QUOTE(Boon3 @ Jul 7 2020, 01:42 PM)

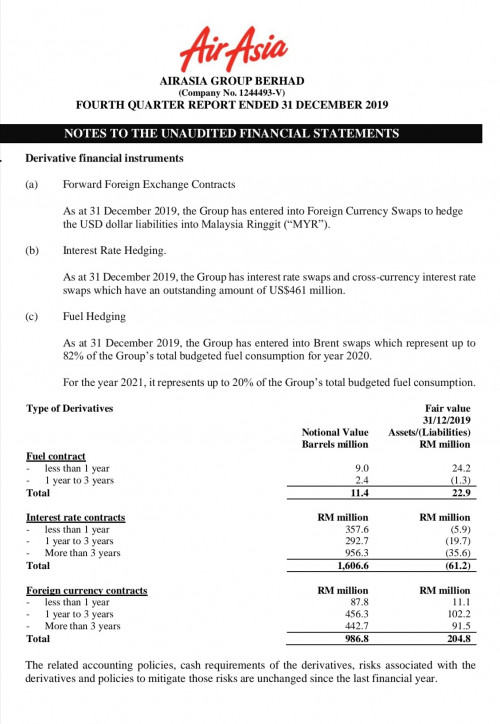

This was from Dec QR report from AirAsia...

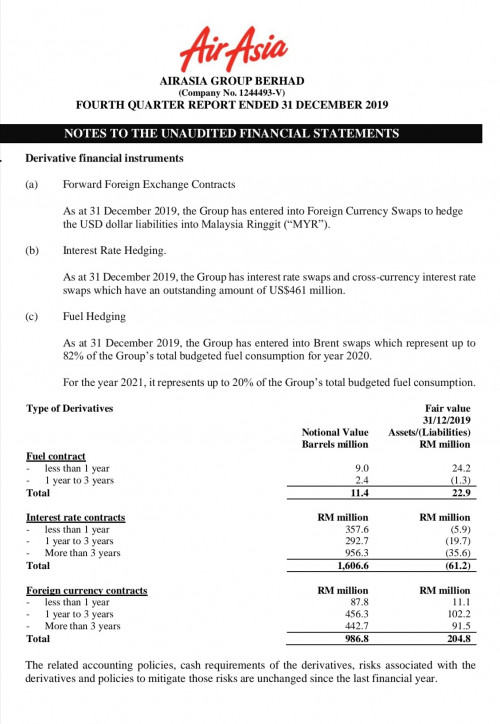

This was yesterday..

Much easier to see, when one put this together. The focus, imo, should be the fuel contracts due in less than one year.....

The fuel contract due one year in Dec was about 9 million barrels.

Yesterday the contract due one year has shrunk to 3.1 million barrels.

So they settled and cut loss.... according to their report they loss 110 million.

Based on MARCH 31st fair market prices, these fuel contract due less than 1 year, was carrying a loss of 794.9 million.

Now this part does the reader no good. According to the notes, page 30, AirAsia said the following...

process of restructuring the remaining exposure.... lol ... process of cutting loss la....

Therefore, the max loss on fuel hedges on the next quarter should be less than 794.9 million....

We can guestimate a little on them Singapore jet fuel prices....

Recent article... https://www.flightglobal.com/airlines/jet-f.../138772.article

This one part...

Jet fuel has some what recovered a bit...

and then we know from articles like this earlier this year... https://www.theedgemarkets.com/article/aira...ing-fuel-prices

Therefor, the paper losses from these fuel hedges is gonna be big... but how much did they cut since March 31st? Well, I have a feeling it should not be more than 795 million...

..... my opinion remains... they are way too reckless on their hedging. In fact, in my opinion, they are gambling far too big with these hedges.

And worst still, AirAsia has a history of losing millions and millions with their hedges and they are still doing it.

Google AirAsia hedging losses and you can see article like this...

https://www.theedgemarkets.com/article/aira...all-fuel-hedges

Never learn from its mistakes, no?

In short, whoever holds AA shares until Q2 report comes out = needs their head checked?

This was yesterday..

Much easier to see, when one put this together. The focus, imo, should be the fuel contracts due in less than one year.....

The fuel contract due one year in Dec was about 9 million barrels.

Yesterday the contract due one year has shrunk to 3.1 million barrels.

So they settled and cut loss.... according to their report they loss 110 million.

Based on MARCH 31st fair market prices, these fuel contract due less than 1 year, was carrying a loss of 794.9 million.

Now this part does the reader no good. According to the notes, page 30, AirAsia said the following...

process of restructuring the remaining exposure.... lol ... process of cutting loss la....

Therefore, the max loss on fuel hedges on the next quarter should be less than 794.9 million....

We can guestimate a little on them Singapore jet fuel prices....

Recent article... https://www.flightglobal.com/airlines/jet-f.../138772.article

This one part...

Jet fuel has some what recovered a bit...

and then we know from articles like this earlier this year... https://www.theedgemarkets.com/article/aira...ing-fuel-prices

Therefor, the paper losses from these fuel hedges is gonna be big... but how much did they cut since March 31st? Well, I have a feeling it should not be more than 795 million...

..... my opinion remains... they are way too reckless on their hedging. In fact, in my opinion, they are gambling far too big with these hedges.

And worst still, AirAsia has a history of losing millions and millions with their hedges and they are still doing it.

Google AirAsia hedging losses and you can see article like this...

https://www.theedgemarkets.com/article/aira...all-fuel-hedges

Never learn from its mistakes, no?

Jul 7 2020, 03:21 PM

Jul 7 2020, 03:21 PM

Quote

Quote 0.0144sec

0.0144sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled