QUOTE(yuatyi @ Oct 28 2015, 05:20 PM)

May I ask all FSM sifu here. Which PRS I should go for? I am eyeing those PRS Growth Fund (meaning with aggressive allocation).

I have heard about AffinHwang PRS Growth Fund and also Kenanga OnePRS Growth Fund.

What's your opinion? I am thinking of getting PRS for income tax purpose.

TQ

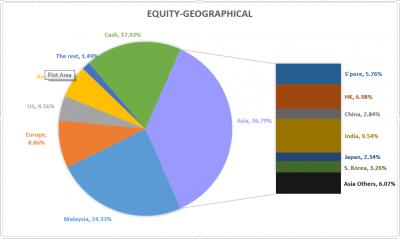

I myself invest in CIMB Asia ex-Japan PRS (forgot full name). Reason being I wanted to invest in non-malaysian fund. So, not much choice if you are looking for investment outside Malaysia (based on latest fund fact sheet I believe it is 0% exposure to Malaysia).

There’s also affin hwang growth, whereby they do have some exposure to asia ex-japan… 20% - 30% and the rest Malaysia (not sure you need to research on that). But if you think now ain’t the time to go in overseas market, stick to fully Malaysia funds like Kenanga and the rest.

also while CIMB Asia-ex Japan PRS track record looks really amazing, keep in mind, the gains are also due to weakening MYR and not purely just the fund's returns.

Oct 2 2015, 10:51 AM

Oct 2 2015, 10:51 AM

Quote

Quote

0.0251sec

0.0251sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled