AFAIK, ASX also never mention that they will guarantee ur capital

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

|

Jan 14 2016, 04:39 PM Jan 14 2016, 04:39 PM

|

Junior Member

375 posts Joined: Jan 2011 |

AFAIK, ASX also never mention that they will guarantee ur capital

|

|

|

|

|

|

Jan 14 2016, 04:58 PM Jan 14 2016, 04:58 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

just in case someone missed this..Portfolio suggested by "lukenn".

a locally back tested portfolio of 10.92% CAGR on last 10 yrs (2004~2014) at 50% FI : 50% EQ page# 37, post# 723 |

|

|

Jan 14 2016, 05:09 PM Jan 14 2016, 05:09 PM

|

Junior Member

311 posts Joined: Mar 2010 |

QUOTE(T231H @ Jan 14 2016, 04:58 PM) just in case someone missed this..Portfolio suggested by "lukenn". lol someone actually noticed. a locally back tested portfolio of 10.92% CAGR on last 10 yrs (2004~2014) at 50% FI : 50% EQ page# 37, post# 723 But to be fair, those were the funds that did quite well over the last 10 years. You may not have chosen them at that point in time... |

|

|

Jan 14 2016, 05:09 PM Jan 14 2016, 05:09 PM

|

Senior Member

3,541 posts Joined: Mar 2015 |

(Reaching for my popcorn). Let the battle begin.

|

|

|

Jan 14 2016, 05:09 PM Jan 14 2016, 05:09 PM

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(superb999 @ Jan 14 2016, 04:39 PM) Yes. You're right. They never mentioned in b&w but you are buying and selling at RM1/unit. You tell me how is that not capital protected?If is not why do you think the non-bumi quota is always sold out? If is not rm1/unit, you think got people want to put? Anyway I feel ASX FP is a FD on steroid. One should have enough money in something safe FD/ASX/bond which can generate enough passive income for one's monthly expenses. |

|

|

Jan 14 2016, 05:11 PM Jan 14 2016, 05:11 PM

|

Junior Member

311 posts Joined: Mar 2010 |

|

|

|

|

|

|

Jan 14 2016, 05:32 PM Jan 14 2016, 05:32 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

Ponzi 2 up 0.2%

Titan up 0.9% Yay |

|

|

Jan 14 2016, 05:57 PM Jan 14 2016, 05:57 PM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Ramjade @ Jan 14 2016, 05:09 PM) Yes. You're right. They never mentioned in b&w but you are buying and selling at RM1/unit. You tell me how is that not capital protected? I hope this is the last time I address this remark, but I doubt itIf is not why do you think the non-bumi quota is always sold out? If is not rm1/unit, you think got people want to put? Anyway I feel ASX FP is a FD on steroid. One should have enough money in something safe FD/ASX/bond which can generate enough passive income for one's monthly expenses. The buying and selling at RM1/unit is to make people who are adverse of losing money to go into this eventhough it's a pure equity fund. If any of this people bother to read the master prospectus http://www.asnb.com.my/v3_/pdf/produk/mast..._prospectus.pdf and the various fund factsheets http://www.asnb.com.my/v3_/pdf/produk/ASB/...0331PHS-ASB.pdf It is clearly stated that • ASB is a fixed price fund and it is not a capital guaranteed fund under the Guidelines So please, do not ever equate ASX funds as capital guaranteed investments such as FDs anymore. It's not even guaranteed by the government of Malaysia such as bank rakyat FDs or SSPN savings. If it follows the normal SC guidelines, it would have a risk rating of 8 like Kenanga Growth Fund As to it being always fully subscribed, that's where the national interest is, they have to have products like this to make sure Msia share market doesn't swing crazily up and down during times like this. Key question is - Do you want to be part of that, the black box method where you don't know how much your RM1 per unit is worth, it could be RM0.80 now or RM1.20 now. By putting 100% of your money in that, is the same as putting 100% of your money in Kenanga Growth Fund; which is not advisable I made my choice, I want to know how much my investment is worth, even if it means sometimes it's less than my capital. I also want to put some of my money in non-Malaysia assets to diverify better. My 7.7% IRR is much lower risk than putting the money in ASX; it's 70EQ:30FI I know, you think your investment is risk free like FD.... we can continue to agree to disagree because even PNB say it is not risk free like FD |

|

|

Jan 14 2016, 05:57 PM Jan 14 2016, 05:57 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(dexk @ Jan 14 2016, 04:25 PM) I think you missed a few points. Please correct me if I'm wrong. Ans to Q1:1) You benchmark against KGF only. Meaning someone has to be 100% invested in KGF only. I see so many people here go for diversification and sacrifice potential gains in exchange for a more stable portfolio. In the end, their total portfolio return is around 7% (Based on my observation on average from what some of you posted here). It is still/also not capital guaranteed. 2) In the scenario of a Greek style bankruptcy. Do you think KGF or ASX will be able to preserve you capital better? You might argue chances of this is low, if so then why diversify at all? 3) In the end, 7-8% is not too bad. Not everyone is a gambler. 4) Also there are some people who has/is gambling their whole fortune into their own business for example and do not want/need to take anymore gamble with their retirement funds. I need to benchmark it to KGF as ASX is a 100% local exposed fund, so is KGF. I need to compare apples to apples. But I need to bring you back to the original point of my argument which is not about the return per se, but at how ASX is not reflective of the total assets it holds. Ans to Q2: It has not happen and whatever we say is purely speculative. However, for the sake of argument, I speculate both will not persevere capital as neither both are capital guaranteed. Ans to Q3: It is an opinion expressed by you, it is difficult to argue on opinions. If 7 to 8% is what is comfortable to you, who am I to dictate otherwise. Nonetheless all I am saying is that given an apple to apple comparison i.e., both are locally exposed equity fund, one gave you 8% p.a., the other 16% p.a, you be the judge. Ans to Q4: Noted. Equity fund such as KGF are used to increase one's wealth, if someone who already have wealth and need to persevere it for next generation for example, then there are other tools out there. KGF / ASX may no longer be the right tool. Xuzen |

|

|

Jan 14 2016, 06:12 PM Jan 14 2016, 06:12 PM

|

Senior Member

3,541 posts Joined: Mar 2015 |

QUOTE(dasecret @ Jan 14 2016, 05:57 PM) The buying and selling at RM1/unit is to make people who are adverse of losing money to go into this eventhough it's a pure equity fund. If any of this people bother to read the master prospectus http://www.asnb.com.my/v3_/pdf/produk/mast..._prospectus.pdf and the various fund factsheets http://www.asnb.com.my/v3_/pdf/produk/ASB/...0331PHS-ASB.pdf It is clearly stated that • ASB is a fixed price fund and it is not a capital guaranteed fund under the Guidelines |

|

|

Jan 14 2016, 06:20 PM Jan 14 2016, 06:20 PM

|

Senior Member

4,725 posts Joined: Jul 2013 |

i shall stop updating my portfolio for awhile... ignorance is bliss...

joining the ppl in FD thread in chasing the higher FD rate seems better on the heart... |

|

|

Jan 14 2016, 06:31 PM Jan 14 2016, 06:31 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Jan 14 2016, 07:02 PM Jan 14 2016, 07:02 PM

|

Junior Member

311 posts Joined: Mar 2010 |

QUOTE(adele123 @ Jan 14 2016, 06:20 PM) i shall stop updating my portfolio for awhile... ignorance is bliss... OT : The fellas there are quite entertaining. joining the ppl in FD thread in chasing the higher FD rate seems better on the heart... Assuming they out perform the board rate b 0.5%, and it requires moving their capital every quarter. Per 100k deposits, they make an extra RM500 pa., or RM125/move. Nett of expenses, I'm really wondering what the point is. This post has been edited by lukenn: Jan 14 2016, 07:06 PM |

|

|

|

|

|

Jan 14 2016, 07:11 PM Jan 14 2016, 07:11 PM

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(dasecret @ Jan 14 2016, 05:57 PM) I hope this is the last time I address this remark, but I doubt it First thank you. After being told repeated time, now I know. I used to don't know that it's not FD.The buying and selling at RM1/unit is to make people who are adverse of losing money to go into this eventhough it's a pure equity fund. If any of this people bother to read the master prospectus http://www.asnb.com.my/v3_/pdf/produk/mast..._prospectus.pdf and the various fund factsheets http://www.asnb.com.my/v3_/pdf/produk/ASB/...0331PHS-ASB.pdf It is clearly stated that • ASB is a fixed price fund and it is not a capital guaranteed fund under the Guidelines So please, do not ever equate ASX funds as capital guaranteed investments such as FDs anymore. It's not even guaranteed by the government of Malaysia such as bank rakyat FDs or SSPN savings. If it follows the normal SC guidelines, it would have a risk rating of 8 like Kenanga Growth Fund As to it being always fully subscribed, that's where the national interest is, they have to have products like this to make sure Msia share market doesn't swing crazily up and down during times like this. Key question is - Do you want to be part of that, the black box method where you don't know how much your RM1 per unit is worth, it could be RM0.80 now or RM1.20 now. By putting 100% of your money in that, is the same as putting 100% of your money in Kenanga Growth Fund; which is not advisable I made my choice, I want to know how much my investment is worth, even if it means sometimes it's less than my capital. I also want to put some of my money in non-Malaysia assets to diverify better. My 7.7% IRR is much lower risk than putting the money in ASX; it's 70EQ:30FI I know, you think your investment is risk free like FD.... we can continue to agree to disagree because even PNB say it is not risk free like FD "capital protection" here means you cannot lose your money. How on earth you are going to lose your money if you buy and sell at RM1/unit? I know is not stated in b&w, hence the "" Again sounds and look like me scenario. It was never a FD but still feels like one ("capital protection", consistent returns) For me it doesn't matter whether it made a loss or not. Most important for me is my main money must not disappeared (loss through investment) and the returns must be above FD! They want to conjure money our from thin air also I don't care. As long as when I want the money and I am able to withdraw it, no problem. Any side money can make a loss. QUOTE(xuzen @ Jan 14 2016, 05:57 PM) Ans to Q4: I agreed with you on this. If one wants to be rich, one cannot depend on single digit returns. Noted. Equity fund such as KGF are used to increase one's wealth, if someone who already have wealth and need to persevere it for next generation for example, then there are other tools out there. KGF / ASX may no longer be the right tool. Xuzen Btw, if one can go in and out of ASX FP anytime, would that be a better choice than CMF? QUOTE(brotan @ Jan 14 2016, 06:31 PM) Yes and no. Returns of FD promos are 4.x%. Better than CMF. Downside is not liquid enough. |

|

|

Jan 14 2016, 07:16 PM Jan 14 2016, 07:16 PM

|

Senior Member

4,725 posts Joined: Jul 2013 |

QUOTE(brotan @ Jan 14 2016, 06:31 PM) while CMF return now is quite high at 3.9%, it is way better than normal board rate. but for some conservative ones, locking in with FD which the interest is guaranteed than is more favourable.i like to point out also that CMF isn't always this high. it does vary, but based on my own experience thus far, i think on average should be around 3.6% or 3.7% for the past year which is still not bad. |

|

|

Jan 14 2016, 07:21 PM Jan 14 2016, 07:21 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

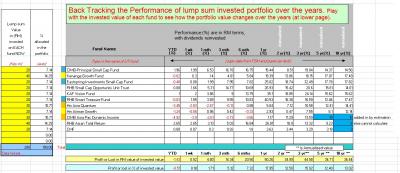

QUOTE(T231H @ Jan 14 2016, 04:58 PM) just in case someone missed this..Portfolio suggested by "lukenn". a locally back tested portfolio of 10.92% CAGR on last 10 yrs (2004~2014) at 50% FI : 50% EQ page# 37, post# 723 QUOTE(lukenn @ Jan 14 2016, 05:09 PM) lol someone actually noticed. lukenn But to be fair, those were the funds that did quite well over the last 10 years. You may not have chosen them at that point in time... I sendiri buat (not verified) back track template. using last few days data from FSM at 36% m'sia SC ...I just got 13% annualised returns in 10 yrs duration where else your portfolio as in post# 723 is very much less volatile, yet it still got 10.92% it just make me wonder.....is higher volatility good? btw, I attached the back track template...just in case anyone try it out and found error in computation formula...pls tell me ya....me not expert in excel... Attached thumbnail(s)

Attached File(s)  Back_Track_Portfolio_ROI_Template.zip ( 21.08k )

Number of downloads: 8

Back_Track_Portfolio_ROI_Template.zip ( 21.08k )

Number of downloads: 8 |

|

|

Jan 14 2016, 07:48 PM Jan 14 2016, 07:48 PM

Show posts by this member only | IPv6 | Post

#1397

|

Senior Member

3,806 posts Joined: Feb 2012 |

QUOTE(yklooi @ Jan 14 2016, 07:21 PM) lukenn 2-year return is annualized, so you need to multiply the return by 2.I sendiri buat (not verified) back track template. using last few days data from FSM at 36% m'sia SC ...I just got 13% annualised returns in 10 yrs duration where else your portfolio as in post# 723 is very much less volatile, yet it still got 10.92% it just make me wonder.....is higher volatility good? btw, I attached the back track template...just in case anyone try it out and found error in computation formula...pls tell me ya....me not expert in excel... Example, for CIMB-Principal Small Cap, N6 value (in Dun delete) should be MAIN!N5*C6*2/100 Ditto for 3, 5, and 10-year returns. This post has been edited by river.sand: Jan 14 2016, 07:48 PM |

|

|

Jan 14 2016, 07:53 PM Jan 14 2016, 07:53 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(river.sand @ Jan 14 2016, 07:48 PM) 2-year return is annualized, so you need to multiply the return by 2. Example, for CIMB-Principal Small Cap, N6 value (in Dun delete) should be MAIN!N5*C6*2/100 Ditto for 3, 5, and 10-year returns. I follow annualised return as in FSM data format.... I think can use.....b'cos I am calculating it as annualise. thanks for the input...will review again to see if really can use or not. |

|

|

Jan 14 2016, 08:18 PM Jan 14 2016, 08:18 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(adele123 @ Jan 14 2016, 06:20 PM) i shall stop updating my portfolio for awhile... ignorance is bliss... Adele,joining the ppl in FD thread in chasing the higher FD rate seems better on the heart... U should be getting excited ma right? i mean, CHEAPER equities to buy more wor. like shopping on SALE SALE SALE! since need/holding long (or should i say 'savings allocater'), i'd prefer things to be on sale since i want/need to buy anyway sorry - "grocery shopping" habits die hard. i'm the fler infront of the queue with fully loaded milk-powder 12 months' worth during a worthwhile sale other's reality may differ |

|

|

Jan 14 2016, 08:20 PM Jan 14 2016, 08:20 PM

|

All Stars

14,871 posts Joined: Mar 2015 |

QUOTE(yklooi @ Jan 14 2016, 07:21 PM) lukenn I sendiri buat (not verified) back track template. using last few days data from FSM at 36% m'sia SC ...I just got 13% annualised returns in 10 yrs duration where else your portfolio as in post# 723 is very much less volatile, yet it still got 10.92% it just make me wonder.....is higher volatility good? btw, I attached the back track template...just in case anyone try it out and found error in computation formula...pls tell me ya....me not expert in excel... I think that is the culprit. |

|

Topic ClosedOptions

|

| Change to: |  0.0327sec 0.0327sec

0.31 0.31

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 02:10 AM |