QUOTE(river.sand @ Dec 23 2015, 04:08 PM)

According to this articles, rate hike by Fed does have indirect effects on equities...

http://www.investopedia.com/articles/06/in...sp?header_alt=c

http://www.cnbc.com/2015/09/15/when-the-fe...at-happens.html

Since you love statistical analysis, you would be interested in this...

Rate hike definitely have effects on REITs, though I guess Tits are not heavy in this sector.

That said, strengthening USD may be able to offset the loss of momentum in US market.

Excuse me while pasir sungai and I engage in some CFA-buddy tete-a-tete http://www.investopedia.com/articles/06/in...sp?header_alt=c

http://www.cnbc.com/2015/09/15/when-the-fe...at-happens.html

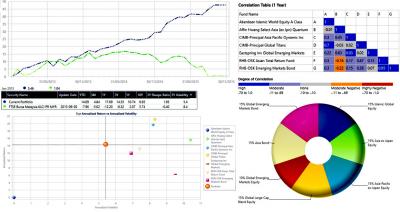

Since you love statistical analysis, you would be interested in this...

Rate hike definitely have effects on REITs, though I guess Tits are not heavy in this sector.

That said, strengthening USD may be able to offset the loss of momentum in US market.

All these are theories which you will learn in your CFA program. Good! However always take them with some perspective:

The expected return of say Titties fund is around 20%++. What is a little ant bite of 0.25% increase in risk free rate gonna do to it? Perhaps now its return becomes 19.75% ++? Will you be sad? Cannot eat; cannot sleep?

I reiterate: Equities fund are not bond funds... they are not so sensitive to interest rate change.

Xuzen

p/s My perspective: With interest rate increase, more cash will flow to the US and this makes USD more popular. In basic Economics 101 when supply increase, the supply gets more expensive. This means USD will become more expensive / go higher. The chances of USD gains against MYR is a bigger factor to consider than that 0.25% ant bite increase in risk free rate. And we all already know that historically Titties fund went up chiefly because of MYR weakness. This will continue with more future fed rate hike.

This post has been edited by xuzen: Dec 24 2015, 10:40 AM

Dec 24 2015, 10:26 AM

Dec 24 2015, 10:26 AM

Quote

Quote

0.0316sec

0.0316sec

0.73

0.73

6 queries

6 queries

GZIP Disabled

GZIP Disabled