QUOTE(darkspirit @ May 26 2020, 06:09 PM)

Good infoSTOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

May 27 2020, 12:28 AM May 27 2020, 12:28 AM

Return to original view | Post

#41

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(darkspirit @ May 26 2020, 06:09 PM) Good info |

|

|

|

|

|

May 29 2020, 10:45 AM May 29 2020, 10:45 AM

Return to original view | Post

#42

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(darkspirit @ May 28 2020, 07:08 PM) Pop... Normally I check this participant information in https://www.pickastock.info/Market and other sector performance as well. Good info. Thanks. |

|

|

May 31 2020, 04:22 PM May 31 2020, 04:22 PM

Return to original view | Post

#43

|

Senior Member

2,379 posts Joined: Sep 2017 |

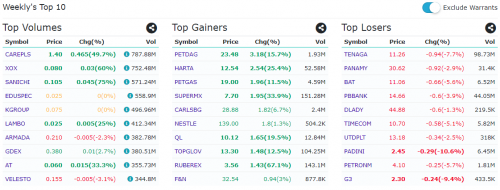

QUOTE(darkspirit @ May 31 2020, 11:31 AM) Weekly Top Volumes, Gainer and Loser.. Thanks for the pickastock website. For XOX, if you FOMO, just buy a bit then. 22/5/2020 announce new private placement of about 30% of XOX shares, XOX share price still keep rising after that--that's a vote of confidence there https://www.pickastock.info/Top10 Planned to buy XOX next week because volume surge so high but quarterly report so bad This post has been edited by abcn1n: May 31 2020, 04:31 PM |

|

|

Jun 1 2020, 05:03 PM Jun 1 2020, 05:03 PM

Return to original view | Post

#44

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(questnetter @ Jun 1 2020, 11:24 AM) LATEST NEWS: K1 is the only Malaysian company secured 1 of the 21 licenses from NASA for Covid19 Ventilators. 331 companies applied, and 21 got it, 8 from US, 1 from Malaysia (K1). https://www.nasa.gov/press-release/eight-us...-19-ventilator/ List of selected companies for the 21 licenses: https://medeng.jpl.nasa.gov/covid-19/ventil...r/registration/ Buy now before it flies like the glove stocks QUOTE(questnetter @ Jun 1 2020, 12:25 PM) Yes, TP is 0.60 from i3. They haven't announced QR yet, which should be a good one. Nasal swab approval also not yet announced. Cloud business in SG also on track for 100% takeover. And now NASA announcement for Ventilator license. This company is involved in the Top 2 line of business: Health (Covid19 related) + IT (Cloud) during this crisis, plus so many good news, I don't see why it cannot go up. It is cash rich and has strong fundamentals. Glove stocks some without fundamental also just shoot up to follow the trend. QUOTE(questnetter @ Jun 1 2020, 01:11 PM) The news is about NASA prototype earlier got the FDA certification, and now for mass production, 21 companies around the world secured the license. K1 is one of them, and the only Malaysian company got it. I think with this license now K1 can sell to buyers in US or Asia. QUOTE(icemanfx @ Jun 1 2020, 01:26 PM) Was trying to search for info on why k-one surged today. Should have read here instead. Good luck to those who entered the stock |

|

|

Jun 5 2020, 01:23 AM Jun 5 2020, 01:23 AM

Return to original view | Post

#45

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(darkspirit @ Jun 4 2020, 11:14 PM) Now the market is not logic, I bat tomorrow still up for financial or oil and gas stocks. Market is way ahead of the economy at this point. Seems like there's a 'party' that is moving $ from 1 sector to another. Foreign funds keep flowing out from the market, so who actually is the 'culprit' in doing the sector rotation.Financial https://www.pickastock.info/comparison/sector/ENERGY Energy https://www.pickastock.info/comparison/sect...L-GAS-PRODUCERS |

|

|

Jun 8 2020, 11:55 PM Jun 8 2020, 11:55 PM

Return to original view | Post

#46

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

|

|

|

Jun 9 2020, 09:42 AM Jun 9 2020, 09:42 AM

Return to original view | Post

#47

|

Senior Member

2,379 posts Joined: Sep 2017 |

Rakuten got problems. Can't place any trades. Sigh!

|

|

|

Jun 9 2020, 10:37 AM Jun 9 2020, 10:37 AM

Return to original view | Post

#48

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(Vanguard 2015 @ Jun 9 2020, 12:04 AM) Genting shot up today already. Tried to buy some but Rakuten keep saying cannot place order now. Don't dare to buy any now because Rakuten has ever said cannot place order and there is no outstanding order in the order tab but then the next day I find that the order is executed. Scary! QUOTE(Vanguard 2015 @ Jun 9 2020, 09:54 AM) Yep, because we pay peanuts for trading fees, we get monkeys. Rakuten Trade server got problem. Even the apps Ispeed is not much better. This last few weeks, quite a few platforms got problems--Rakuten, Maybank and some others too. But consider it a blessing a disguise. Imagine if you are doing short term trading this morning where you need to buy and sell within minutes. Mati-lah. If you bought a stock at a good price but you cannot unload it fast enough when the price keep plunging because the server is down. P/S: Kentrade platform is running as usual but the trading fees is a lot higher if you are trading in high volume. QUOTE(EnterYourName @ Jun 9 2020, 10:25 AM) in a bear market, speculator became "long term investor" and in bull market, long term investor became short term speculator lol Haha! I'm more to investor but may do some swing trades in the market .This post has been edited by abcn1n: Jun 9 2020, 10:37 AM |

|

|

Jun 20 2020, 11:18 PM Jun 20 2020, 11:18 PM

Return to original view | Post

#49

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(icemanfx @ Jun 18 2020, 02:43 PM) QUOTE(rotloi @ Jun 18 2020, 02:45 PM) Look at the history stock market crash means 60 to 80 percent wipe out. It can happen 2021 2022 2023... every year 20 percent ++ wipe. Interesting 2 charts. But then, how true will it be in the future because currently things are not the same as previously (eg: Fed money printing). Prices of many things especially food have been increasing (getting more expensive), so logically stocks should also get more expensive especially with the money printing going around the world. Doesn't make sense for things to get more expensive but not stocks. Especially nowadays when governments don't want too great a price plunge, they will pull out the stops to ensure a less drastic fall/a faster recovery (stock market)This post has been edited by abcn1n: Jun 20 2020, 11:20 PM |

|

|

Jun 21 2020, 01:24 AM Jun 21 2020, 01:24 AM

Return to original view | Post

#50

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

Jun 22 2020, 01:34 AM Jun 22 2020, 01:34 AM

Return to original view | Post

#51

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(propertyfeature @ Jun 21 2020, 09:54 PM) Yes. Why?QUOTE(dest9116 @ Jun 21 2020, 07:08 PM) Tomorrow gonna be a very bad day, dow drop so much samo and futures too, anything gained by gloves last Fri will probably retrace Dow only drop 0.8%. Not a lot but if futures don't pick up, most markets will be downThis post has been edited by abcn1n: Jun 22 2020, 01:36 AM |

|

|

Sep 11 2020, 03:19 PM Sep 11 2020, 03:19 PM

Return to original view | Post

#52

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

Sep 13 2020, 04:41 PM Sep 13 2020, 04:41 PM

Return to original view | Post

#53

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(AVFAN @ Sep 13 2020, 03:51 PM) FYI... Interesting article. Thanks for the linksomeone is kind enough to compile this... let's watch the "5 days" periods before their expiry. first one coming up: oct 5-9 for supermax c78 expiring on oct 12. https://klse.i3investor.com/blogs/trading_w...ve_Warrants.jsp |

|

|

|

|

|

Sep 16 2020, 03:55 PM Sep 16 2020, 03:55 PM

Return to original view | Post

#54

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(chromatino_hex @ Sep 16 2020, 12:16 PM) Yeah. I recommend tech stocks for now for low risk appetite. Also, I also know that most funds are bullish on Timecom and MPI (even though its share price is pretty high) Do some research on these companies and you’ll decide whether to invest Have been eyeing these counters but price too high for my liking. Hoping that there will be some downturn in stocks worldwide for me to pick up some stocks |

|

|

Sep 16 2020, 04:20 PM Sep 16 2020, 04:20 PM

Return to original view | Post

#55

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(ComingBackSoon @ Sep 16 2020, 03:28 PM) For those who bought into Ekovest or planning to buy into Ekovest, I suggest you to thread very carefully. LKH doesn't have a good reputation. Giant croc who doesn't give a fuck about minorities. Take a look at what happened in early 2017 to IWC and Ekovest before you invest. You have been warned. QUOTE(dickybird @ Sep 16 2020, 04:05 PM) I would be looking to exit ekovest not buy. Have been holding Ekovest for some time already at a loss. Wondering whether to dump it for BE if price riseIt's a trap for real estate plays for now nonexistent Chinese buyers liao. Johor is now a dead place with no Sg and Chinese influx. This post has been edited by abcn1n: Sep 16 2020, 04:22 PM |

|

|

Sep 17 2020, 01:09 PM Sep 17 2020, 01:09 PM

Return to original view | Post

#56

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(ChAOoz @ Sep 16 2020, 07:38 PM) Can go look at this one. Very informative and you can do your own analysis from there. Thankshttp://clips.thestar.com.my.s3.amazonaws.c...ply%20chain.jpg I feel for outsourced assembly and test (OSAT) & Fabrication almost all kinda priced in already and in the expensive range. For Malaysia, our strong point in tech is testing due to Intel early investment in Penang and as their final assembly hub. There is still some meat in EMS side if you like. Oh yeah those supporting intel, AMD & broadcom are running on full steam now just saying |

|

|

Sep 17 2020, 07:52 PM Sep 17 2020, 07:52 PM

Return to original view | Post

#57

|

Senior Member

2,379 posts Joined: Sep 2017 |

Many of the gloves stocks are making lower highs and lower lows which generally means they are on a downtrend. And this is despite the revenue and profit getting better, in addition to the big gloves companies top management saying supply continues to be tight for years to come blah blah blah. This is rather worrying? I myself am thinking of buying gloves stocks but I can't reconcile the above. Doesn't make sense that the market is so manipulated until they can do like that unless they really want the price to dive even much further before going up (if so, better to wait longer before buying).

|

|

|

Sep 17 2020, 11:00 PM Sep 17 2020, 11:00 PM

Return to original view | Post

#58

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(ComingBackSoon @ Sep 17 2020, 08:09 PM) Yeah I noticed the lower high and lower low too. Which is why I cancelled my 8.08 buy order. Am very afraid that reversion to mean is taking place. If price really drop to around $5.20, I believe there will be some bounce at least. After that, no idea. The harsh drop last week was probably a wakeup call. The rebound on Friday and Monday was probably a dead cat bounce for all of us to get out. As much as I like glove and their growing profits, buying their shares at current level is a bit more like gambling than investing. Investors would have bought 3-6 months ago. Again guys, it took tan sri to appear at television, 200m of share buyback, and the brewing expectation of bombastic qr for the share price to rise back to rm8.50 level. Can anyone convince me that there are other short term catalyst for price growth. QUOTE(icemanfx @ Sep 17 2020, 08:19 PM) P/E ratio is low at 34.09 (based on i3) and will get lower when profits go up (profits should be going up for at least a few years) if based on what gloves top management are saying.QUOTE(Vanguard 2015 @ Sep 17 2020, 08:28 PM) https://www.bernama.com/en/news.php?id=1880672 Sounds like price will rise with the HK listing until what icemanfx say below. Now, really do not know whether price will rise with the listing. Sighhttps://www.malaymail.com/news/money/2020/0...emic-de/1904127 https://www.malaymail.com/news/money/2020/0...der-and/1904149 News on Top Glove. You be the Judge. QUOTE(icemanfx @ Sep 17 2020, 08:31 PM) To list in HK to enable majority shareholders to transfer their assets overseas. Bursa could hardly absorb their unloading without effecting share price. So if list in HK (assuming all else stays the same except for the listing), what is likely to happen to Top Glove share price in Bursa--up or down |

|

|

Oct 3 2020, 09:20 PM Oct 3 2020, 09:20 PM

Return to original view | Post

#59

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(ry8128 @ Oct 3 2020, 09:13 PM) No 2nd round of mco, luckily. But if thing turns our worse, then it might happen. Possible Sarawak election. Even when new covid case at all time highJust some heads up to u guys, better to have cash in hand for 2nd round of mco. Dun over invest. This 2nd round wont be like the 1st round, as no one will know can our country survive 2nd round or not. The fact that we have highest number of cases these few days and yet we still not implementing mco speaks volume about the impact it will bring. https://www.malaymail.com/news/malaysia/202...ri-says/1909194 |

|

|

Oct 9 2020, 01:08 PM Oct 9 2020, 01:08 PM

Return to original view | Post

#60

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

| Change to: |  0.0828sec 0.0828sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 06:46 AM |