Sorry if you say cost is not important, why bother buying from FSM Malaysia? Better buy from agent and kena charge 5.5% right? Cutting down cost = more saving. 1.5% is in the NAV already. That one cannot save. But save where you can. i.e: Service charge. If I want to save, I will go for ETF (that's my long term plan), Right now, no account cannot do anything. Waiting for account to be approve.

Why bother paying 0.4%/pa (FSMOne) when Philips giving only 0.75% one time charge? What's 3% saving? I already calculated. For every SGD1k you park inside FSM/Philips per year for 10 years, FSM earns about SGD2200 while Philips only earned SGD750.

If you add another zero to 1k to make it SGD10k/year, FSM will earn SGD22000 and Philips only earn SGD7500 from you. SGD22000 might not be alot for you. But that's alot for me.

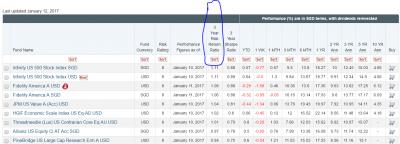

Further proof

By choosing Philips, one save 65.91% over 10 years which if annualized is 6.591% pa. FSM platform fees of SGD2200/SGD10k is 22% of your money. Almost 25%!!!

Compare that to SGD750/SGD10k. Only 7.5% (still acceptable)

Now tell me again cost is not important.

Cost is an important part. Never underestimate cost as it add up overtime. Eg is shown above. If people tell you cost not important either:

1) Person have too much money

2) Never do calculation enough

True.. but then you need to get documents signed by notary public, then you need to courier it to them.. those are costs too. Unlike FSM one, they just need it to be scanned and emailed.

Dec 19 2016, 03:00 PM

Dec 19 2016, 03:00 PM

Quote

Quote

0.0276sec

0.0276sec

0.22

0.22

6 queries

6 queries

GZIP Disabled

GZIP Disabled