QUOTE(dasecret @ Jan 8 2016, 09:45 AM)

I supposed each of your account would be designated for a different purpose right? I did thought of transferring my current individual account to 2 beneficiary accounts for my 2 kids; but what if 1 perform and 1 doesnt?

This is going to be another one of my long winded post....

In a way you are right. Each account is designated for a different purpose.

(1) Primary account - This is a Beneficiary Account for my wife. If I die tomorrow, she can transfer out the money instantly without waiting for the grant of probate.

(2) Secondary account no. 1 - This is actually my wife's Personal Account. But I control it. This will be a conservative account. At the most only 50% in equity. Most of the money are currently parked under bond funds and CMF.

(3) Secondary account no. 2 - This is a Beneficiary Account meant for my son's education fund. I am using an aggressive approach for this fund in view of the long term horizon.

(4) Secondary account no. 3 - This is my Personal Account (newly minted). It is a PRS account with 2 separate PRS funds now. I am adding a global fund to complement it. So only 3 funds in total.

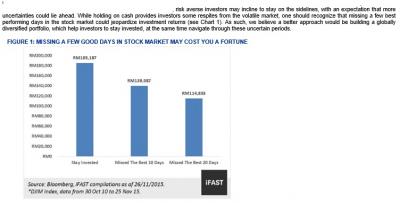

So, the million dollar question now. What if all 4 Accounts tank within 10 years time and suffer heavy losses??? Another Global Financial Crisis or Asian Financial Crisis is highly possible within the next 10 years or even this year. I think we cannot worry too much about things which are beyond our control. Otherwise we will end up putting all our money in FD or under the mattress. Inflation will kill us slowly in the long run.

That's why I have diversified into other "investments". I don't consider myself a savvy investor, so I tend to buy a bit of everything. I am also doing monthly self contribution for EPF, SSPN (for tax purpose) and periodic top up for ASM and AS I Malaysia. I have also bought an endowment policy.

Anything else that I missed out apart from investing directly in the stock market or property investment?

This post has been edited by Vanguard 2015: Jan 8 2016, 11:17 AM

Jan 7 2016, 08:53 PM

Jan 7 2016, 08:53 PM

Quote

Quote

0.0223sec

0.0223sec

0.27

0.27

6 queries

6 queries

GZIP Disabled

GZIP Disabled