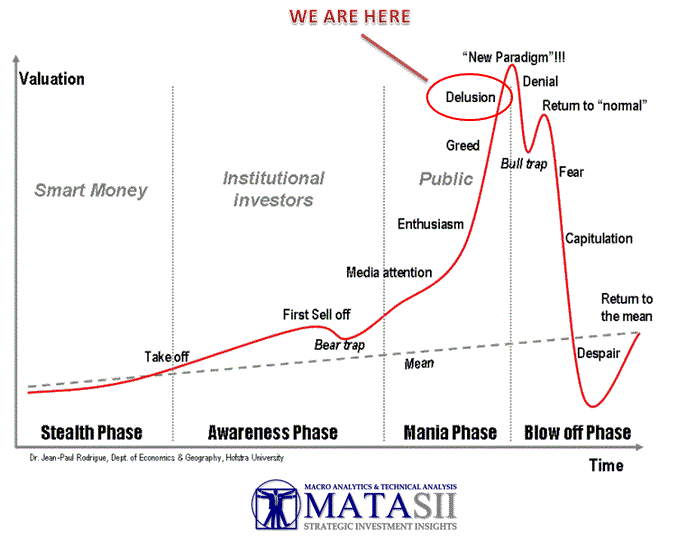

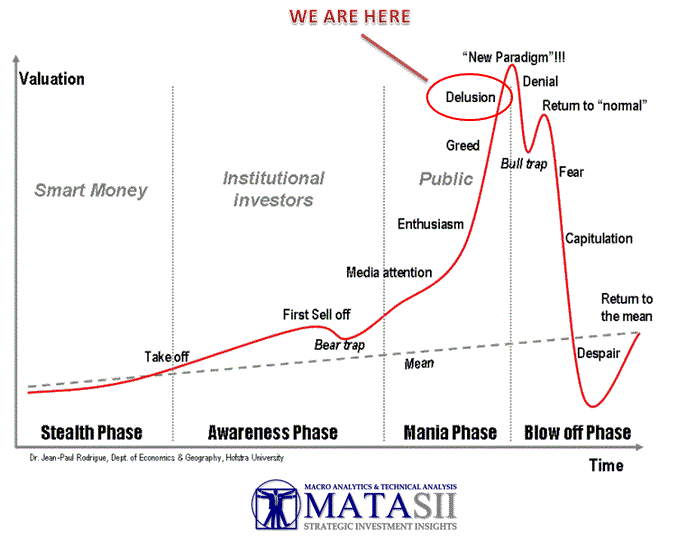

Let's not forget  |

|

|

|

|

|

Yggdrasil

|

Aug 12 2020, 03:08 PM Aug 12 2020, 03:08 PM

|

|

QUOTE(Speedstar1 @ Aug 12 2020, 03:06 PM) There are 144 govt & 240 private hospitals in Malaysia. Assuming all of them take part in vaccination and allocate 5 docs/ MOs every day, 8 hours of work a day, 4 patients every hour, they're able to vaccinate around 61,440 people a day. In order to vaccinate 33 mil Malaysians, it will take 537 days. This is on optimistic assumption that there is enough supplies at reasonable prices and hospitals are able to allocate resources in terms of manpower, space, storage etc. This is for our country which has a relatively good healthcare system, but what about countries like India with population over a billion and inadequate healthcare system coupled with poverty etc? Still think vaccines will make the virus dissappear overnight? Would love to have vaccines that can bring our lives back to pre covid normalcy. But that reality is some time away. And judging by multiple waves happening in well controlled places like NZ, it's clear that this virus is not going away anytime soon Why need vaccinate everyone if not infected? Even if it's for prevention, no need in a hurry. |

|

|

|

|

|

Yggdrasil

|

Aug 12 2020, 03:17 PM Aug 12 2020, 03:17 PM

|

|

QUOTE(Speedstar1 @ Aug 12 2020, 03:10 PM) You mean we're supposed to vaccinate people after they're infected? You sick only take medicine or take medicine before sick? FYI, even mandatory jabs like BCG vaccine only lasts 15 years. Most children took the jab when they were young. You probably have the scar on your left arm. Many adults walking around today already lost the protection after 15 years but didn't bother to vaccinate again. More info here.Why? Because it costs money. Around RM100~RM200 per BCG jab. Imagine the cost of the covid vaccine when it first comes out. Probably costs RM10,000 per jab. This post has been edited by Yggdrasil: Aug 12 2020, 03:19 PM |

|

|

|

|

|

Yggdrasil

|

Aug 12 2020, 03:32 PM Aug 12 2020, 03:32 PM

|

|

QUOTE(Speedstar1 @ Aug 12 2020, 03:25 PM) Vaccines are taken before you get sick, medication after. What are you trying to convey actually? You're trying to say as if demand for glove in Malaysia will continue to be strong because Malaysians will continue to be infected with Covid as it takes time to vaccine the whole Malaysian population. Demand for glove locally will return to normal (pre-covid levels) but demand for glove from overseas will still depend on the respective countries. If you want to make a statement that demand for Malaysian's gloves by overseas market like US, Japan etc, then you should be using their hospital data not Malaysia's. |

|

|

|

|

|

Yggdrasil

|

Aug 13 2020, 01:15 PM Aug 13 2020, 01:15 PM

|

|

QUOTE(yahiko @ Aug 13 2020, 12:57 PM) http://www.astroawani.com/berita-dunia/vak...klinikal-255027ppl start book vaksin.. even though belum pass. why pharma no up .. ayam sad Because it's not Malaysia who found the vaccine. You think Russia will give for free? Obviously they want to monopolise. Later charge RM10b to buy the patent. If US found the vaccine, they will monopolise or keep it state secret. Malaysia's pharmaceutical companies are overvalued IMO. Most people I know who went to Cambridge or Oxford etc left Malaysia to go Singapore, US or UK to work. What are the chances some UM graduate working in Pharmaniaga or Duopharma finding the cure?  The chances of some unknown biotech company in US finding it first is higher. This post has been edited by Yggdrasil: Aug 13 2020, 01:17 PM |

|

|

|

|

|

Yggdrasil

|

Aug 13 2020, 08:37 PM Aug 13 2020, 08:37 PM

|

|

QUOTE(HereToLearn @ Aug 13 2020, 08:17 PM) The loan growth also increases due to the low interest rate environment. Lower interest rate does not necessarily translate loan growth. Although demand for loan increases, banks may not supply the loan because of increased credit risk. With lower interest rates, banks can borrow from the central bank cheaper (e.g. 1% compared to 3% previously) to lend out to borrowers. However, if the probability of default is higher (people losing their jobs or companies in trouble), banks are not interested to lend because the risk is too high. If the borrower defaults, banks still need to pay the central bank the full amount. |

|

|

|

|

|

Yggdrasil

|

Aug 13 2020, 09:20 PM Aug 13 2020, 09:20 PM

|

|

QUOTE(HereToLearn @ Aug 13 2020, 08:47 PM) Again my picks in FIs are 1. Takaful (Insurance bukan bank) 2. BIMB For rebounding play 1. CIMB For me it's: Lowest risk of bankruptcy: 1. Public Bank 2. Hong Leong Bank Growth 1. Maybank 2. BIMB Value (but high risk): 1. Alliance 2. CIMB But I'm still not touching banks yet. A bit too risky for little reward. |

|

|

|

|

|

Yggdrasil

|

Aug 13 2020, 10:02 PM Aug 13 2020, 10:02 PM

|

|

QUOTE(bronkos @ Aug 13 2020, 09:56 PM) any comments on ambank? I have 1 lot in there currently looks like out of ICU but not out of woods yet. Sorry I haven't looked at it in depth. Just glance from trend and past practices because I'm not really looking at banks right now. |

|

|

|

|

|

Yggdrasil

|

Aug 14 2020, 10:19 AM Aug 14 2020, 10:19 AM

|

|

QUOTE(Vanguard 2015 @ Aug 14 2020, 09:58 AM) The glove stocks are in red this morning. Some of you may be waiting for Top Glove to drop below RM25. Well, it is now trading at RM24.520 and still falling. So, what do you plan to do now? Is it a discount or a trap? From the previous data, when the QR for Top Glove and Supermax were released with superb profit, their share prices dropped instead. Does this mean that all of the feel good factors have already been factored into the valuation of the shares? I believe the next QR for Kossan is due next week. Will it suffer the same fate as Supermax? Please place your bet, ladies and gentlemen. Profits probably below expectations. TOPGLOV is currently trading near Maybank's market cap but earning only 17% of Maybank's annual profit. Annual profit: | MAYBANK | TOPGLOV (extrapolated) | | RM8.30b | RM347.9m x 4 = RM1.4b |

Market capitalisation (today's price) | MAYBANK | TOPGLOV | | RM87.7b | RM65.9b |

This is despite multiplying TOPGLOV's latest QR (which is supposed to be the best so far). It likely to drop after covid. |

|

|

|

|

|

Yggdrasil

|

Aug 14 2020, 10:29 AM Aug 14 2020, 10:29 AM

|

|

QUOTE(ComingBackSoon @ Aug 14 2020, 10:21 AM) Stock market is forward looking. Maybank’s profit has not bottom out yet while Topglove’s profit has yet to peak. Topglove may not peak but it will fall after covid. Also, profit might fall next quarter if this quarter's profit already included 1 year's supply of gloves. I.e. Q2 2020 outstanding results is because of hospitals buying 1 year supply of gloves. Hence, they don't need to buy anymore in Q3 2020. Maybank is doing surprisingly well compared to other banks (e.g. CIMB or Alliance) in Q1 2020, despite IFRS 9 requiring early impairment. It even recorded a higher profit, surpassing the previous quarter. Note: I'm not arguing who's right. I'm just stating facts and info given so far. |

|

|

|

|

|

Yggdrasil

|

Aug 14 2020, 10:35 AM Aug 14 2020, 10:35 AM

|

|

QUOTE(ComingBackSoon @ Aug 14 2020, 10:32 AM) 18 month worth of purchase order has been placed with a 30% deposit. Meanwhile, Maybank is still enjoying low NPL due to moratorium. Im also stating facts. Cheers Where you heard got 18 months purchase order and 30% deposit? |

|

|

|

|

|

Yggdrasil

|

Aug 14 2020, 10:42 AM Aug 14 2020, 10:42 AM

|

|

QUOTE(ComingBackSoon @ Aug 14 2020, 10:39 AM) Analyst reports. I read all of them. Which bank issue one? |

|

|

|

|

|

Yggdrasil

|

Aug 14 2020, 10:47 AM Aug 14 2020, 10:47 AM

|

|

QUOTE(Speedstar1 @ Aug 14 2020, 10:43 AM) Of course they did well in the 1st qtr, simply cos the moratorium and subsequent NPL/ restructuring haven't kicked in yet. Plenty of mid & large corporate accounts are being restructured as we speak Are you from the banking industry? I used to audit a bank and I study IFRS 9. Banks basically need to impair loans before they go bad using ECL method. This is why bank's profits have been affected since this standard was introduced but it also means banks are less risky and the financial statements are presented more fairly. No doubt that banks may need to adjust ECL rate and move more loans from Stage 1 to Stage 3 but banks with history of strict lending like Maybank and Public Bank shouldn't be affected much. |

|

|

|

|

|

Yggdrasil

|

Aug 14 2020, 11:07 AM Aug 14 2020, 11:07 AM

|

|

QUOTE(Speedstar1 @ Aug 14 2020, 10:55 AM) Maybank isn't known for their strict lending. That would be Public Bank. Maybank's greatest strength lies in their massive deposit base that gives them the cheapest lending cost, 2nd of which is PBB. In times like these, don't you think that their deposit holdings would've gone down significantly? I would think so Holding reserves is a requirement but holding too much reduces profit. BNM already requires a statutory reserve (if the bank is deemed higher risk, it may ask for additional reserves on top of that). They also have regulatory reserves. In times like this, banks already start to increase reserves rather than reduce. I'm not sure what you mean by deposit holding. You mean customer deposit? Banks can borrow from either customer or BNM to lend. Borrowing from customer is cheaper but if banks have no choice, they can borrow from BNM too since it's already cheap. |

|

|

|

|

|

Yggdrasil

|

Aug 14 2020, 11:10 AM Aug 14 2020, 11:10 AM

|

|

QUOTE(Marcus5003 @ Aug 14 2020, 11:06 AM) May i know in bank's balance sheet, how did they take in the the loan's collateral (properties, land & etc)? or it is off-balance sheet item and will only capture in the balance sheet when the loan had been default? Should be on the loan agreement i.e. like if breach covenant, then bank entitled to something like increase interest rate or full payment on demand. Banks usually don't want the borrower's assets. They want cash. They will likely sell it away to get cash. Just like bank lelong. If borrower cannot pay for house, they lelong the house. They won't keep it to do rental business. |

|

|

|

|

Aug 7 2020, 08:48 PM

Aug 7 2020, 08:48 PM

Quote

Quote

0.8288sec

0.8288sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled