QUOTE(idyllrain @ Oct 31 2015, 02:38 PM)

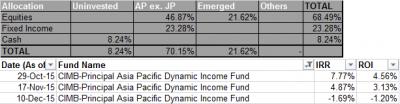

Since putting in the functionality to grab fund prices from FSM, I've been devising a way to track the value of my portfolio. This is what I've come up with:

What it does is that every time I update my fund prices, it will snapshot the current investment per fund, current value of your investment per fund, and the NAV price for that day. This daily information is then used to construct this chart. The chart itself is dynamic and you will not have to add in more graphs when you add in new funds in the future.

There is no requirement to update every day (it will only be more accurate) and some days the historical data may be inaccurate as FSM can be slow with their Fund Price updates (you can go in and fix this manually if you wish but in the long run it should be insignificant).

Is this something you guys will be interested in?

p/s: Yellow line represents absolute profit/loss

Do you mind sharing your excel with this chart? You can mask the data / put dummy values to protect the privacy of the investments.

What it does is that every time I update my fund prices, it will snapshot the current investment per fund, current value of your investment per fund, and the NAV price for that day. This daily information is then used to construct this chart. The chart itself is dynamic and you will not have to add in more graphs when you add in new funds in the future.

There is no requirement to update every day (it will only be more accurate) and some days the historical data may be inaccurate as FSM can be slow with their Fund Price updates (you can go in and fix this manually if you wish but in the long run it should be insignificant).

Is this something you guys will be interested in?

p/s: Yellow line represents absolute profit/loss

QUOTE(yklooi @ Oct 31 2015, 05:45 PM)

polarzbearz...pls have a look...and add in if ok?....

Nov 1 2015, 01:56 PM

Nov 1 2015, 01:56 PM

Quote

Quote

0.0195sec

0.0195sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled