QUOTE(Taikor.Taikun @ Feb 3 2021, 09:53 AM)

You're thinking of Lordstown, which we knew last year. Atlis is a new customer for them.This post has been edited by Assassin's: Feb 3 2021, 09:58 AM

STOCK MARKET DISCUSSION V150

|

|

Feb 3 2021, 09:58 AM Feb 3 2021, 09:58 AM

Return to original view | IPv6 | Post

#41

|

Junior Member

467 posts Joined: Mar 2012 |

|

|

|

|

|

|

Feb 11 2021, 09:26 AM Feb 11 2021, 09:26 AM

Return to original view | IPv6 | Post

#42

|

Junior Member

467 posts Joined: Mar 2012 |

Remember guys, today Bursa half-day only. So if got 4pm show, it would be on 12pm. 1tanmee liked this post

|

|

|

Feb 15 2021, 10:17 AM Feb 15 2021, 10:17 AM

Return to original view | Post

#43

|

Junior Member

467 posts Joined: Mar 2012 |

QUOTE(ChAOoz @ Feb 15 2021, 09:43 AM) For current I'm going to stay in bear camp for awhile, until i see a resilient Q1/Q2 FY21 report out on all those hardware giants like Apple/Intel/AMD/Nvidia etc. The dec / year end shopping season is over, this is a new year lets see is demand for consumer electronics still strong after everyone bought their fill on last year. For our local tech company, I think its better to look at the major OSAT player (e.g. ASE, Amkor) instead since most of our local tech company are either OSAT or build ATE for OSAT player. If they decide to do capex expansion or seeing high volume of utilization, then our tech stock would also technically profit from it.So far, Amkor have decided to expand their capex by 25%, while ASE is maintaining them compare to last year. Amkor: QUOTE For 2021, we expect to increase our capex to around $700 million, an increase of more than 25% over 2020 in anticipation of continuing growth over the next few years. https://www.fool.com/earnings/call-transcri...rnings-call-tr/ASE: QUOTE With the strong business momentum, we are actually raising that expectation in our capex to be similar to 2020's level, which was at $0.7 billion. This post has been edited by Assassin's: Feb 15 2021, 10:21 AM |

|

|

Feb 15 2021, 12:17 PM Feb 15 2021, 12:17 PM

Return to original view | Post

#44

|

Junior Member

467 posts Joined: Mar 2012 |

QUOTE(andrekua2 @ Feb 15 2021, 12:05 PM) Unisem current PE ratio here is correct technically, but thats only because its including the last 2 bad quarter where they still have the loss making Batam plant. They already close that plant in Q1 2020 and it should be a smooth sailing now.If we consider at least 40m per quarter from now on, their PE ratio should be around 52-ish. |

|

|

Feb 18 2021, 02:48 PM Feb 18 2021, 02:48 PM

Return to original view | IPv6 | Post

#45

|

Junior Member

467 posts Joined: Mar 2012 |

My biggest loss was TENAGA and AXIATA.

Before Sept 2020, I thought TENAGA would never hit below RM10, and AXIATA will never be below RM3. So I average down on these stock and it went horribly. I was seeing -20% on these stock that was supposedly to be rock solid companies. After that, I swore to never touch Malaysia blue-chip stock and never practice averaging down, I would only go for mid-cap and small-cap and be aggresive in cutting loss. So far, 3 of my stock now have reached 100% gain |

|

|

Feb 19 2021, 10:00 PM Feb 19 2021, 10:00 PM

Return to original view | IPv6 | Post

#46

|

Junior Member

467 posts Joined: Mar 2012 |

Anyone here looking at PESTECH? Even after a 40+% run up in 2 weeks, it still in the 20 PE ratio.

If we assume forward earning to be at least 25m per quarter (same as last quarter), then the forward PE is only around 9.6. And its RM1.7b orderbook reminds me of KPOWER growth story. On second thought, maybe PESTECH debt is a bit concerning compare to KPOWER. This post has been edited by Assassin's: Feb 19 2021, 11:46 PM |

|

|

|

|

|

Feb 20 2021, 05:30 PM Feb 20 2021, 05:30 PM

Return to original view | IPv6 | Post

#47

|

Junior Member

467 posts Joined: Mar 2012 |

|

|

|

Feb 25 2021, 02:32 PM Feb 25 2021, 02:32 PM

Return to original view | IPv6 | Post

#48

|

Junior Member

467 posts Joined: Mar 2012 |

LOL, MSM limit up.

|

|

|

Feb 25 2021, 07:48 PM Feb 25 2021, 07:48 PM

Return to original view | IPv6 | Post

#49

|

Junior Member

467 posts Joined: Mar 2012 |

MFCB got announcement coming.

Share is suspended until 12.30pm tomorrow. |

|

|

Feb 25 2021, 10:27 PM Feb 25 2021, 10:27 PM

Return to original view | IPv6 | Post

#50

|

Junior Member

467 posts Joined: Mar 2012 |

QUOTE(lauwenhan @ Feb 25 2021, 09:02 PM) I bought like 30 lots of MFCB just for fun yesterday lol. Haha insider trading if it turns out to be good news. Better be some bad news so I can collect more. But the suspence for MFCB is killing me. Be cautious though. Last time JFTech halted trading and announced their partnership with Huawei and the stock instantly tanks on the first trading day. "Sell the news" hopefully does not happen with MFCB or aka IB's darling stock of 2021. They're also into solar with their subsidiary MFP Solar and did bid for LSS4, so I'm expecting this suspension is related to LSS4.@Krv bought MFCB years ago. I wonder if he is still holding. Paging @Krv someone tag him please. I saw his comment on MFCB a while ago. Not sure where it is. This guy must be rich if he is still holding omg AFAIK a lot of remisiers advise their clients to buy MFCB because of the outstanding balance sheet and growing EPS. I used to have doubts about their hydropower projects but looking at their website, this feels lke another monster company with crazy revenue and low-profile management (Similar to OSAT companies in Malaysia). I am gonna put my tech profits here for sure. Hope I can collect more and the stock tanks more lmao It would also explains why Solarvest rallied +12% today. This post has been edited by Assassin's: Feb 25 2021, 11:16 PM |

|

|

Mar 1 2021, 09:30 AM Mar 1 2021, 09:30 AM

Return to original view | IPv6 | Post

#51

|

Junior Member

467 posts Joined: Mar 2012 |

|

|

|

Mar 1 2021, 12:12 PM Mar 1 2021, 12:12 PM

Return to original view | IPv6 | Post

#52

|

Junior Member

467 posts Joined: Mar 2012 |

QUOTE(gapipig @ Mar 1 2021, 12:03 PM) The shortage of chips is due to high demand for consumer product. Greatech does not profit from that demand, as it's more towards EV/Solar.Examples of company that benefit from that high demand would be MPI, Unisem, Inari & Vitrox. gapipig and JohnKekHow liked this post

|

|

|

Mar 4 2021, 04:42 PM Mar 4 2021, 04:42 PM

Return to original view | IPv6 | Post

#53

|

Junior Member

467 posts Joined: Mar 2012 |

I've sold KGB and went with PESTECH.

KGB selling volume is huge right now, while PESTECH may be picking up back again. |

|

|

|

|

|

Mar 5 2021, 09:31 AM Mar 5 2021, 09:31 AM

Return to original view | IPv6 | Post

#54

|

Junior Member

467 posts Joined: Mar 2012 |

Kpower & Scib green now, lets see if it continue to stay green. This post has been edited by Assassin's: Mar 5 2021, 09:32 AM JohnKekHow liked this post

|

|

|

Mar 8 2021, 04:34 PM Mar 8 2021, 04:34 PM

Return to original view | IPv6 | Post

#55

|

Junior Member

467 posts Joined: Mar 2012 |

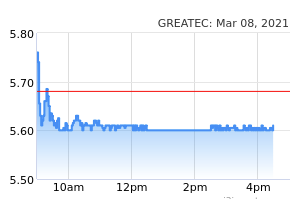

Just saw the big defense at 5.6 for Greatec (10.8m). Wonder who that is?

This post has been edited by Assassin's: Mar 8 2021, 04:46 PM |

|

|

Mar 9 2021, 10:41 AM Mar 9 2021, 10:41 AM

Return to original view | IPv6 | Post

#56

|

Junior Member

467 posts Joined: Mar 2012 |

|

|

|

Mar 9 2021, 03:01 PM Mar 9 2021, 03:01 PM

Return to original view | IPv6 | Post

#57

|

Junior Member

467 posts Joined: Mar 2012 |

|

|

|

Mar 10 2021, 09:03 AM Mar 10 2021, 09:03 AM

Return to original view | IPv6 | Post

#58

|

Junior Member

467 posts Joined: Mar 2012 |

KPS just rose 16% on open after KYY blog about it

|

|

|

Mar 10 2021, 09:39 AM Mar 10 2021, 09:39 AM

Return to original view | IPv6 | Post

#59

|

Junior Member

467 posts Joined: Mar 2012 |

QUOTE(ChAOoz @ Mar 10 2021, 09:13 AM) Kps got a few good companies under its belt. One of it is cpi penang, which is doing automotive related manufacturing. Yeah, I see a lot of people comparing KPS PE ratio to ATAIMS/VS/SKPRES because they own ToyoPlas and think its undervalue. Thats because KPS not a pure play EMS like those guys, it also has other business like King Coil (mattress production), AquaFlo (water treatment) and KPS HCM (construction).But still its a holding company like insas, not my cup of tea The old guy was being very deceptive when he only mentioned the plastic manufacturing side. He's acting more like a salesman than a researcher. |

|

|

Mar 12 2021, 10:26 PM Mar 12 2021, 10:26 PM

Return to original view | IPv6 | Post

#60

|

Junior Member

467 posts Joined: Mar 2012 |

These listed companies win the bid for LSS4 project

Finally, after months waiting, LSS4 bid winners has finally been announced. * Advancecon Holdings Bhd via Advancecon Solar Sdn Bhd at 26MW * Three bids by Solarvest Holdings Bhd via Atlantic Blue Sdn Bhd totalling 50MW * MK Land Holdings Bhd via MK Land Resources Sdn Bhd at 10.95MW * Tan Chong Motor Holdings Bhd through a consortium involving Tan Chong Motor Assemblies Sdn Bhd at 20MW * JAKS Resources Bhd via JAKS Solar Power Sdn Bhd at 50MW * Kumpulan Powernet Bhd with Perbadanan Kemajuan Negeri Pahang at 50MW * Ranhill Utilities Bhd at 50MW * Gopeng Bhd at 50MW * Tenaga Nasional Bhd via TNB Renewables Sdn Bhd at 50MW, and * Uzma Bhd via Uzma Environergy Sdn Bhd at 50MW. The notable company missing from this list is Samaiden and Cypark, so next Monday will probably not be a good day for these two stock. This post has been edited by Assassin's: Mar 12 2021, 10:29 PM |

| Change to: |  0.1133sec 0.1133sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 10:31 PM |