Fundsupermart.com (FSM) Malaysia is the online unit trust distribution arm of iFAST Capital Sdn. Bhd. ("iFAST Capital").

Fundsupermart.com (FSM) Malaysia is the online unit trust distribution arm of iFAST Capital Sdn. Bhd. ("iFAST Capital").

iFAST Capital is a holder of a Capital Markets Services Licence (CMSL) and is licensed by the Securities Commission to conduct the following regulated activities:

- To deal in unit trusts

- To offer investment advisory services

- To deal in Private Retirement Scheme

iFAST Capital is also registered with the Federation of Investment Managers Malaysia (FiMM) as an Institutional Unit Trust Adviser (IUTA).

iFAST Capital is a subsidiary of iFAST Malaysia Sdn. Bhd., which is wholly owned by iFAST Corporation Ltd. ("iFAST Corporation"). iFAST Corporation is headquartered in Singapore and the iFAST group of companies are also present in Hong Kong, Malaysia and China. The company was incorporated in Singapore on 10 January 2000.

iFAST Corporation was listed on the Singapore Exchange Mainboard in December 2014.

iFAST Corporation, via its wholly owned subsidiary iFAST Financial Pte. Ltd., is Singapore's leading online distributor of unit trusts as well as the leading operator of an investment platform for financial advisers and financial institutions. It carries the Capital Markets Services (CMS) and Financial Adviser (FA) licences issued by the Monetary Authority of Singapore (MAS), and is also one of three appointed Central Provident Board (CPF) Investment Administrators.

One of iFAST Corporation's shareholders is SPH AsiaOne Ltd, the Internet arm of Singapore Press Holdings, which is Singapore's largest media group. In recent years, iFAST Corporation has been expanding beyond local shores. In 2007, iFAST Corporation launched its first overseas business, Fundsupermart in Hong Kong and in 2008, it launched Fundsupermart in Malaysia. iFAST Corporation launched its office in China in 2014.  1. Wide range of information2. Extensive product range and value-added services3. One of the cheapest Sales Charges in town!

1. Wide range of information2. Extensive product range and value-added services3. One of the cheapest Sales Charges in town!

To keep discussions at this thread fruitful and constructive, it would be greatly appreciated that fellow investors try to look for answer to their queries at

Frequently Asked Questions before posting here.

And FSM has a very helpful LIVE Customer Service,

MAKE FULL USE OF THEM. Look for this at FSM home page:

What is unit trust?Federation of Investment Managers Malaysia - ABC of Unit TrustsOther FAQs on Fundsupermart.com and unit trust investing in general1. NAV pricing and processing time

What is unit trust?Federation of Investment Managers Malaysia - ABC of Unit TrustsOther FAQs on Fundsupermart.com and unit trust investing in general1. NAV pricing and processing time» Click to show Spoiler - click again to hide... «

Except for OSK-UOB Cash Management Fund, purchases for which payment is received by FSM before 3PM on a working day is transacted on the same day, i.e. you will purchase units based on NAV pricing of that day. However, NAV pricing for most funds will only be published by the Fund House after 5PM on the next working day (T+1).

Purchases of funds at FSM will be fully processed at T+4, "T" being Transaction Date.

On T and T+1, your order will be under processing.

On T+2, FSM will price your order, your price transacted and no. of units purchased will be known.

On T+3, your priced order would be still "floating".

On T+4, your order will be incorporated into your holdings summary, purchase order is therefore fully completed.

2. The NAV price of the fund that I'm interested in is quite high now, should I stay away? Investment gurus always say "buy low, sell high"...» Click to show Spoiler - click again to hide... «

First of all, understand what is NAV price. I always like to explain things by using simple examples. Here goes...

- Fund ABC issues 1 million units at Initial Offer Price of RM1.00 per unit.

- As such, at Day 1, NAV of ABC is 1 million units x RM1.00 = RM1 million. NAV price is RM1.00.

- After the end of the Initial Offer Period, ABC starts to operate, it starts to invest.

- Let's say ABC bought RM200,000 worth of Maybank shares, RM300,000 of Dutch Lady shares and RM500,000 of BAT shares.

- Let's say after 1 month,

Market value of holdingsMaybank RM180,000

Dutch Lady RM360,000

Guinness Anchor RM400,000

BAT shares were sold off during the monthTotal value of equities held: RM940,000

Cash: RM50,000 (dividends received from BAT)

Total value of net assets i.e. NAV: RM990,000

NAV price per unit: RM990,000 / 1 million units = RM0.9900

Ah Beng says: "

ABC is now cheaper, can buy!"

Answer:

NO! You cannot determine the "cheapness" of a fund by looking at its NAV price alone. We can only deduce that the ABC had made an NAV loss of 1% during the 1-month period, but you cannot say that it is "cheap".

The fund could have bought Maybank when it was overpriced, and now its holdings of Maybank had gone down 10%. Maybank is now cheap!

Guinness Anchor could be oversold, thus ABC sold its holdings of BAT and bought into Guinness Anchor. Another undervalued stock in ABC's holding!

However, Dutch Lady have rallied 20% in the past 1 month, it could be overbought i.e. expensively valued now.

Simply said, you determine the "cheapness" of a fund by reference to its underlying holdings. The NAV price

CANNOT give you a single clue as to whether it is an opportune time to buy into a fund.

Let's say u are looking at a fund which focuses on plantation stocks. Plantation stocks on the KLCI could be oversold, went down 20% in the past 1 month yet the fund only recorded an NAV loss of 5% in the same period. You might think, "aiya, only -5%, the fund is still expensive, don't want buy in now lah". But you could be terribly wrong; it could be that the fund was sitting on a heavy cashpile during the past 1 month, hence it did not lose much. But plantation stocks are now trading at a discount, it is an opportune time for the fund to buy!

Of course, all this is based on the assumption that the fund manager is not stupid.

If the fund manager still sits on its huge cashpile and refuses to enter the market, then later when plantation stocks rally up 30% the fund could still be sitting there with -5%/+5%.

QUOTE

Investors should not judge if a unit trust is cheap or expensive based on its unit trust price or NAV. Instead, they should focus on the valuations (PE ratios) of the underlying equity markets that the unit trust invests in.

3. Common misconceptions about unit trust dividends/distributions:

(i) After dividend distribution, NAV price will go down, the fund will become cheaper.

(ii) A fund that declares dividends is better than a fund that does not, dividends are my profit, they make me richer.» Click to show Spoiler - click again to hide... «

Put it simply, dividend is just "left hand go right hand"; there is ZERO IMPACT to the investor's value of holdings.

- Fund XYZ has 100,000 units issued, initially issued at RM1.00

- Current NAV price is RM1.02

- XYZ declares a "10% dividend" of 10 sen a unit

- After the dividend, the NAV will go down to RM0.92

For sake of illustration, we assume that dividends are paid out in cash (not reinvested), and no tax on the distribution.

Ali says: "

Eh XYZ very good, gave me 10% returns..."

Answer:

WRONG! The 10% is expressed by reference to the Initial Offer Price of RM1.00 (RM1.00 x 10% = 10 sen). It does not mean that the fund made a profit of 10% for investors. In this scenario, the fund actually only made a return of 2% (RM1.00 + 2% = RM1.02) during the period.

Simply said, just imagine you pass me RM100 to invest in a trolley cart. 1 year later the trolley cart become worth RM92, and I collected rental income of RM10 on your behalf. The value of your investment is now RM102. I then decide to return 10% i.e. RM10 to you. So now u have a RM92 trolley cart and RM10 in cash on hand. The "dividend" that I decided to give you has

ZERO IMPACT on the net worth of your investment, which remain at RM102.

Here's another variation to the scenario above; your RM100 investment could actually have incurred a loss, and I

could still decide to "reward" you with a 10% "dividend". Let's say a wheel on your trolley was damaged, now your trolley is only worth RM60. The value of your investment is now RM60 + RM10 (rental income received in cash) = RM70. But I could still proudly say that I'm declaring a 10% "dividend" to reward you

Key Lesson Point

Key Lesson PointA unit trust fund

can declare dividend even when it has actually made its investors@unitholders poorer. By regulation, a unti trust fund can only declare dividend out of its

REALISED INCOMES (interest income, dividend income, net proceed from sale of investments, rental income etc). Gains from market price fluctuations are not realised, i.e. they're "paper gain/(loss)". So, you could be having

(a) Fund A got realised incomes from which to declare dividends, even though during the same period it has huge paper losses.

(b) Fund B made lots of paper gains from market price movements, but it cannot/decided not to declare dividend to unitholders because of insufficient realised incomes. Bear in mind, some funds actually have a "no dividend" policy, and they are great performers.

» Click to show Spoiler - click again to hide... «

Just a simple example to illustrate, but that's essentially how it works...

You hold 100 units at RM1.00 each. RM1.00 x 100 = RM100

Let's say you get 10 units extra from distribution. After distribution you hold 110 units at RM0.9091 each. RM0.9091 x 110 = RM100

Now, let's assume you top up RM10 after ex-date,

RM10 / RM0.9091 = 11 units bought

Value of your holdings now:

(110 + 11) x RM0.9091 = RM110

Initial value: RM100

Top up: RM10

Total: RM110

Yes, topping up after distribution ex-date brings your unit cost down. BUT AT THE SAME TIME the value per unit i.e. NAV price also comes down - IT MAKES NO DIFFERENCE whether you top up before or after ex-date. Cost per unit in UT means little in isolation, the difference between cost per unit and NAV price multiplied by your units held is what matters.

(iv) Distribution = IncomeQUOTE(jerrymax @ Mar 25 2013, 10:51 PM)

Ok so after dividend distribution, you get some additional units and NAV drops.

Then after few weeks if fund perform well then NAV increases to the point where it is back to the NAV before distribution. Doesnt it mean you gain some income from distribution?

» Click to show Spoiler - click again to hide... «

In such scenario, whether the fund makes distribution or not also you will gain!

To avoid confusion, DON'T THINK ABOUT NAV PRICE, think VALUE (no. of units held x NAV price).

E.g.

Got distribution

One day before ex-date you hold RM1,000 (RM1.0000 x 1,000 units)

The next day its ex-date AND (assuming) distribution is also credited on the same day, you also hold RM1,000 (RM0.9091 x 1,100 units), let's assume that you got 100 units from the distribution.

The fund's underlying investments gained 8% in the next 3 months

Your holdings: (RM0.9091 + 8%) x 1,100 units = RM0.9818 x 1,100 units = RM1,080

No distribution

Your holdings value: RM1,000 (RM1.0000 x 1,000 units)

The fund's underlying investments gained 8% in the next 3 months

Your holdings: (RM1.0000 + 8%) x 1,000 units = RM1.0800 x 1,000 units = RM1,080

QUOTE(jerrymax @ Mar 25 2013, 11:19 PM)

Then what's the point of dividend distribution since units and NAV price has negative correlation?

» Click to show Spoiler - click again to hide... «

Distribution is very relevant especially to retiree investors who want a source of income. For this type of investors, basically what they can do is to invest in a fund that has a distribution policy, and elect to receive distributions in the form of CASH. To an investor who elect to receive distributions in cash, distributions are a form of income, a cash inflow; gains in NAV price are capital growth.

E.g. upon retirement you have RM1mil which you invest in a fund. The fund that you invested in made a return of 10% and declares 8% as dividend for the financial year, that's RM80,000 of cash inflow for you! Of course, when a distribution is declared and paid, the NAV price will drop proportionately. The balance of 2% that are not declared as distribution will be reinvested for future growth.

4. Annual Management Charge, Trustee Fee and NAV pricing» Click to show Spoiler - click again to hide... «

NAV stands for "Net Asset Value", an accounting term which simply means the value of TOTAL ASSETS less TOTAL LIABILITIES.

In unit trust accounting, Annual Management Charge and Trustee Fee are accrued daily and reflected in the NAV pricing. Now let me explain by using a simple example...

- The annual salary for the Fund Manager of Huat Huat Equity Fund is fixed at 1% of the Asset Under Management (AUM)

- As at today, value of AUM for Huat Huat is RM100M

- Fund size of Huat Huat is 100M units

Just like most of us, the FM's salary is paid monthly in arrears. But for the purpose of accounting, it has to be accrued daily. Thus, as at end of today, Huat Huat would have total assets of RM100M and a LIABILITY in the form of the FM's 1-day unpaid salary.

NAV for Huat Huat today is:

RM100M - (RM100M x 1% x 1/365)

= RM100M - RM2,739.73

= RM99,997,260

NAV price today:

RM99,997,260 / 100M units

= RM0.9999

Investors do not need to separately pay for the Management Fee and Trustee Fee, these charges are already deducted from the value of our holdings.

5. Return On Investment (ROI) vs Annualised Return, similar to Internal Rate of Return (IRR)» Click to show Spoiler - click again to hide... «

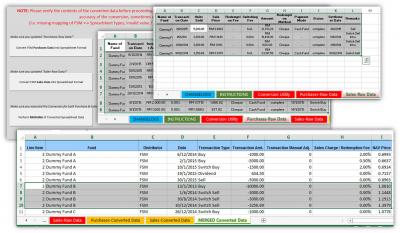

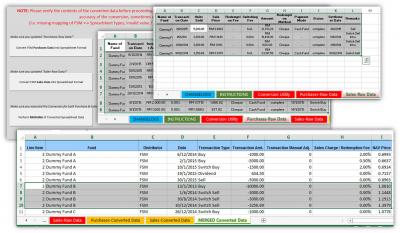

Important link to v8 - The MS Excel Masterclass version!Download here >>>

Pinky's Portfolio Worksheet with IRR CalculationDownload here >>>

polarzbearz's Portfolio Summary with Pinky's IRR Calculation (and here for Polarzbearz's FSM-to-Spreadsheet Conversion Tool)

Make sure you read the instructions as many of the cells have formula in it. You can freely modify, update, or change it to suit your needs (and even share with others if you don't mind

Make sure you read the instructions as many of the cells have formula in it. You can freely modify, update, or change it to suit your needs (and even share with others if you don't mind  )Golden Quote

)Golden QuoteQUOTE(Vanguard 2015 @ Jul 9 2015, 10:10 AM)

My personal experience in investing in unit trusts:-

1. We invest in unit trusts using spare cash. We have back up emergency funds of at least 3-6 months. No bad debts e.g. credit card debts.

2. Long term investment horizon of at least 2-3 years. This will even out the market fluctuation.

3. We cannot time the market. Therefore we have to do DCA or VCA and do portfolio rebalancing from time to time.

If we cannot satisfy the above requirements, it is best to stay away from unit trust investments or any other investments for that matter.

Unit trust investments is not a capital guaranteed get rich quick scheme. There are risks involved.Happy investing!

Disclaimer -

Disclaimer -

I am not a UT agent, nor am I employed by FSM. All my comments here are posted in good faith and with the intention to share knowledge. I am not to be held liable for any losses that may be incurred as a result of following any advice/opinion shared here. I believe the same should be applicable for any other LYN members posting here.

Oct 2 2015, 10:29 AM, updated 10y ago

Oct 2 2015, 10:29 AM, updated 10y ago

Quote

Quote 0.0432sec

0.0432sec

1.01

1.01

7 queries

7 queries

GZIP Disabled

GZIP Disabled