QUOTE(voyage23 @ Mar 3 2016, 10:43 PM)

What do you guys think of Manulife's PROGRESS fund? Not in FSM but when my friend compared it with EI small caps and KGF over 5 years, it is comparable

What's the sales charges?Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

|

Mar 3 2016, 10:49 PM Mar 3 2016, 10:49 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

|

|

|

Mar 3 2016, 10:53 PM Mar 3 2016, 10:53 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

Thank God today's market mostly green

|

|

|

Mar 3 2016, 11:13 PM Mar 3 2016, 11:13 PM

|

Junior Member

368 posts Joined: Jun 2013 |

|

|

|

Mar 4 2016, 12:04 AM Mar 4 2016, 12:04 AM

|

Senior Member

10,001 posts Joined: May 2013 |

BOJ's Nakaso Signals Japan May Reduce Rates Again, But Not Now

http://www.bloomberg.com/news/articles/201...ain-but-not-now How low can d rates go? |

|

|

Mar 4 2016, 07:40 AM Mar 4 2016, 07:40 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

Ah.. mostly up. Now waiting for my Asia ex Japan and Chinapek funds to go up as well..

|

|

|

Mar 4 2016, 07:49 PM Mar 4 2016, 07:49 PM

|

Junior Member

249 posts Joined: Jan 2015 |

QUOTE(xuzen @ Mar 3 2016, 10:10 PM) Bond c) Its volatility is around 7.8% (check out its FFS). With this type of volatility better go for dividend type equity fund... their volatility is roughly the same but return is higher. Bro Xuzen, Can name me some dividend type equity fund? i m bit confused. |

|

|

|

|

|

Mar 4 2016, 07:54 PM Mar 4 2016, 07:54 PM

|

Junior Member

249 posts Joined: Jan 2015 |

what to buy ? market seems to be going up.

EAISC ? KGF ? TITAN ? |

|

|

Mar 4 2016, 08:18 PM Mar 4 2016, 08:18 PM

|

Senior Member

2,525 posts Joined: Sep 2013 |

|

|

|

Mar 4 2016, 09:03 PM Mar 4 2016, 09:03 PM

|

Junior Member

249 posts Joined: Jan 2015 |

|

|

|

Mar 4 2016, 09:58 PM Mar 4 2016, 09:58 PM

|

All Stars

48,465 posts Joined: Sep 2014 From: REality |

MYR getting stronger against USD

|

|

|

Mar 4 2016, 11:51 PM Mar 4 2016, 11:51 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Mar 4 2016, 11:54 PM Mar 4 2016, 11:54 PM

Show posts by this member only | IPv6 | Post

#2772

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

Mar 5 2016, 12:13 AM Mar 5 2016, 12:13 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

JomPay channel: Pay as per swipe

Should try with UOB VOX or CIMB Cash Rebate |

|

|

|

|

|

Mar 5 2016, 12:27 AM Mar 5 2016, 12:27 AM

|

All Stars

14,892 posts Joined: Mar 2015 |

some months back...some one asked about Berkshire Hathaway Shareholder Letter

3 Lessons From Buffett’s Shareholder Letter [4 Mar 16] Warren Buffett’s annual shareholder letter is one of the most widely read publications amongst investors every year. In this week’s edition of Idea of the Week, we share with investors three lessons we learnt from his 2015 annual letter to his shareholders https://secure.fundsupermart.com/main/artic...4-Mar-16--11316 |

|

|

Mar 5 2016, 07:59 AM Mar 5 2016, 07:59 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

Mar 5 2016, 10:29 AM Mar 5 2016, 10:29 AM

|

Junior Member

311 posts Joined: Mar 2010 |

QUOTE(voyage23 @ Mar 3 2016, 10:43 PM) What do you guys think of Manulife's PROGRESS fund? Not in FSM but when my friend compared it with EI small caps and KGF over 5 years, it is comparable The 3 funds you're looking at are all local, small/mid cap funds. You can probably put in KAF Vision, RHB Smart Treasure into the same list too.

This post has been edited by lukenn: Mar 5 2016, 08:10 PM |

|

|

Mar 5 2016, 08:30 PM Mar 5 2016, 08:30 PM

|

Junior Member

311 posts Joined: Mar 2010 |

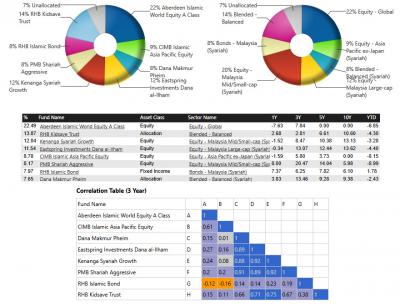

QUOTE(Muhammad Abdul Latif @ Feb 22 2016, 04:17 PM) Hi, Tried to get as close as I can to your portfolio. Proxy RHB Dana Hazzem with RHB Kidsave. It used to be RHB Dana Kidsave. Dont have you RHB REgional fund either. A bit too new. I am new at this Forum and also a new investor in FSM. Have been investing for about six months in shariah funds. Here is my portfolio, would appreciate any observation on it to improve. Thanks. Latif

|

|

|

Mar 5 2016, 11:01 PM Mar 5 2016, 11:01 PM

|

Junior Member

368 posts Joined: Jun 2013 |

QUOTE(lukenn @ Mar 5 2016, 10:29 AM) The 3 funds you're looking at are all local, small/mid cap funds. You can probably put in KAF Vision, RHB Smart Treasure into the same list too. Hey thanks! Looks like it's really comparable to EISC and KGF. I am using my EPF to invest in Manulife (either Progress or Flexi funds) as the application is easier as compared to if I were to do it myself from FSM. In my own portfolio in FSM I am holding both EISC and KGF actually.

|

|

|

Mar 5 2016, 11:22 PM Mar 5 2016, 11:22 PM

|

Senior Member

2,679 posts Joined: Oct 2014 |

QUOTE(voyage23 @ Mar 5 2016, 11:01 PM) Hey thanks! Looks like it's really comparable to EISC and KGF. I am using my EPF to invest in Manulife (either Progress or Flexi funds) as the application is easier as compared to if I were to do it myself from FSM. In my own portfolio in FSM I am holding both EISC and KGF actually. Usually i walk in to FSM office to do Epf withdrawal. Very fast and friendly only 10 min. |

|

|

Mar 6 2016, 12:12 AM Mar 6 2016, 12:12 AM

|

Junior Member

311 posts Joined: Mar 2010 |

QUOTE(voyage23 @ Mar 5 2016, 11:01 PM) Hey thanks! Looks like it's really comparable to EISC and KGF. I am using my EPF to invest in Manulife (either Progress or Flexi funds) as the application is easier as compared to if I were to do it myself from FSM. In my own portfolio in FSM I am holding both EISC and KGF actually. If you're already holding 2 small cap funds in your portfolio, why would you add another ? |

|

Topic ClosedOptions

|

| Change to: |  0.0322sec 0.0322sec

0.39 0.39

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 02:30 AM |