QUOTE(HJebat @ May 2 2013, 02:53 PM)

Guys, here's my details:

Type of plan: saving plan

Annual payment: $2017.00

Payment period: 20 years

Cash value at 20th year: $55298

I tried to calculate the rate of return of the cash value at 20th year using free online tools and it turned out to be 2.92%. I'm poor with numbers. So, I would like to check with those regulars here, is my calculation correct?

Yes, 2.92% annualised return i.e. IRR. Type of plan: saving plan

Annual payment: $2017.00

Payment period: 20 years

Cash value at 20th year: $55298

I tried to calculate the rate of return of the cash value at 20th year using free online tools and it turned out to be 2.92%. I'm poor with numbers. So, I would like to check with those regulars here, is my calculation correct?

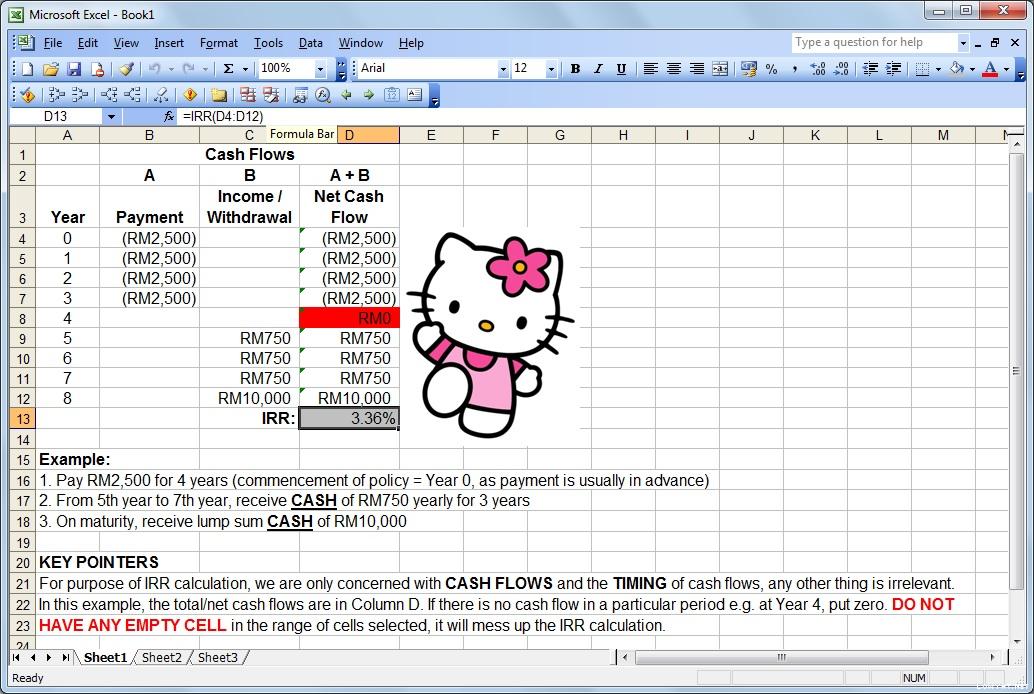

Use this as guide for IRR calculation:

This post has been edited by Pink Spider: May 2 2013, 03:36 PM

May 2 2013, 03:23 PM

May 2 2013, 03:23 PM

Quote

Quote 0.0255sec

0.0255sec

0.97

0.97

7 queries

7 queries

GZIP Disabled

GZIP Disabled