QUOTE(foofoosasa @ Feb 20 2017, 10:14 AM)

My old stake is still there floating around.. wanna exit.. Investors Club V9, Previously known as Traders Kopitiam

Investors Club V9, Previously known as Traders Kopitiam

|

|

Feb 20 2017, 10:28 AM Feb 20 2017, 10:28 AM

Return to original view | Post

#201

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

|

|

|

Feb 20 2017, 10:29 AM Feb 20 2017, 10:29 AM

Return to original view | Post

#202

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 20 2017, 10:41 AM Feb 20 2017, 10:41 AM

Return to original view | Post

#203

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 20 2017, 01:28 PM Feb 20 2017, 01:28 PM

Return to original view | Post

#204

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(foofoosasa @ Feb 20 2017, 01:00 PM) I have been an investor in Armada for quite some time...basically this is what i see..1. Earnings has been dragged down by their OSV division and also write down of assets (especially OSV). 2. Ongoing dispute and law suit for Armada Claire, which leads to loss of income and write down of FPSO. 3. Actually their FPSO division is quite healthy, as long as their customers abide by contract. 4. Positive catalyst is better utilization from their OSV and winning the A. Claire lawsuit. This post has been edited by gark: Feb 20 2017, 01:28 PM |

|

|

Feb 20 2017, 01:47 PM Feb 20 2017, 01:47 PM

Return to original view | Post

#205

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

Boon3

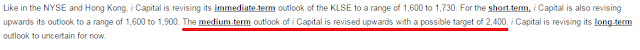

TTB.. the "super" fund manager who has been waiting and waiting for KLCI to crash to 900 points since 2011 ...  Latest prediction TTB now predicts KLCI will shoot to 2,400 points by end 2017/2018.  From super bear to super bull... what do you all think? The last bear has fallen... stock euphoria has come? » Click to show Spoiler - click again to hide... « This post has been edited by gark: Feb 20 2017, 01:53 PM |

|

|

Feb 20 2017, 01:54 PM Feb 20 2017, 01:54 PM

Return to original view | Post

#206

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

|

|

|

Feb 20 2017, 03:13 PM Feb 20 2017, 03:13 PM

Return to original view | Post

#207

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 21 2017, 10:09 AM Feb 21 2017, 10:09 AM

Return to original view | Post

#208

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 21 2017, 10:20 AM Feb 21 2017, 10:20 AM

Return to original view | Post

#209

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 21 2017, 10:26 AM Feb 21 2017, 10:26 AM

Return to original view | Post

#210

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 21 2017, 10:35 AM Feb 21 2017, 10:35 AM

Return to original view | Post

#211

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 21 2017, 10:36 AM Feb 21 2017, 10:36 AM

Return to original view | Post

#212

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 21 2017, 01:48 PM Feb 21 2017, 01:48 PM

Return to original view | Post

#213

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Vanguard 2015 @ Feb 21 2017, 11:57 AM) I am continuing my fishing expedition today for AEON Credit, Ta Ann and CIMB shares. Wah another KFC trader in the making... Also fishing for Inari Ametron to add to my portfolio. Sold off MReit and Magnum because I need more ammo and growth funds. I may re-enter the REIT market once I have additional ammo in the future. Don't you think selling off shares so soon just after you buy it .. is lacking conviction? What is reason you buy in the first place? You need to wait for your purchases to age and blossom, like fine wine.. This post has been edited by gark: Feb 21 2017, 01:49 PM |

|

|

|

|

|

Feb 21 2017, 01:51 PM Feb 21 2017, 01:51 PM

Return to original view | Post

#214

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 21 2017, 01:55 PM Feb 21 2017, 01:55 PM

Return to original view | Post

#215

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(CristEG @ Feb 21 2017, 01:01 PM) Hi all gurus in lowyat, Danger of playing with call warrant is that you can stand to lose 100% of your capital.I'm new in the market and facing a problem that would like to get some advice from you: I hold a large amount of cash settled warrants (AairAsiaC40), and its gonna expired next week. The problem is that the current price is near to zero (I bought it when its 0.175 >_<) and the trading volume is so low that I doubt there chances for me to sell all those warrants in such a short time. May I know what would be the best way for me to cut my loss to minimum? Your help or enlightenment is much appreciated! p/s: I was too busy with my daily job when the price was high and I never set a stop point since I'm new. And as you know the price has been dropping ever since (T_T) Since this warrant is very out of the money and going to expire soon, no choice but to accept your losses. You can try to queue at 0.005 to see if got someone will buy from you. New player, dont head first to call warrants first .. learn by trading normal stocks first. |

|

|

Feb 21 2017, 06:24 PM Feb 21 2017, 06:24 PM

Return to original view | Post

#216

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 21 2017, 06:35 PM Feb 21 2017, 06:35 PM

Return to original view | Post

#217

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Vanguard 2015 @ Feb 21 2017, 06:33 PM) Gark, I just did a quick research for this fund. The fundamentals look sound. But today the price still dropped -2.20% today and it closed at RM4.880. Not researched..What do you think is the intrinsic value for this stock? But it is garment related export counter..rides on strength of USD ... and price fluctuations is normal. This post has been edited by gark: Feb 21 2017, 06:36 PM |

|

|

Feb 21 2017, 06:46 PM Feb 21 2017, 06:46 PM

Return to original view | Post

#218

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Feb 21 2017, 07:01 PM Feb 21 2017, 07:01 PM

Return to original view | Post

#219

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Boon3 @ Feb 21 2017, 06:54 PM) There's much difference in personal ability. Concentration of portfolio is a double edge sword. If you guess correctly, you win big, but if not you will lose big also (or opportunity loss).Some can play many stocks at one time. Many can't. Some can play with 2-3 stocks at one go. Many can't. And .....one really wouldn't know what exactly is good for one self....unless one test each method out extensively. Why? Cos...don't we want to attack the market with our best gung phew? So during all the extensive testing ..... Do we want to use real money and die a thousand deaths? Or do we want to be smart and test it out in a lab where it doesn't cost us plenty of innoceny money when we farkk up? Ooops....shyte.... garment ah? Errr.... In a diversified portfolio, you have both chances of win and lose, but at smaller quantum so you get a more moderate results. It depends on which style you like, or which is more suitable for you. Even doing the best homework and the best tools, you will end up with some mistakes. For me I like some diversification, but not over diversified |

|

|

Feb 21 2017, 07:09 PM Feb 21 2017, 07:09 PM

Return to original view | Post

#220

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

Topic ClosedOptions

|

| Change to: |  0.1268sec 0.1268sec

0.30 0.30

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 02:53 AM |