QUOTE(Nabuji @ Apr 30 2020, 05:43 AM)

Y not if u buy and sleep and wake up after 5 year

Reasonable thinking. I mean there's some logic behind the thinking. Given time, surely AA would recover, right? I mean give it long enough time, there's a good chance that AirAsia will be back flying every where....

There's a saying... time is a friend of a good business.... cos good business grows over time. However this theory doesn't hold for the weaker business. Air travel has gone much, much cheaper in time but there's more competition, more airlines adopting the same strategy and extremely competitive in pricing and costs aren't getting cheaper. So in a sense, this is a damn lousy business to be in. You gotta be damn good to survive.

Anyway, let divert and show you a chart. Well, the thinking is about the same. You wanna bet on a 5 year time frame. But before you do that, wouldn't you want to know how AirAsia did exactly 5 years ago?

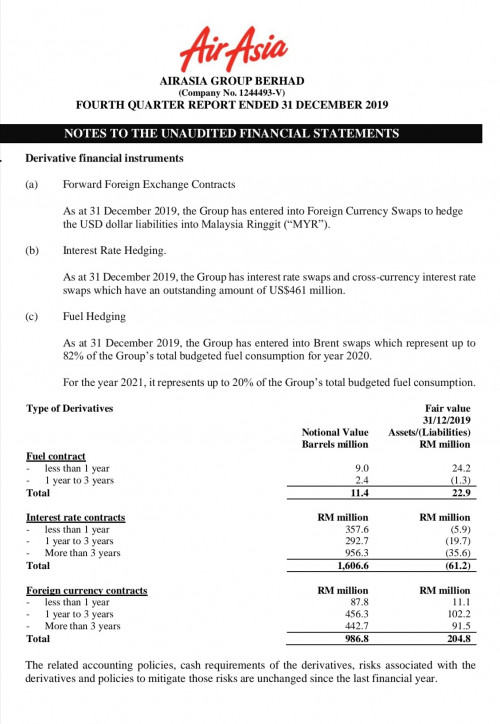

Chart 1... this is chart shows it as it is.... ie the exact traded stock prices before and after the special dividends which AirAsia paid out...

AA stock performance since 2015. (5 years ago - give and take la)

Chart 2 ... this chart shows after the prices are adjusted after the dividends are paid out....

Now many use charts to predict. Me? I try to understand what the market tells me about the stiock.

ok. First 1 will IGNORE the after Jan 2020 period. Now the chart tells me clearly the good times is over. The stock peaked in early 2018. What are the significant events that lead the stock to fall?

before 2018, You have the hefty special privilege placement of shares to Tony and side kick. Then we have sales of AA own leasing arm. Billion dollar sale. And AirAsia had already embarked on their sale and leaseback of airplanes. Loads of money will be flowing into AirAsia (how convenient the share placement to Tony). Speculation was so panas that AA was giving away 'free money' back to shareholders. Of course, the greed of money drove the stock higher....

the stock then started paying the special dividend of 40 sen on Dec 2018 and another 90 sen on Jul 2019.

so despite all the market feel good news, the stock had been declining.

So base on this 5 year time frame, this signals to me is that AA had already 'peaked' since early 2018. And this was before the C19 became full blown....... so would i bet that the next 5 year time frame, the stock would recover and fly higher?

That's my opinion... 3 sen nia ...... what's yours?

Yea, base on this, would you dare bet on a horse that is already weak since 2018?

No other stock to bet on?

Anyway, as it is, with no 100% vaccine, no one will be gung ho on air travel. Every country will have their own way on dealing with the virus. Some will impose quarantines on visitors from overseas. If there's a 2 week quarantine on arrivals, how many air travelers would want to fly to that country? What if some country impose a no fly zone? And surely, once air travel continues, airlines will resume their price wars to seduce air travel. What about social distancing on flights? If there is, there will be plenty of empty seats per flight. When do you expect normal air travel to continue?

So many questions/doubts yes?

Now back to AirAsia. The next QR wont be that bad, since we will still see some revenue, since the QR is for Dec 2019 to Feb 2020 period. The bad and worrying one is for the current months, when AA is practically not flying. That report only comes in Aug 2020.

So if you wanna bet, don't you think it's a safer bet to bet after Aug 2020 qr report? Betting now, the risk are aplenty. So much worry. Can AA survive? If not, how bad a bailout is required? etc etc etc .....

Anyway, sorry for long post.

GL

Apr 28 2020, 04:32 PM

Apr 28 2020, 04:32 PM

Quote

Quote

0.0503sec

0.0503sec

0.25

0.25

7 queries

7 queries

GZIP Disabled

GZIP Disabled