QUOTE(MUM @ Jan 12 2016, 05:06 PM)

Thanks for explaining....

in the end...is it capital protected in layman term?

how should I explain it to my children?

It looks like capital protected (bcos buy/sell at RM1) but it is actually not?...sound confusing....

Let me assist you:

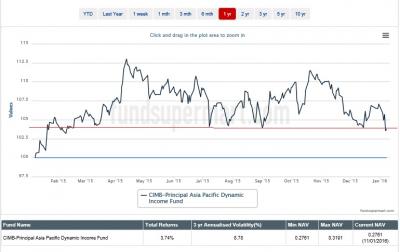

Let's say on 1/1/2016 you buy a ASX fund at RM 1.00 / unit. The fund made 20cts per unit, or market up 20%. By now your fund NAV should be RM 1.20 right? You sell it, you should get RM 1.20 right?

But how much is ASX price? Forever RM 1.00, what happened to your 20cts? They declare a 7% dividend and all of you go ga-ga! This means ASX only pay you 7cts, what happened to you other 13cts?

ASX FM then use the 13cts to keep in their holding.

Let's say next year the fund lose 20% and the NAV is now RM 0.80 and you want to redeem it immediately. They will use the rollover profit to pay you at RM 1.00.

You will say that this is good, as you are assured of RM 1.00 all the time. But for those who are financially savvy, we want full disclosure and be compensated accordingly, i.e., follow market force. We want to be able to fully able to enjoy the whole 1.20 when it is time opportune.

Now you get it?

Xuzen

p/s for the past 10 years tracking, KGF annualized return is 16% p.a. How much is ASX? 7 or 8 % maximum right? Now you see how much opportunity cost you have lost?

This post has been edited by xuzen: Jan 12 2016, 08:04 PM

Jan 12 2016, 06:40 PM

Jan 12 2016, 06:40 PM

Quote

Quote

0.0171sec

0.0171sec

0.65

0.65

6 queries

6 queries

GZIP Disabled

GZIP Disabled