QUOTE(Cubalagi @ Oct 30 2021, 09:56 AM)

if shorted last friday then yea (closed 1562.5), but if only started today morning, might be too late

This post has been edited by Medufsaid: Nov 1 2021, 09:29 AM

STOCK MARKET DISCUSSION V150

|

|

Nov 1 2021, 09:29 AM Nov 1 2021, 09:29 AM

Return to original view | IPv6 | Post

#21

|

Senior Member

3,486 posts Joined: Jan 2003 |

|

|

|

|

|

|

Dec 17 2021, 05:01 PM Dec 17 2021, 05:01 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

3,486 posts Joined: Jan 2003 |

unless the fund has such a big % of the shares in the company, mass buys/selloffs shouldn't affect the fund performance much.

e.g., UT xxx has 100 unit trust holders invest in Comp A 10,000,000 shares (0.001% of total shares) Comp B 20,000,000 shares (0.001% of total shares) Comp C 5,000,000 shares (0.001% of total shares) if one day 50 UT holders sell everything, the fund manager will just sell 50% of shares a/b/c equally. the other 50% holders shouldn't see any meaningful impact (maybe UT will cause the 3 shares to drop by 0.001%) in their investment. or, if they were intending to do some "fund rebalancing", then they would use this as a convenient opportunity to sell off any companies that they plan to eliminate This post has been edited by Medufsaid: Dec 17 2021, 05:20 PM |

|

|

Dec 17 2021, 05:39 PM Dec 17 2021, 05:39 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

3,486 posts Joined: Jan 2003 |

yup, but i never deny that there will be no impact, just not meaningful enough. if there's 100 UT houses out there, only 1 "Public Mutual (for example)" UT house is doing 50% mass selling, shouldn't affect that much in the long run

This post has been edited by Medufsaid: Dec 17 2021, 05:40 PM |

|

|

Dec 24 2021, 05:40 PM Dec 24 2021, 05:40 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

3,486 posts Joined: Jan 2003 |

some stock exchanges half day (Hang Seng) or fully closed (Dow Jones)

This post has been edited by Medufsaid: Dec 24 2021, 05:40 PM |

|

|

Mar 3 2022, 11:27 AM Mar 3 2022, 11:27 AM

Return to original view | IPv6 | Post

#25

|

Senior Member

3,486 posts Joined: Jan 2003 |

well it's like a gamble. imagine getting MRDIY IPO at RM1.60 or CTOS at RM1.10. can cover that Senheng loss

(don't dare to buy IPOs either though) This post has been edited by Medufsaid: Mar 3 2022, 11:31 AM |

|

|

Mar 3 2022, 11:12 PM Mar 3 2022, 11:12 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

3,486 posts Joined: Jan 2003 |

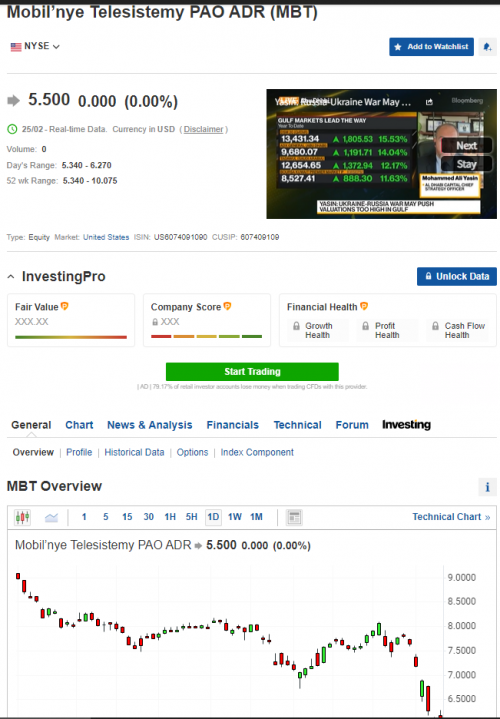

Russian stock market closed for 4th day. The ADRs seem to be also closed too. I better do a screenshot as this is indeed historical https://www.investing.com/equities/mobilnye-telesistemy-adr  ZzZzz... liked this post

|

|

|

|

|

|

Apr 15 2022, 04:22 PM Apr 15 2022, 04:22 PM

Return to original view | Post

#27

|

Senior Member

3,486 posts Joined: Jan 2003 |

|

|

|

Apr 26 2022, 09:06 AM Apr 26 2022, 09:06 AM

Return to original view | Post

#28

|

Senior Member

3,486 posts Joined: Jan 2003 |

|

|

|

May 27 2022, 10:54 PM May 27 2022, 10:54 PM

Return to original view | Post

#29

|

Senior Member

3,486 posts Joined: Jan 2003 |

|

|

|

Sep 2 2022, 11:43 AM Sep 2 2022, 11:43 AM

Return to original view | Post

#30

|

Senior Member

3,486 posts Joined: Jan 2003 |

Rakuten Trade minimum fee is $1.88, so this stanchart could be worth it if your stocks are below $1,880 (of cos IBKR still the best)

|

|

|

Sep 4 2022, 12:36 PM Sep 4 2022, 12:36 PM

Return to original view | Post

#31

|

Senior Member

3,486 posts Joined: Jan 2003 |

they recently announced USD account. so you only convert once to USD and can trade however you want. (don't forget the rakuten 0.1% commission of each trade vs IBKR tiered pricing of min U$0.35 or U$0.0035 per share)

This post has been edited by Medufsaid: Sep 4 2022, 12:39 PM |

|

|

Sep 19 2022, 12:17 PM Sep 19 2022, 12:17 PM

Return to original view | Post

#32

|

Senior Member

3,486 posts Joined: Jan 2003 |

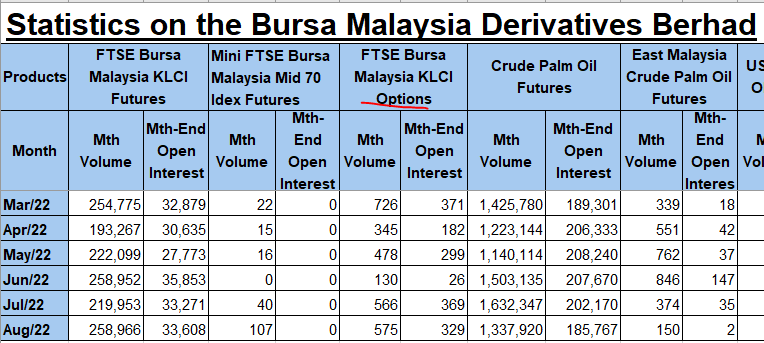

assuming got 20 business days in a month, daily only 29 lots traded. this is call and puts yea

https://www.bursamalaysia.com/market_inform...tic/derivatives This post has been edited by Medufsaid: Sep 19 2022, 12:19 PM |

|

|

Dec 16 2023, 01:13 PM Dec 16 2023, 01:13 PM

Return to original view | Post

#33

|

Senior Member

3,486 posts Joined: Jan 2003 |

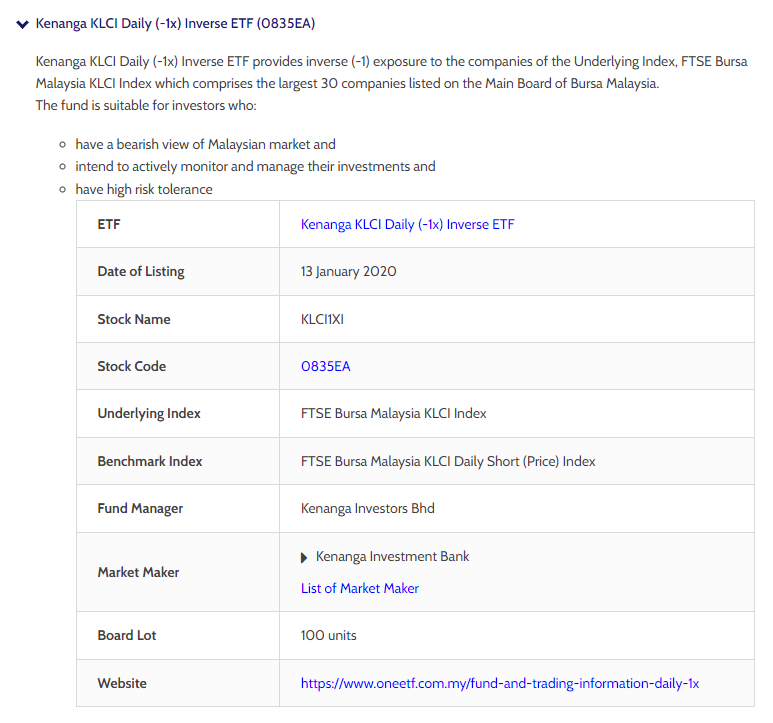

QUOTE(watabakiu @ Oct 21 2023, 12:11 AM) I'm watching this Netflix Eat the Rich series, & it got me thinking.. Can retail investors short sell in Bursa? you can short-sell the index by opening a Derivatives account and selling FKLI. however, might be risky for new-to-intermediate retail investors. alternatively, you can buy 0835EA counter, where you short-sell the index without leverage. however, very low liquidity  |

|

|

Mar 5 2024, 04:12 PM Mar 5 2024, 04:12 PM

Return to original view | Post

#34

|

Senior Member

3,486 posts Joined: Jan 2003 |

our local Bursa is one of them the twitter preview is too brief, below full text » Click to show Spoiler - click again to hide... « This post has been edited by Medufsaid: Mar 5 2024, 04:13 PM howyoulikethat liked this post

|

|

|

Aug 5 2024, 02:37 PM Aug 5 2024, 02:37 PM

Return to original view | Post

#35

|

Senior Member

3,486 posts Joined: Jan 2003 |

|

| Change to: |  0.1060sec 0.1060sec

0.59 0.59

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 11:37 AM |