QUOTE(Boon3 @ Apr 3 2020, 08:33 AM)

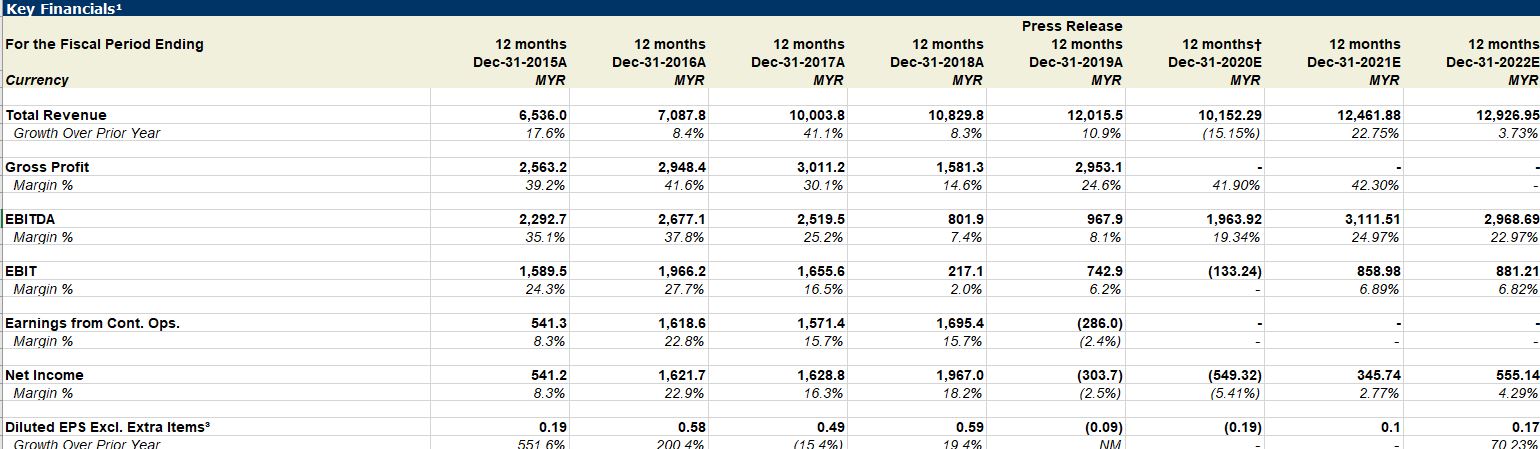

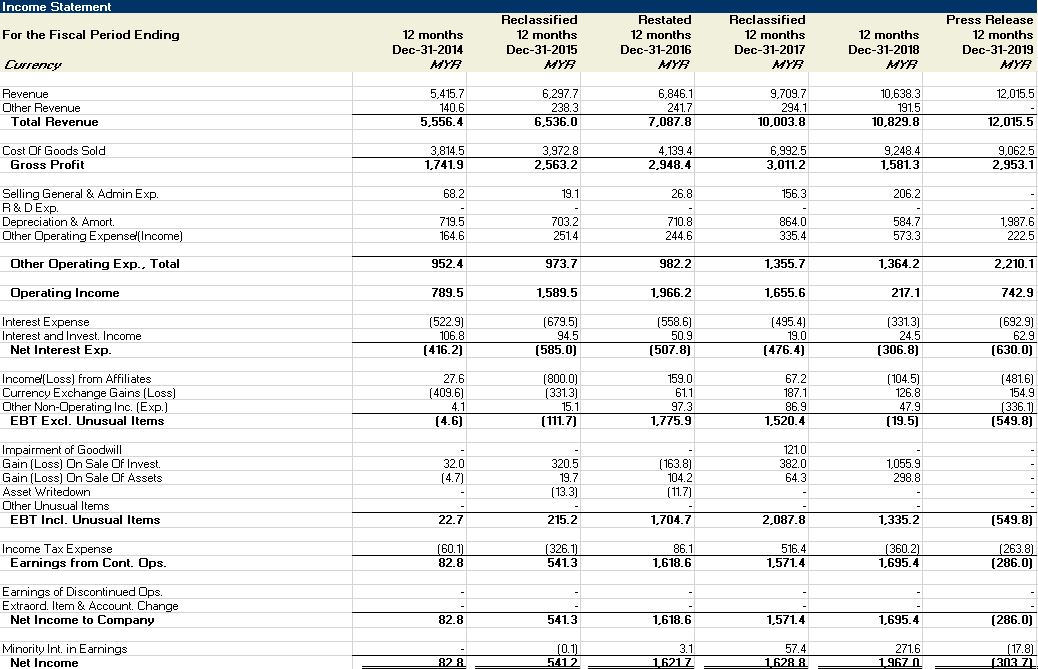

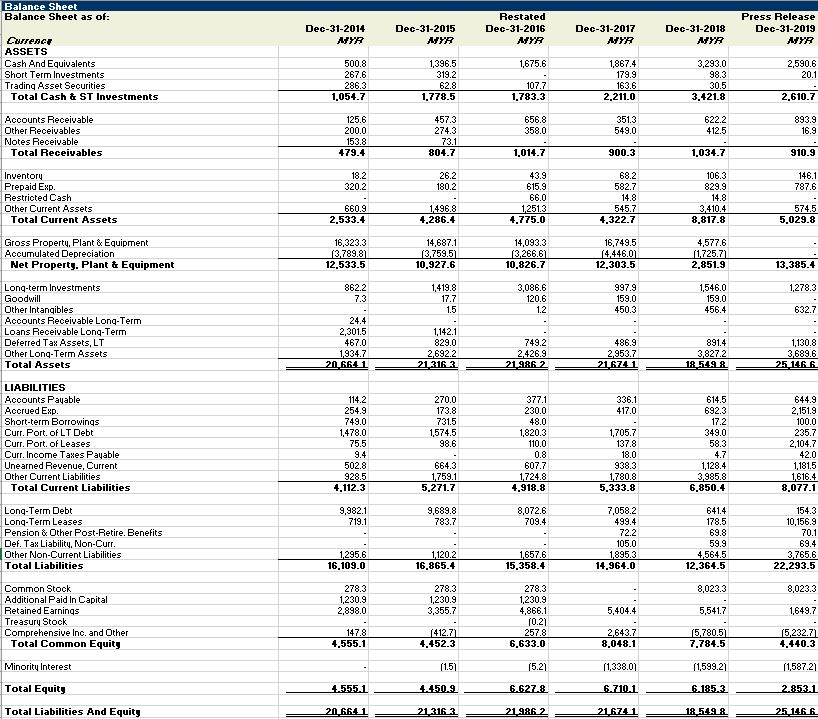

See, in that article, he openly said the company has more than 2 billion in cash (which is correct but his definition of net cash is utterly wrong as loans and leases needs to be paid) but slyly he admitted his company needs cash.

Why?

That is the more important question.

And imo, it lies again on the company hedging which runs into billions.

1.Fuel hedging. He's got that terribly wrong. 11 million barrel plus as per qr report. Some reports said they were hedged at over 60. Oil price now? How much losses? And with planes not flying, these oil hedges will be a terrible problem.

2. Interest rate contracts runs into the billions. Has he gotten that right?

3. Currency hedges. Ringgit at one point strengthened very strongly against the dollar since the last qr. Then it tanked big time. Two massive swings during the period. Did he gambled correctly.

4. Audit Audit Audit. So huge amounts gambled in its hedging. Even the auditor raised concern. Do refer annual rpt. Me? Too little info and I feel AA is gambling and not hedging. That's my opinion.

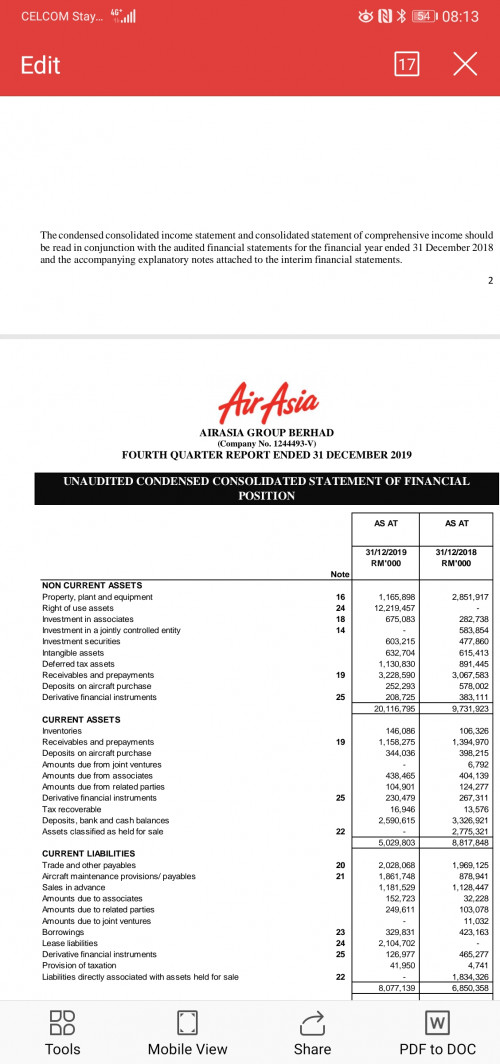

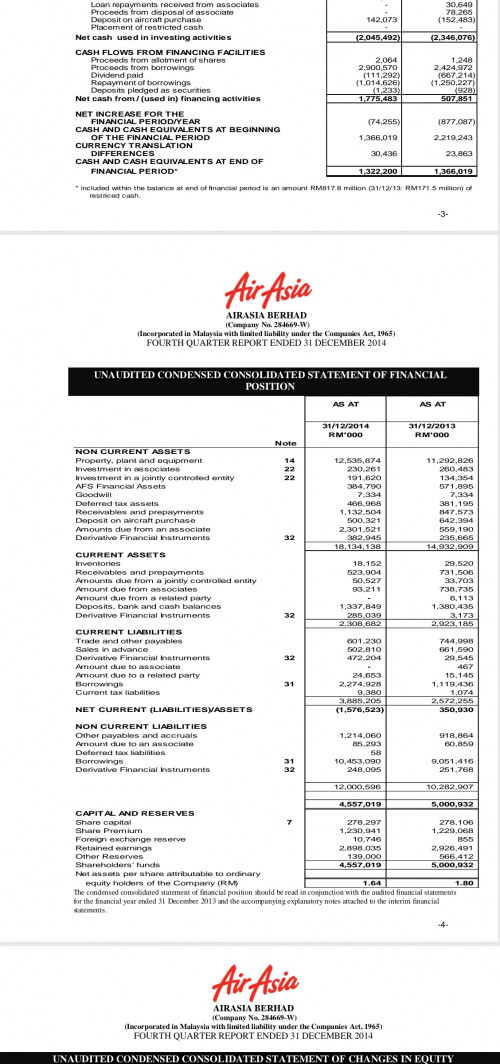

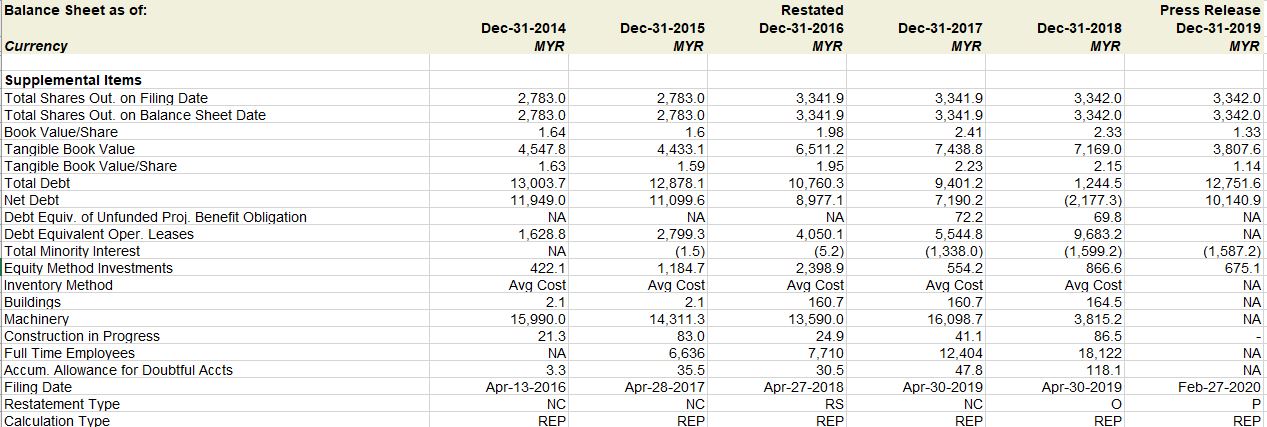

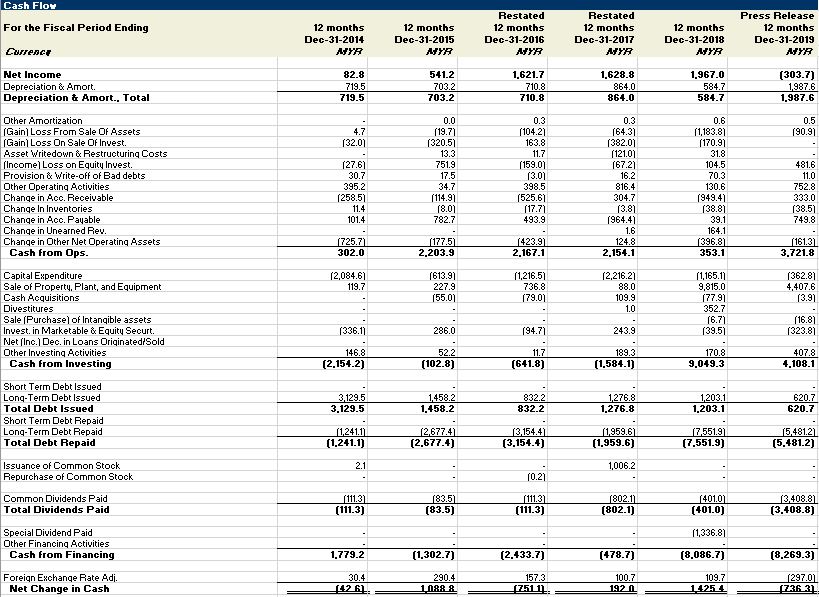

Besides the hedging, the sale and lease issue. We know that most of the current cash pile came NOT from its operation but its financing. The sale of the planes raised most of the current cash pile. It's lease liability is now over 12 billion. This is insane. Gila betul.

With planes not flying, a lot of money will be needed to pay leases on planes not flying. Fastest way to burn cash....

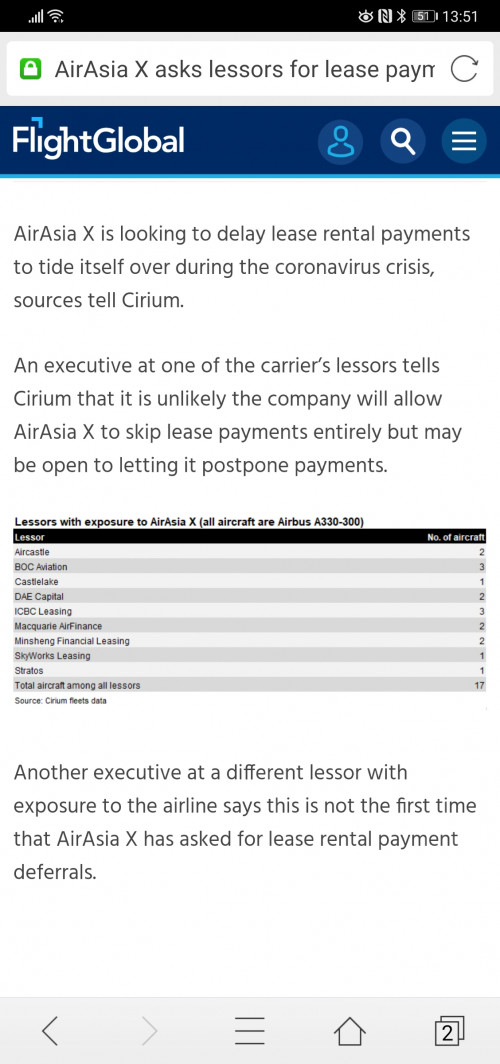

And again there isn't much info is there? At what prices are they selling these planes. What was their purchase price. What are the leasing terms? If there is a delay or no payment, will AA be forced to default on their planes? Reports that AAX wa seeking deferrals of payment in Feb 2020 and it was noted that not all lessor will agree.

And yeah, with most planes being sold, how can AirAsia get loan from bank? Not much asset left to pledge mah...

Which is why Tony openly pleads the govt to lend them money.

What a blardy joke. The govt is not a bank la

Anyway, should govt even lend money to a company whose planes are already sold.. income almost gone.... now if the virus situation persist a couple more months and mco persist...how will AirAsia get income? Even when the situation improve, how many will even dare to fly? Won't they be weary? If so even when AA flies again, won't ticket sales be down?

Hmmmmm..... Star biz talking about some of the issues raised here... Why?

That is the more important question.

And imo, it lies again on the company hedging which runs into billions.

1.Fuel hedging. He's got that terribly wrong. 11 million barrel plus as per qr report. Some reports said they were hedged at over 60. Oil price now? How much losses? And with planes not flying, these oil hedges will be a terrible problem.

2. Interest rate contracts runs into the billions. Has he gotten that right?

3. Currency hedges. Ringgit at one point strengthened very strongly against the dollar since the last qr. Then it tanked big time. Two massive swings during the period. Did he gambled correctly.

4. Audit Audit Audit. So huge amounts gambled in its hedging. Even the auditor raised concern. Do refer annual rpt. Me? Too little info and I feel AA is gambling and not hedging. That's my opinion.

Besides the hedging, the sale and lease issue. We know that most of the current cash pile came NOT from its operation but its financing. The sale of the planes raised most of the current cash pile. It's lease liability is now over 12 billion. This is insane. Gila betul.

With planes not flying, a lot of money will be needed to pay leases on planes not flying. Fastest way to burn cash....

And again there isn't much info is there? At what prices are they selling these planes. What was their purchase price. What are the leasing terms? If there is a delay or no payment, will AA be forced to default on their planes? Reports that AAX wa seeking deferrals of payment in Feb 2020 and it was noted that not all lessor will agree.

And yeah, with most planes being sold, how can AirAsia get loan from bank? Not much asset left to pledge mah...

Which is why Tony openly pleads the govt to lend them money.

What a blardy joke. The govt is not a bank la

Anyway, should govt even lend money to a company whose planes are already sold.. income almost gone.... now if the virus situation persist a couple more months and mco persist...how will AirAsia get income? Even when the situation improve, how many will even dare to fly? Won't they be weary? If so even when AA flies again, won't ticket sales be down?

https://www.thestar.com.my/business/busines...-light-strategy

The article mention lease charges about 500 million. The figures should be much more......

Apr 4 2020, 12:25 PM

Apr 4 2020, 12:25 PM

Quote

Quote

0.0351sec

0.0351sec

0.28

0.28

6 queries

6 queries

GZIP Disabled

GZIP Disabled