QUOTE(littlediana @ Dec 4 2007, 07:35 PM)

why no one answer my question de ?

that is not necessary to discount the provision as long as the provision is paid not more than one year later..

If the provision need to discounted, the question normally will give the discount rate or market rate...

For example, when the provision need to be paid at 2 years later is 1000 (discount rate = 5%)and the amount in the B/S should be

Year 1 = 1000 / 1.05^2 = 907 PLUS interest for the year =907x5%=45.35

=952.35

Year 2 =952.35 +(952.35x5%)=999.9675

=1000

Figure different due to rounding error..so at the end of the year 2 is should have 1000 in the liability which is the amount expected to settle the obligation..

Added on December 4, 2007, 9:29 pmQUOTE(keith_hjinhoh @ Dec 4 2007, 07:19 PM)

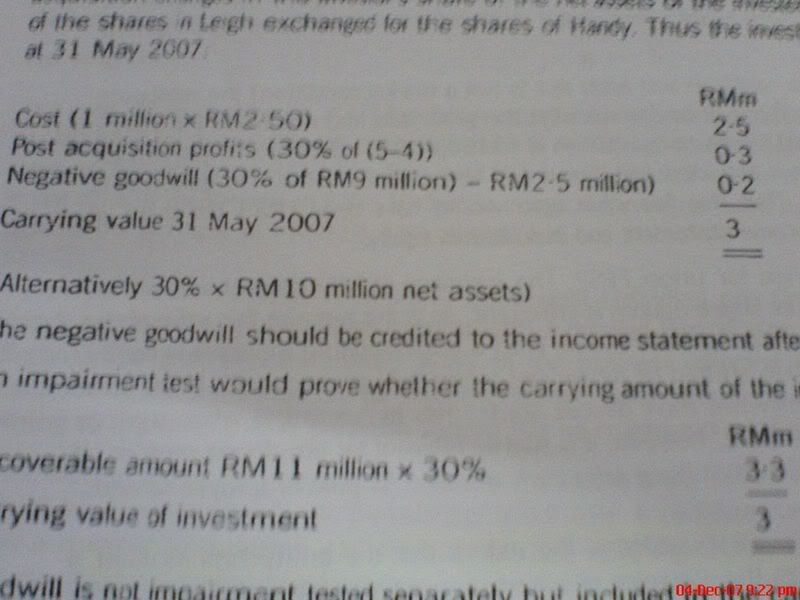

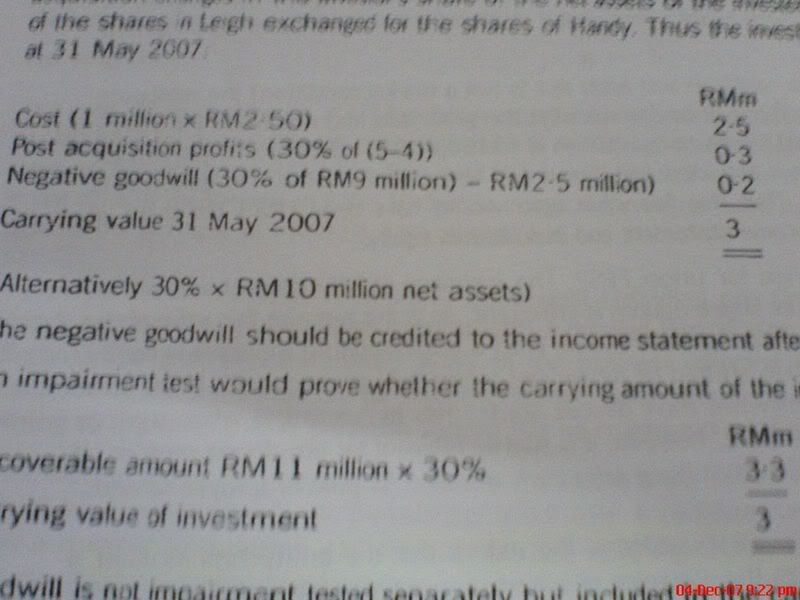

Negative goodwill is deal at Group B/S

Dr Retained Profits

Cr Investment in associates

somehow the question is the goodwill should be fully treated when calculate total COI - FV of net assets, why you have this negative goodwill later?

**Goodwill + FV of Net Asset = Cost of investment FYI...

Is it goodwill impairment?

Setaraf dengan nya... i'm not really sure, you've to call em up to ask.

this i also not sure..since is the answer given in the past year...

and is it..

This post has been edited by scorpiok: Dec 4 2007, 09:29 PM

This post has been edited by scorpiok: Dec 4 2007, 09:29 PM

Nov 15 2007, 11:29 PM

Nov 15 2007, 11:29 PM

Quote

Quote

0.0222sec

0.0222sec

1.27

1.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled