Outline ·

[ Standard ] ·

Linear+

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

kimyee73

|

Jan 5 2016, 11:42 PM Jan 5 2016, 11:42 PM

|

|

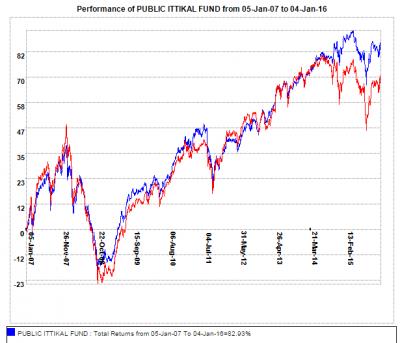

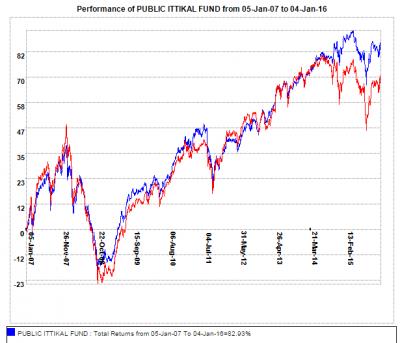

QUOTE(river.sand @ Jan 5 2016, 07:23 PM) Don't know what fund you took profit of, but I am using Affin Hwang Select Asia (ex Japan) Quantum Fund to explain my point. See charts below... In July 2008, just before the collapse of Lehman Brothers, the reference value was 116; In Jan 2011, the reference value was 207. You see, if I had this fund before 2008, and didn't take profit, I still got pretty decent return. Of course, if I had sold in April or May 2008, and bought back in early 2009, my return would be greater. But alas, I could not foresee the imminent market crash. And, if I took profit in Jan 2011, I would have missed the growth until 2015. I said PM UTC, so they are Public Mutual funds. Took profit meant sold some units so that you're back to same value as initially invested. All profits switched into money market fund. I hope we are on the same page when talking about taking profit. Your example using AHSAQF is not applicable as this Ponzi 1.0 fund is asia pac small cap while my funds were EPF approved funds mainly Malaysia large cap equity. Below is a good performing Public Mutual Ittikal Fund. If I just go with the ride, the fund value was stagnant for 3 years. With the switch, I made over 35% profits over the same period.  This post has been edited by kimyee73: Jan 5 2016, 11:42 PM

This post has been edited by kimyee73: Jan 5 2016, 11:42 PM |

|

|

|

|

|

kimyee73

|

Jan 5 2016, 11:50 PM Jan 5 2016, 11:50 PM

|

|

QUOTE(Kaka23 @ Jan 5 2016, 09:54 PM) Jialat lor this news... I got some exposure in China lei.. What is the exit strategy for china funds?  |

|

|

|

|

|

kimyee73

|

Jan 5 2016, 11:57 PM Jan 5 2016, 11:57 PM

|

|

QUOTE(wongmunkeong @ Jan 5 2016, 11:52 PM) buy more, every 25% to 30% down  seriously... CIMBC50 here i come (more)!  My FXI already down 11%. Buy some more? Stop loss at 25%. |

|

|

|

|

|

kimyee73

|

Jan 6 2016, 02:27 PM Jan 6 2016, 02:27 PM

|

|

QUOTE(yklooi @ Jan 6 2016, 10:37 AM)  I think they ......you decide  dare not challenge,..else...Jennifer angry and take action....  Based on last year event, I did asked CIS at the event if I can go home and place order. He said I can do it until 12 midnight. Anybody can do it, not just those who attended, that was not so well kept secret. I expect it will be the same this year. |

|

|

|

|

|

kimyee73

|

Jan 6 2016, 02:31 PM Jan 6 2016, 02:31 PM

|

|

Anyone else attending Penang event this Saturday? We can get together for a chat.

|

|

|

|

|

|

kimyee73

|

Jan 6 2016, 10:11 PM Jan 6 2016, 10:11 PM

|

|

QUOTE(brotan @ Jan 6 2016, 08:48 PM) KAF Vision is performing extremely well Yes indeed. The following small cap funds did very well in 2015 KAF Vision RHB Small Cap Opportunity EI Small Caps RHB Smart Balanced |

|

|

|

|

|

kimyee73

|

Jan 7 2016, 08:45 AM Jan 7 2016, 08:45 AM

|

|

QUOTE(Kaka23 @ Jan 6 2016, 10:34 PM) Will have momentum in 2016? Malaysia small caps or Asia ex-Japan in general? i don't have Algozen to predict that, need to ask Xuzen. Looking at December return, small cap funds dominated top 2 positions with CIMB small cap and RHB small cap while KAF Vision was not far behind. A few days into new year, FSM 1 month return have all 3 of them in top 5. I think you'll not stray far by going with Malaysia small cap in your portfolio. Ponzi 1.0 which is Asia xJap small cap is not doing as well though. |

|

|

|

|

|

kimyee73

|

Jan 7 2016, 08:41 PM Jan 7 2016, 08:41 PM

|

|

QUOTE(yklooi @ Jan 7 2016, 04:39 PM) just hope so.... but this ATR wouldn't last in my stable....transferring them to RHB Smart Treasure when the NAV movement stopsstory telling time again... on 4 Jan (Monday), without seeing the market movement, just after breakfast...i went to AffinHwang Asset Mgmt to 1) sell my Jpn and HSAO......wanted to transfer the cash to FSM to buy into KGF and EISC 2) transfer my HSO to Ponzi 1.0 3) top up my PRS.... went home looked at the mkts....sell offs all round......CURSED my self....why do i sell on this day? yesterday, some mkts went up...i cursed my self abit more again... Today mkts sell off again....i said to myself.....luckily i did sold some off on Monday....  How do you determine NAV movement has stop? Apart from RHB Smart Treasure, have you considered others such as PMB Shariah Aggressive/Growth Funds? |

|

|

|

|

|

kimyee73

|

Jan 7 2016, 11:46 PM Jan 7 2016, 11:46 PM

|

|

QUOTE(TakoC @ Jan 7 2016, 08:53 PM) I have exposure in 4 funds. I ask myself these questions, maybe you could provide your view? EI Small Cap - you still see value in small cap? Historically blue chip always move first, follow up small cap stocks, final leg is penny stocks. That's what I heard (don't bomb me on this). So with penny stocks hoo-haa over last year. Is it too early to look at small cap? Yes, aware that a lot of small cap perform very well. Ponzi 1.0 - high exposure in Malaysia. Ok. Fair since you want top Up EI small cap. Ponzi 2.0 - high China/HK exposure. Do you think it's too early to top up on China? Titan - so your 2016 strategy you focus on all region. Top up everything la right? Lol. From Malaysia to US. Sapu! I think it is the other way around. Small caps precede Big caps. In the bull market, small caps provide the growth. when market not so stable, sell small cap and hide behind big caps. when downturn, move to boring big caps. |

|

|

|

|

|

kimyee73

|

Jan 10 2016, 06:23 PM Jan 10 2016, 06:23 PM

|

|

QUOTE(David83 @ Jan 9 2016, 11:10 PM) The outlook for 2016 is pretty neutral based on the summary of today's seminar. Bullish market like China and India also cautiously phrased with stocks selection rather than general broad market. The word he used was cautiously optimistic. Manulife guy personally will invest 60:40 ratio between China and India if given only these 2 choices. |

|

|

|

|

|

kimyee73

|

Jan 10 2016, 09:19 PM Jan 10 2016, 09:19 PM

|

|

How come my IRR did not go down, went up instead? Based on 7/1/16 NAV price, IRR is now 7.87%, up from 7.23% on 31/12/15.  |

|

|

|

|

|

kimyee73

|

Jan 10 2016, 09:32 PM Jan 10 2016, 09:32 PM

|

|

QUOTE(wil-i-am @ Jan 10 2016, 07:56 PM) Anyone top up Bolehland fund? Went into RHB Smart Treasure, RHB Small Cap and KGF |

|

|

|

|

|

kimyee73

|

Jan 11 2016, 04:48 PM Jan 11 2016, 04:48 PM

|

|

QUOTE(yklooi @ Jan 11 2016, 10:20 AM) PLUS....maybe some of these funds are inside the portfolio at high %? i think kimyee has about 9% of AMPRECIOUS Maybe I'm too heavy on fixed income at 61%. 9% in RHB Islamic bond, 8.5% in RHB EM bond, 8.5% in RHB ATR, 30% in CMF and the rest in various bond funds for switching purpose. Follow FSM advice, cut back on equity allocation. |

|

|

|

|

|

kimyee73

|

Jan 11 2016, 06:37 PM Jan 11 2016, 06:37 PM

|

|

QUOTE(brotan @ Jan 11 2016, 06:20 PM) anyone here invest in ETF? Malaysia or USA? |

|

|

|

|

|

kimyee73

|

Jan 11 2016, 11:18 PM Jan 11 2016, 11:18 PM

|

|

QUOTE(brotan @ Jan 11 2016, 09:27 PM) ic thanks so anyway invest in ETF? local or abroad I think some have la. For US ETF, apart from myself, wongseafood also have but not sure about the rest. Are there questions you have in mind? |

|

|

|

|

|

kimyee73

|

Jan 15 2016, 11:55 AM Jan 15 2016, 11:55 AM

|

|

QUOTE(river.sand @ Jan 15 2016, 08:44 AM) Be worried about your EPF money  No need to worry one. EPF is like a giant Ponzi scheme. There are always new employees that will contribute and lock down for about 35 years before can take out. 35 years later, there are always new employees contributing enabling you to take out your money  |

|

|

|

|

|

kimyee73

|

Jan 16 2016, 11:54 PM Jan 16 2016, 11:54 PM

|

|

Did not top up today. Thinking of doing it but my indicator did not trigger a buy. Was hoping there will be some this week but there is none, so a bit reluctant to do it since already did top up last week.

|

|

|

|

|

|

kimyee73

|

Jan 17 2016, 06:16 PM Jan 17 2016, 06:16 PM

|

|

QUOTE(Kaka23 @ Jan 17 2016, 12:24 AM) Even US market and China your indicator didnt trigger some buy? Not yet, it will trigger only when trend is swing up. Right now they are straight down. It will not catch the bottom but at least avoid catching a falling knife. |

|

|

|

|

|

kimyee73

|

Jan 17 2016, 06:20 PM Jan 17 2016, 06:20 PM

|

|

QUOTE(Kaka23 @ Jan 17 2016, 12:30 AM) Then no dinner for those gold and platinum account holder also..  Last week in Penang event we had lunch indoor but pity those who came late, they ran out of food and have to settle for special order packed lunch. |

|

|

|

|

|

kimyee73

|

Jan 17 2016, 06:38 PM Jan 17 2016, 06:38 PM

|

|

QUOTE(Vanguard 2015 @ Jan 17 2016, 02:08 PM) Isn't this rear view mirror investing? It is like flipping a coin. 50/50 chance the RHB Smart Treasure fund will continue its sterling performance. Sorry ah to the forumers here. I don't mean to be a party pooper. It definitely is. RHB smart treasure is in my radar since April last year but because their past 5 years performance was not as good as KGF, I decided not to jump in until recently. Missed the 2015 boat already. See if it will continue to go up this year, else abandon ship. Another fund on my radar since March 2015 is PMB Shariah Aggressive Fund. Perhaps I should be more aggressive to abandon ship going forward  |

|

|

|

|

Jan 5 2016, 11:42 PM

Jan 5 2016, 11:42 PM

Quote

Quote 0.0491sec

0.0491sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled