QUOTE(BliitzkrieG @ May 8 2021, 09:08 AM)

Wonderful insight!

Generally 9/10 short term traders tend to lose and long term investor will be the other way round.

I3 is full with toxic.

Internet has been split into glove lovers and haters. One would like to hear positive news and opinions and hate the naysayers. Well I guess they gotto

weigh both sides and do their own study. Same goes to bursa. Other sector up and glove will go down and vice versa.

Oh yeah, one needs to be very careful with what they reads. Read it with open mind and do our own studies....

here's a good example...

If one is lazy or one chooses to read/see what they want to see, this would appear to be yet another purchase of shares from the Lau Pan.

But it's not that straight forward.....

this is because in full the announcement actually reads ...

It's a DBT.

Which brings a totally whole new perspective....

Why? The seller.

That's the Executive Director selling/disposing/transferring (Aha !!! ... see.. with words, one can choose and of course the least damaging version is 'transferring') 1,000,000 shares to his lau pan.

Now because it was done in a DBT deal, not many became aware... that the ED of Top Glove sold 1,000,000 shares.

And this is where the interpretation of the transaction....

the ever loving glove supporters who say .... hey ... small issue... and say maybe there's a reason that the lau pan wants more share of the company.... no problem here. stop making more noises.

the every irritating NOISE MAKERS would say ..... hey... could be bad. The ED doesn't even believe in the company stock anymore.... informs the lau pan the decision to sell but the lau pan says... don't you dare sell in the market but sell to me via a DBT.

well? maybe... both are noises... and what is more important, ALWAYS, is your own opinion. Yes?So we can dig deeper too, yes? (always the best thing to do..

)

here's something that

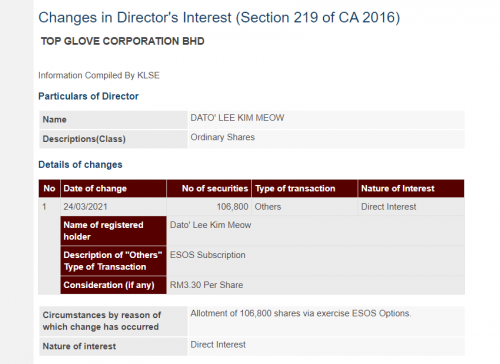

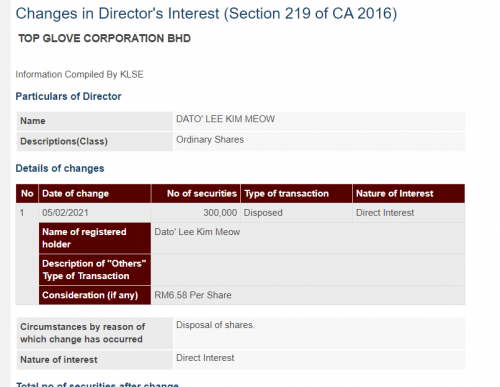

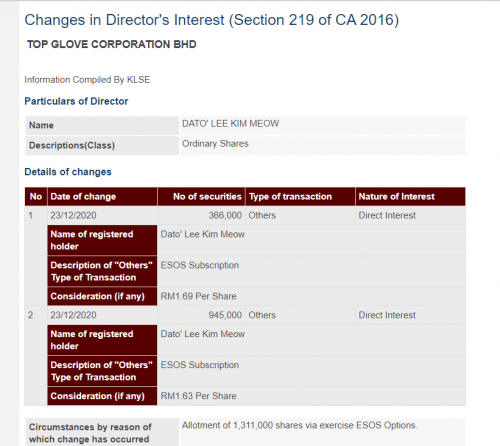

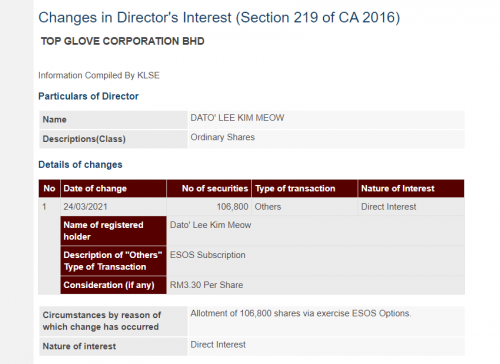

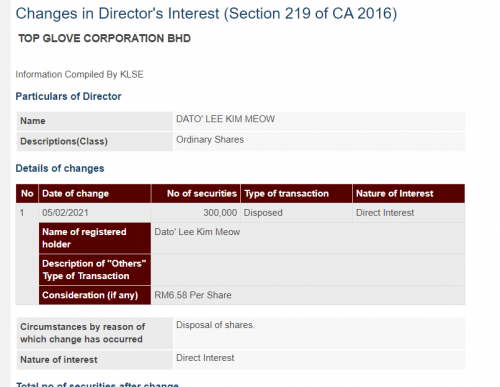

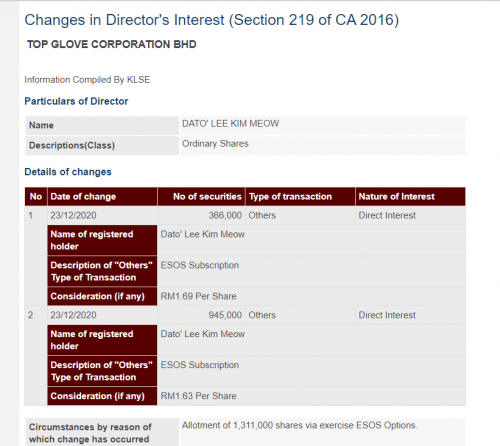

statikinetic was interested in ... ESOS issue...

source:

https://malaysiastock.biz/Company-Announcem...aspx?id=1305077 https://malaysiastock.biz/Company-Announcem...aspx?id=1293337https://malaysiastock.biz/Company-Announcem...aspx?id=1283809Getting the ESOS cheaply and disposing the ESOS higher for a nice quick profit...

so if we add it up the total shares.... perhaps nobody was correct.

Both the ever loving glove supporters and the NOISE MAKERS could very well be wrong. This is nothing but a simple case of the ED getting cheap ESOS and selling it for a quick nice profit.

Which goes to say... what is important... as you said ... weigh both sides and do our own study.

If one insist on frequenting forums, it's pointless to do declare others as noise makers. Sometimes, the noise makers, could have a very legit point.

This post has been edited by Boon3: May 8 2021, 10:10 AM

May 7 2021, 10:20 PM

May 7 2021, 10:20 PM

Quote

Quote

0.0543sec

0.0543sec

0.81

0.81

6 queries

6 queries

GZIP Disabled

GZIP Disabled