Dear Mr. Wong,

Good morning.

Part 1: According to your current portfolio, I can see you did a very good job on the asset allocation part. Basically your portfolio is quite well-diversified, as long as your investment horizon is 3-5 years, I would love to see the growth of your portfolio down on the road. Recently the market is sort of volatile mainly due to China issues, however we believe that as being the world second largest economy, China remains attractive in fundamental point of view. Besides, Europe is in the beginning stage of recovery, another round of QE could be a stimulus. As for Malaysia, we remains neutral this year, you may read 2016 Malaysia Outlook: Challenging .

Overall the asset is become cheaper, my humble opinion for you is to consider top up for the current holdings at cheaper price. Don’t panic about the short term volatility, as long as the fundamental remains positive, it is till good to go for it.

Should you have any queries or require any further information, please do not hesitate to contact us.

Thank you and have a pleasant day

Part 2: If you're watching the recent market correction and wondering what to do, consider learning how to cope with volatility instead of changing your financial plan. Often, the wisest thing to do during periods of extreme market volatility is to stick with the investment plan that you've already devised.

Here are a few simple rules to help you through the current feverish reaction.

Rule #1: Recognize that volatility and periodic corrections are common in equity markets.

The key to getting through unexpected turbulence is to understand that swings in the financial market are normal—and relatively insignificant over the long haul. The best approach to protect portfolios is to diversify among a broad mix of global stocks and high-quality bonds so that you are better poised to buffer the declines in the equity market

Rule #2: Tune out the noise, and remove emotion from investing.

Seeing the same story at the top of every news site you visit, as well as seeing related portfolio fluctuations, is likely to worry you more than it should. If you're a long-term investor, resist the urge to make drastic changes to your investment plans in reaction to market moves. You may find what's driving the overreaction in markets is nothing more than speculation. try not to look at your accounts every day. It's unnecessary and may do more harm than good. Remember that portfolio changes, aside from routine rebalancing, can result in significant capital gains if you sell after a big market run-up, possibly even if conditions have changed. And don't forget you need to know when to jump out of the market and then get back in—decisions few investors can and should tackle.

Rule #3: Make volatility work for you.

Save more, and continue to invest regularly. Boosting savings is important to your long-term financial goals. We believe market returns will be muted over the next few years; therefore, stick to your investing principles and avoid getting caught up in the market. If you invest regularly through regular saving plan, or a target-date fund, you're putting the market's natural volatility to work for you. Continue making contributions to take advantage of dollar-cost averaging. Buying a fixed dollar amount on a regular schedule offers opportunities to buy low during market dips. Over time, regular contributions can help reduce the average price you pay for your fund shares.

“If your portfolio is broadly diversified and has the appropriate balance for your financial goals, time horizon, and risk comfort level, sticking with it is a wise move.”

Thank you and have a pleasant day.

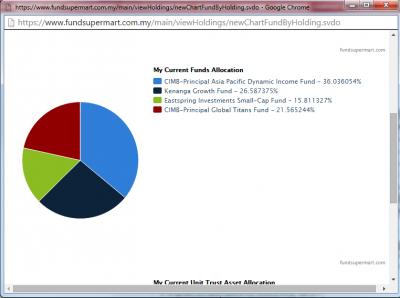

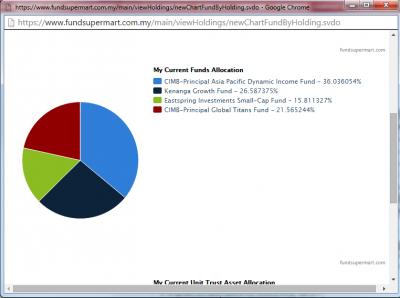

My current holdings so far.

[/quote]

KGF & ESISC are highly correlated to each other, if it up to me, I would choose only one. At the moment, ESISC has a better risk-reward performance.

KGF covers bigger fish, ESISC covers small fish right? *When I entered both that was my perspective*

Dec 21 2015, 10:22 PM

Dec 21 2015, 10:22 PM

Quote

Quote

0.0497sec

0.0497sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled