those holding big on glove stocks are really playing musical chair.

Just hope to exit before it ends

STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Nov 4 2020, 06:44 PM Nov 4 2020, 06:44 PM

Return to original view | Post

#101

|

Junior Member

362 posts Joined: Jul 2013 |

those holding big on glove stocks are really playing musical chair.

Just hope to exit before it ends |

|

|

|

|

|

Nov 20 2020, 05:35 PM Nov 20 2020, 05:35 PM

Return to original view | Post

#102

|

Junior Member

362 posts Joined: Jul 2013 |

|

|

|

Nov 20 2020, 06:53 PM Nov 20 2020, 06:53 PM

Return to original view | Post

#103

|

Junior Member

362 posts Joined: Jul 2013 |

red buy green buy, everyday buy RM 69mil

When do Tan Sri plan to stop? LOL |

|

|

Nov 20 2020, 10:17 PM Nov 20 2020, 10:17 PM

Return to original view | Post

#104

|

Junior Member

362 posts Joined: Jul 2013 |

|

|

|

Nov 21 2020, 10:28 PM Nov 21 2020, 10:28 PM

Return to original view | Post

#105

|

Junior Member

362 posts Joined: Jul 2013 |

Syed saddiq just posted on facebook why gov should do windfall tax on glove counters.

but the outcome is lots of bashing LOL Must be alot of glove investors |

|

|

Nov 23 2020, 05:05 PM Nov 23 2020, 05:05 PM

Return to original view | Post

#106

|

Junior Member

362 posts Joined: Jul 2013 |

top glove supporters tmrow can withdraw FD and catch the spike down tmrow

|

|

|

|

|

|

Nov 23 2020, 06:50 PM Nov 23 2020, 06:50 PM

Return to original view | Post

#107

|

Junior Member

362 posts Joined: Jul 2013 |

i think tan sri need to allocate rm200mil for sbb tmrow

LOL |

|

|

Nov 23 2020, 08:16 PM Nov 23 2020, 08:16 PM

Return to original view | Post

#108

|

Junior Member

362 posts Joined: Jul 2013 |

i foresee gap down too, before tan sri comes in to share buy-back

|

|

|

Nov 26 2020, 05:16 PM Nov 26 2020, 05:16 PM

Return to original view | Post

#109

|

Junior Member

362 posts Joined: Jul 2013 |

my avg cost for top glove is still at 7.80.

I first entered at 9.50, then top up when dip, then dip deeper, then top up again. My last 2 top up was 6.40 last week or so, then 6.63 yesterday. Hopefully can release some capital at breakeven soon T.T |

|

|

Nov 27 2020, 01:43 PM Nov 27 2020, 01:43 PM

Return to original view | Post

#110

|

Junior Member

362 posts Joined: Jul 2013 |

the npl provisions didnt seems to affect MBB much. Did people over-persimmistic over the economy? LOL This post has been edited by prozfromhell: Nov 27 2020, 01:43 PM HereToLearn liked this post

|

|

|

Nov 27 2020, 02:05 PM Nov 27 2020, 02:05 PM

Return to original view | Post

#111

|

Junior Member

362 posts Joined: Jul 2013 |

QUOTE(HereToLearn @ Nov 27 2020, 01:58 PM) Some people have to spread fear ma, if not how do you get to own a sleep -well dividend stock with discounts. i dunno read from where, last quarter was severely impact by the modification adjustment due to moratorium , and affects their effective interest rate used to recognize revenue?When BNM stopped cutting OPR, we already can make educated guess that the economy recovery is already on track. Back to MBB,  MBB result is almost back to pre-covid because in this quarter, they allocate the loan loss provision like how they would normally allocate during pre-covid. Last quarter, result dipped so much because they allocated A LOT more to prepare for the NPL. Nevertheless, MBB share price is almost back to pre-covid share price (RM8.58). It is a bit late to join the recovery bandwagon for this bank counter already. Unless, you are expecting aggressive loan growth when economy recovers due to pent up demand for luxury or improve-life-quality products (cars, properties etc). Else, it is best if you start hunting other bank counters that still have a lot of room before going back to pre-covid prices. or maybe they got reason to postpone the higher npl provisions, since now gov force them to auto extend for B40 and SME, so it doesnt increase the risk profile yet? \ Just guessing lar, i m no banking expert lol HereToLearn liked this post

|

|

|

Nov 30 2020, 08:48 AM Nov 30 2020, 08:48 AM

Return to original view | Post

#112

|

Junior Member

362 posts Joined: Jul 2013 |

anyone facing difficulties with their maybank trading platform?

T.T |

|

|

Nov 30 2020, 08:59 AM Nov 30 2020, 08:59 AM

Return to original view | Post

#113

|

Junior Member

362 posts Joined: Jul 2013 |

|

|

|

|

|

|

Nov 30 2020, 09:08 AM Nov 30 2020, 09:08 AM

Return to original view | Post

#114

|

Junior Member

362 posts Joined: Jul 2013 |

|

|

|

Dec 7 2020, 10:59 PM Dec 7 2020, 10:59 PM

Return to original view | Post

#115

|

Junior Member

362 posts Joined: Jul 2013 |

|

|

|

Dec 9 2020, 01:35 PM Dec 9 2020, 01:35 PM

Return to original view | Post

#116

|

Junior Member

362 posts Joined: Jul 2013 |

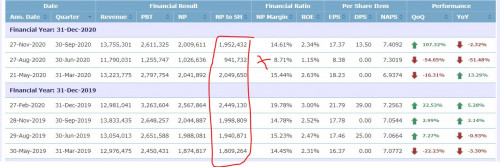

EPS 29 cents per quarter.

Even at PE 10, annual EPS of RM 1.20 x 10 also RM 12 d |

|

|

Dec 15 2020, 07:12 AM Dec 15 2020, 07:12 AM

Return to original view | Post

#117

|

Junior Member

362 posts Joined: Jul 2013 |

hope the atuk gang can retire for good.

|

|

|

Jan 4 2021, 01:57 PM Jan 4 2021, 01:57 PM

Return to original view | Post

#118

|

Junior Member

362 posts Joined: Jul 2013 |

this afternoon gonna see who win the war

TG with the special dividend, or the shark trying to squeeze tg's price |

|

|

Jan 24 2021, 09:36 PM Jan 24 2021, 09:36 PM

Return to original view | Post

#119

|

Junior Member

362 posts Joined: Jul 2013 |

dmg already done. blood bath ahead

but imagine if MCO 3.0 really come true 1 week later |

|

|

Jan 25 2021, 12:37 PM Jan 25 2021, 12:37 PM

Return to original view | Post

#120

|

Junior Member

362 posts Joined: Jul 2013 |

QUOTE(ben3003 @ Jan 25 2021, 12:14 PM) our finance minister is 1 of the greatest joke of all time. Cannot brain having him as finance minister. still way better than the predecessor.He cant do any worst LoTek liked this post

|

| Change to: |  0.1239sec 0.1239sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 11:51 AM |