QUOTE(solstice818 @ May 22 2020, 10:28 AM)

GlovesSTOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

May 22 2020, 10:43 AM May 22 2020, 10:43 AM

Return to original view | IPv6 | Post

#21

|

Junior Member

627 posts Joined: Jan 2003 |

|

|

|

|

|

|

May 27 2020, 09:43 PM May 27 2020, 09:43 PM

Return to original view | IPv6 | Post

#22

|

Junior Member

627 posts Joined: Jan 2003 |

QUOTE(zstan @ May 27 2020, 09:17 PM) my reaction on SupermaxWhen rm2 - Too expensive right now...better stay and patience wait for great great price When rm 3 - aiyo expensive when rm 4 - so expensive when rm 5 - siao ar rm 6 - Fcuk you! rm 7 - FFFFFFF you! |

|

|

May 27 2020, 09:44 PM May 27 2020, 09:44 PM

Return to original view | IPv6 | Post

#23

|

Junior Member

627 posts Joined: Jan 2003 |

|

|

|

May 29 2020, 09:19 PM May 29 2020, 09:19 PM

Return to original view | IPv6 | Post

#24

|

Junior Member

627 posts Joined: Jan 2003 |

|

|

|

May 30 2020, 09:55 PM May 30 2020, 09:55 PM

Return to original view | IPv6 | Post

#25

|

Junior Member

627 posts Joined: Jan 2003 |

QUOTE(Vanguard 2015 @ May 30 2020, 02:37 PM) Not all sunshine my friends. If you scroll back to my earlier posts, I did share the story of my RM170K loss in the stock market. I hope to see someone share the story of making 430K (supermax) or even 600K ( rubberex)We just have to learn from our mistakes and manage our greed and ego. Life goes on. 😃 |

|

|

May 31 2020, 10:31 AM May 31 2020, 10:31 AM

Return to original view | IPv6 | Post

#26

|

Junior Member

627 posts Joined: Jan 2003 |

QUOTE(Vanguard 2015 @ May 30 2020, 10:57 PM) Less one zero can or not - profit of RM43K? A profit of RM430K would require a working capital of RM1 million to RM2 million? Too rich for me. Anyone who claimed to make RM600K, please provide a screenshot of your trading account, QUOTE(goldrush @ May 30 2020, 10:49 PM) because both counter up by 4.3x and 6x in less than 3 monthsso don't need capital of 1M to 2M if got 1M will turn into 4.3M and 6M This post has been edited by jvcpcv55: May 31 2020, 10:32 AM |

|

|

|

|

|

May 31 2020, 10:24 PM May 31 2020, 10:24 PM

Return to original view | IPv6 | Post

#27

|

Junior Member

627 posts Joined: Jan 2003 |

QUOTE(Vanguard 2015 @ May 31 2020, 06:30 PM) Yes, you are right. My bad. Mathematics failed. Supermax 1Q profit up 105%Yes, you are right. On a side note, I don't have RM1 million to sai lang on a single counter like Supermax. Even if I have the money, I won't have the balls to do it. It would probably be spread between 5 to 10 different counters to diversify the risks. But realistically, it is impossible to time the market, i.e. buy at the lowest price and sell at the highest price for any stocks including Supermax. If anyone managed to do it consistently over the long run and not as a one-hit wonder (like the song), then I salute you. share price up 4.5x Riverstone 1Q profit jump 54% but share price only up 1.5x https://links.sgx.com/FileOpen/Riverstone%2...t&FileID=610151 the market is crazy !!!!! This post has been edited by jvcpcv55: May 31 2020, 10:24 PM |

|

|

Jun 1 2020, 09:51 PM Jun 1 2020, 09:51 PM

Return to original view | IPv6 | Post

#28

|

Junior Member

627 posts Joined: Jan 2003 |

QUOTE(icemanfx @ Jun 1 2020, 06:57 PM) China has commissioned thousands of face masks production line in a short period of time, will similarly repeat the same for gloves factory. when these new gloves factory are in production, latex price will rise and squeeze gloves margin from both sides you think gloves factory can build from "a short period of time" ????please go do more home works, maybe you could check with HLT Subsidiary HL Advance Technologies (M) Sdn Bhd how many years needed to build one factory This post has been edited by jvcpcv55: Jun 1 2020, 09:53 PM |

|

|

Jun 3 2020, 10:35 AM Jun 3 2020, 10:35 AM

Return to original view | IPv6 | Post

#29

|

Junior Member

627 posts Joined: Jan 2003 |

today will be a quiet day

|

|

|

Jun 3 2020, 03:15 PM Jun 3 2020, 03:15 PM

Return to original view | IPv6 | Post

#30

|

Junior Member

627 posts Joined: Jan 2003 |

QUOTE(annoymous1234 @ Jun 3 2020, 03:08 PM) lets wait for Top glove QR result on 11 JuneThis post has been edited by jvcpcv55: Jun 3 2020, 03:25 PM |

|

|

Jun 7 2020, 08:19 AM Jun 7 2020, 08:19 AM

Return to original view | IPv6 | Post

#31

|

Junior Member

627 posts Joined: Jan 2003 |

JUST sharing

to see that people treat stock market like a casino. If you don’t have enough cash, do not bother with investments. Investments are for those cash rich people who made enough on daily basis. You need to improve on whatever you do best to raise cash before you come to the stock market. Tips 1. Always choose good company with good fundamental. 2. Do your valuations 3. Do your projections of sales, profit, PE, EPS, Price to book ratio, gearing, sustainable PE projection. 4. Do your due diligence. Research. As you research you will automatically top up more money for every good point that you found in the company. This is how you earn money. 5. Don’t overpay. 6. Think about your entry plan and exit plan. 7. Kenanga, RHB and Maybank research buy time means sell time. If research downgrade, how are they able to unload their stock. 8. Smart market is smart and fool games. Smart earn money from fool. 9. Use your instinct. 10. Weigh your risk. 11. Your entry price matter. Your exit price matter. 12. Good company at crazy valuation is bad investment. Shit company with extremely low valuation can sometimes be a wonderful investment 13. The price of your mistake is always bigger than your win. 14. Play with money that don’t stir your emotions 15. Reduce your buy and sell frequency, then, you will reduce your mistake. I know a fund manager that does less than 10 buy and sell in a year and managed a fund of tens of millions. 16. Never panic buy after a significant price increase and never panic sell after a significant price drop. 17. Do not monitor your stock everyday. Trust your own research and valuation. 18. Don’t trust anyone. Trust your own calculation. 19. Only long term investments can prevent black swan events. 20. Diversify your portfolio. The golden rule of thumb is 5 company in a portfolio. 21. Having a stock which has high PE which has potential to grow is sometimes better investment than company with a low PE that is stagnant for years. There is a reason why the market decide to give a low PE to a company. 22. Always be one step ahead all the time. 23. I would recommend stock market to those who have passion for knowledge. Passion is needed for anyone to truly enjoy what they are doing. 24. Buy what company you can understand. For newbie —————— For newbie, if you lose money to the stock market after one month, you need to quit stock market. Don’t pay tuition fee to stock market. Stock market is extremely dangerous to newbie. Only people who never gamble on stock market will truly make money in stock market. Knowledge is power. Read everyday for 7-8 hours. Good materials are Intelligent Investor by Benjamin Graham and Art of war by Sun Tzu. I would recommend 5 companies for newbie to invest long term (period of at least 3-10 years). You should make about 20% of your investment. There is no quick money in stock market. Harta, Cahyamata, Inari, Dutch lady and Scientex. You can dollar average your money into these 5 company: set aside money over a set period. Eg. 100k to invest 10 times, invest 10k once a month. You can invest more into any of the company which is cheaper on that day. If you can set aside 10% of your salary to invest in these company every month, your return should be 20% of your investment. This method you can average your price to include volatility in the stock. Using this method, you do not need a fund manager and you do not need retirement fund to retire. This method is the most passive investment you make. |

|

|

Jun 7 2020, 08:28 AM Jun 7 2020, 08:28 AM

Return to original view | IPv6 | Post

#32

|

Junior Member

627 posts Joined: Jan 2003 |

|

|

|

Jun 9 2020, 08:35 AM Jun 9 2020, 08:35 AM

Return to original view | IPv6 | Post

#33

|

Junior Member

627 posts Joined: Jan 2003 |

|

|

|

|

|

|

Jun 9 2020, 03:43 PM Jun 9 2020, 03:43 PM

Return to original view | IPv6 | Post

#34

|

Junior Member

627 posts Joined: Jan 2003 |

|

|

|

Jun 12 2020, 09:00 PM Jun 12 2020, 09:00 PM

Return to original view | IPv6 | Post

#35

|

Junior Member

627 posts Joined: Jan 2003 |

QUOTE(ZeroSOFInfinity @ Jun 12 2020, 12:37 PM) https://www.theedgesingapore.com/capital/re...m_campaign=FREE |

|

|

Jun 13 2020, 01:48 PM Jun 13 2020, 01:48 PM

Return to original view | IPv6 | Post

#36

|

Junior Member

627 posts Joined: Jan 2003 |

|

|

|

Jun 16 2020, 07:30 AM Jun 16 2020, 07:30 AM

Return to original view | IPv6 | Post

#37

|

Junior Member

627 posts Joined: Jan 2003 |

|

|

|

Jun 29 2020, 08:05 AM Jun 29 2020, 08:05 AM

Return to original view | IPv6 | Post

#38

|

Junior Member

627 posts Joined: Jan 2003 |

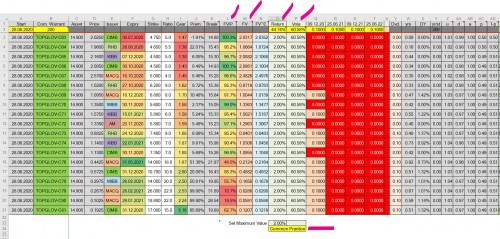

FOR those who like warrants

TOPGLOV-Call Warrants Author: i3gambler  Make reference to the above screen shot. First we look at TOPGLOV target prices given by investment banks. TOPGLOV released their latest quarterly result on 11th June 2020, Therefore I capture only those target prices given on the same day or later, Thanks to i3investor.com for the listing the target prices. The average target price are sky high, an upside room of 44.74%, very rare for a blue chip. Now, to calculate the fair value of call warrants, we need inputs to the calculation, the two critical and arguable inputs are: 1) Interest: Common practice: Input the risk free interest rate, in our current case, should be around 2% My preference: 50% of the upside room of 44.74%, equal to 22.37%, then plus the dividend yield, but subject to a maximum value of 8.00%. 2) Volatility: Common Practice: Calculate from the last 90 trading days, and assume same volatility will be maintained in coming months. My preference: Same calculation, but subject to a maximum value, in this case I choose 30%. Make reference to the following two screen shots: 1) Column C: The middle price at 4.30 pm on Friday, 26th June 2020. 2) Column M: Fair values calculated using 200 steps binomial method. 3) Column L: Fair Value over Market Price.  Discussion: 1) At a very unlikely chance, I could have put wrongly the expiry, exercise price or exercise ratio, so please double check at www.bursamalaysia.com if you want to trade any of call warrants. 2) Currently I do not have any TOPGLOV call warrant, and not like will buy any of them. 3) Trade at your own risk.  |

|

|

Jun 29 2020, 10:24 PM Jun 29 2020, 10:24 PM

Return to original view | IPv6 | Post

#39

|

Junior Member

627 posts Joined: Jan 2003 |

QUOTE(theberry @ Jun 29 2020, 09:59 PM) which stock tell you can last for 5 10 years????genting? felda? LC titan? Petronas? all dropped. why don't focus on what can make for next months instate of the next 10 years immobile liked this post

|

|

|

Jul 1 2020, 09:47 PM Jul 1 2020, 09:47 PM

Return to original view | IPv6 | Post

#40

|

Junior Member

627 posts Joined: Jan 2003 |

QUOTE(AVFAN @ Jul 1 2020, 09:22 PM) it will be irresponsible for anyone to tell u to buy or not to buy at this time and that price. Your moneyi will just say for me, i will not. but will wait for the next dip and see what the situation is then. becos i see risk of overbought scenario creeping in. can't be more specific as things change by the minute and this is not science. e.g. just now... pfizer claims their cov19 vaccine has positive results - dow went from red to green. but it may be a false alarm... or questions... will it affect gloves demand? https://www.cnbc.com/2020/06/30/stock-marke...close-news.html https://www.cnbc.com/2020/07/01/pfizer-stoc...cine-trial.html lastly, do read this as there is some good info, after cutting out the noise and bs like any forum thread. https://klse.i3investor.com/servlets/forum/800000967.jsp you decide |

| Change to: |  1.5734sec 1.5734sec

0.33 0.33

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 02:55 AM |