QUOTE(amerz @ May 22 2012, 03:50 PM)

Thanks,

I already have

1. Prubsn Takaful

Plan 250. Deductible 10k. Auto Upgrade and Retirement.

Life 10k

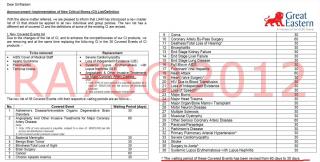

2. GE Life: 100k

3. ING Company Medical Card.

Now I'm looking for my main Medical card, just in case I don't work with my employee any more.

And surveying for early stage cancer or early stage ci.

Budget RM 100 for medical card with lowest sum assured.

Budget RM 150 for medical card with lowest sum assured and CIS or early CI or male CI.

Already surveying Allianz(got a lot of early cancer rider) and Axa affin (like the no lifetime limit and high annual limit). Any other suggestion ?

Age 29, male , smoker, class 1 worker

To match your budget, the best way is :I already have

1. Prubsn Takaful

Plan 250. Deductible 10k. Auto Upgrade and Retirement.

Life 10k

2. GE Life: 100k

3. ING Company Medical Card.

Now I'm looking for my main Medical card, just in case I don't work with my employee any more.

And surveying for early stage cancer or early stage ci.

Budget RM 100 for medical card with lowest sum assured.

Budget RM 150 for medical card with lowest sum assured and CIS or early CI or male CI.

Already surveying Allianz(got a lot of early cancer rider) and Axa affin (like the no lifetime limit and high annual limit). Any other suggestion ?

Age 29, male , smoker, class 1 worker

1. add-on the medical card into your current GE plan (Should be within RM50)

2. Get a new plan with lowest sum assured and with Early Payout Critical Illness for C.I (Plan should be between RM 100-120 depends the waiver rider term years)

If you interested to know more PM me for detail

Good day.

May 22 2012, 04:53 PM

May 22 2012, 04:53 PM

Quote

Quote

0.0559sec

0.0559sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled