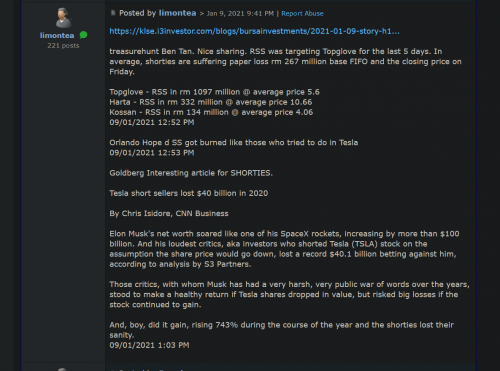

QUOTE(MedElite23 @ Jan 9 2021, 07:28 PM)

I’ll be frank and go ahead to ask this, see if anyone is raw enough to give an honest answer.

How important is it to have your portfolio stay green at a given moment? There’s no shame to admitting to your losses in public man..in fact I find those who share their losses are armoured with good virtues like humility, courage and perseverance

IMO coming from fundamental investor POV, there has to be a time when your portfolio will be in red. When?

When you are “buying low”.

Because chances are you don’t know where is the rock bottom, you WILL end up catching a falling knife, either by will/ by circumstance. So there will be a time when your portfolio make you look the most foolish person on earth while waiting to reap your harvest harhaha..

If your portfolio is green ALL THE TIME, it may mean two things:

1.) you’ve not touched your holdings for many years they all have appreciated to multiples that don’t warrant often portfolio rebalancing, which is rare when emotions are involved.

Or....

2.) you chase high and buy only green counters. In this case your overall paper gain will be short-lived. Because whatever that goes up must....

Inb4 this applies to FA-list only ok. Cheers!

When you are “buying low”, there never the concept of stop loss carry with them. As far I know most what FA camp. How important is it to have your portfolio stay green at a given moment? There’s no shame to admitting to your losses in public man..in fact I find those who share their losses are armoured with good virtues like humility, courage and perseverance

IMO coming from fundamental investor POV, there has to be a time when your portfolio will be in red. When?

When you are “buying low”.

Because chances are you don’t know where is the rock bottom, you WILL end up catching a falling knife, either by will/ by circumstance. So there will be a time when your portfolio make you look the most foolish person on earth while waiting to reap your harvest harhaha..

If your portfolio is green ALL THE TIME, it may mean two things:

1.) you’ve not touched your holdings for many years they all have appreciated to multiples that don’t warrant often portfolio rebalancing, which is rare when emotions are involved.

Or....

2.) you chase high and buy only green counters. In this case your overall paper gain will be short-lived. Because whatever that goes up must....

Inb4 this applies to FA-list only ok. Cheers!

DCA strategy will be the atypical FA investor.

What happened with most FA vs TA, FA sometime can picked the wrong stock at right time OR right stock at wrong time and continue the HoDL religion without knowing where they are and how long praying for gains.

That can be very damaging staying on With one camp.

Correct me

This post has been edited by Syie9^_^: Jan 9 2021, 07:14 PM

Jan 9 2021, 07:05 PM

Jan 9 2021, 07:05 PM

Quote

Quote

0.7001sec

0.7001sec

0.78

0.78

7 queries

7 queries

GZIP Disabled

GZIP Disabled