Outline ·

[ Standard ] ·

Linear+

Fundsupermart.com v12, Najibnomics to lift KLCI?

|

SUSyklooi

|

Oct 22 2015, 04:38 PM Oct 22 2015, 04:38 PM

|

|

QUOTE(river.sand @ Oct 22 2015, 04:03 PM) My thoughts... Let's say you plan to pump in additional 100k every year. (You are such a rich guy  ) You invest in areas/segments which you think are under-represented in the portfolio. It may not be necessary to switch. Further, let's say 5 years ago China represented 20% of your portfolio, and India 5%. Now that China has slowed, you may want to change the allocation to 15% China and 10% India. It is not necessary to have a fixed allocation ratio for 10 years or more.  yes,... there are other factors too..... the needs of one in relation to financial needs, investment objectives, lifestyles, age, income, aspirations, emotion, geopolitical influences, (the stars rating in FSM changes), etc... |

|

|

|

|

|

SUSyklooi

|

Oct 22 2015, 09:57 PM Oct 22 2015, 09:57 PM

|

|

nothing fancy,....just increase HJpn from 3.5% to 8.5% and reduced HSO.

|

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 07:22 AM Oct 23 2015, 07:22 AM

|

|

QUOTE(guy3288 @ Oct 22 2015, 09:20 AM) ....... PS: Wanna ask yklooi and other sifus, wonder if my earlier mentioned of Summary IRR 10% was falsely elevated due to this new purchase Global Titans?? That would be bad as it does not reflect true returns. to be frank, VERY frank...I know nuts about the inside working of IRR/XIRR  I just used the ready made formula available. I think there is effects if the sum topped up is substantial and the ROI from that top up is also substantial in short period of time....I don't have exact maths but "feelings" from what had been known that IRR readings can "create" extremely good numbers if the used to calculate (extrapolate?) in short period of time and as from what had been experienced by forumer @kimyee73 I recalled reading this very illustrative comparison posting by forumer @idyllrain about ROI, CAGR, and IRR are all general metrics that tell you the return of your investment in different ways.very interesting.... and for those that really wanted to know about the "inside the maths" working of IRR...there is a good write up by forumer @j.passing.by in post# 1148, page# 58 https://forum.lowyat.net/topic/3633445/+1140This post has been edited by yklooi: Oct 23 2015, 07:57 AM |

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 07:36 AM Oct 23 2015, 07:36 AM

|

|

QUOTE(river.sand @ Oct 23 2015, 07:21 AM) I am considering to add RHB ATR Fund, but am concerned with China's bond risk. What do you think?  I think same for any funds...there are always concerns of the stocks/bonds to buy...but I think I will leave that concerns to the FM to worry about...furthermore, if the FM thinks that there is no more good things to buy, the ATR has a wider mandate...the FM can buy from somewhere else... yesterday's morning 23050 now 35450 views....wow > 2k views per dayThis post has been edited by yklooi: Oct 23 2015, 07:46 AM |

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 09:57 AM Oct 23 2015, 09:57 AM

|

|

QUOTE(wil-i-am @ Oct 23 2015, 09:50 AM) AmBank offer 24 mths FD @ 4.60% is that over the counter promo?  my IRR just managed to Break the 4.2% target....now 4.6%   have to readjust portfolio.....  to make it work harder.....   with 4.6% as risk free rate....what rate would justify my UTs portfolio IRR....  |

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 10:03 AM Oct 23 2015, 10:03 AM

|

|

QUOTE(Vanguard 2015 @ Oct 23 2015, 09:58 AM) Thanks bro. But 24 months lock in period. Walao eh.  But, but still better return from some of the bond funds in FSM? few years ago, i managed to have 5%pa from HLB...lockin period 5 yrs  looking back and "comparing" my current IRR...at times i think that lockin of 5 yrs of 5%pa is not too bad...for some people This post has been edited by yklooi: Oct 23 2015, 10:04 AM |

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 10:12 AM Oct 23 2015, 10:12 AM

|

|

QUOTE(wil-i-am @ Oct 23 2015, 10:05 AM) Yes I wud reckon at least 2% above risk free rate  that would make it about 6.6%pa my current ROI is abt 10.x% IRR is about 4.3% needed to get another 7% ROI in the next 6 mths (3rd anniversary) and maintain 6.6%ROI pa after that......     clock is "ticking" for every month not getting 0.6% ROI, the portfolio would have to work harder the next month. This post has been edited by yklooi: Oct 23 2015, 10:15 AM |

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 10:17 AM Oct 23 2015, 10:17 AM

|

|

QUOTE(Vanguard 2015 @ Oct 23 2015, 10:14 AM) I agree. I have both these RHB Funds. It can be volatile at times. I am planning to get out from the RHB EMBF soon. why?...just last nite, i was thinking of moving in from RHB EMopp. |

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 10:32 AM Oct 23 2015, 10:32 AM

|

|

QUOTE(alex_cyw1985 @ Oct 23 2015, 10:24 AM) Hi all sifu, I have below funds in my portfolio, any geographical region that I have missed out? Aberdeen Islamic World Equity Fund - Class A Affin Hwang PRS Moderate Fund CIMB-Principal Asia Pacific Dynamic Income Fund CIMB-Principal Global Titans Fund Kenanga Growth Fund RHB Asian Total Return Fund RHB Big Cap China Enterprise Fund sorry.... may i know what is the breakdown % of each fund in relation to your portfolio? BRIC not there  This post has been edited by yklooi: Oct 23 2015, 10:39 AM This post has been edited by yklooi: Oct 23 2015, 10:39 AM |

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 10:53 AM Oct 23 2015, 10:53 AM

|

|

QUOTE(Vanguard 2015 @ Oct 23 2015, 10:45 AM) I have both funds now. RHB ATR and RHB EMBF seems to have very close correlation although they are meant for different markets. When one fund goes up and down, the other fund is like a mirror image and follow suit. .... thanks for the highlights....just browsed the chart center... seems like mirror..like what you mentioned.... with ATR having risk rating of 4 against 5 of EMB maybe i should consider ATR over EMB |

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 04:12 PM Oct 23 2015, 04:12 PM

|

|

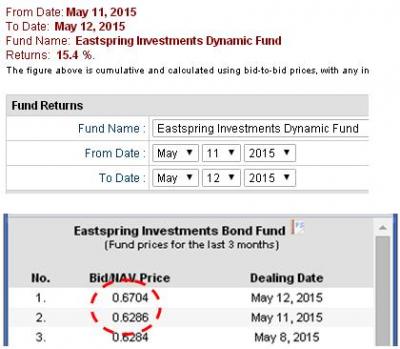

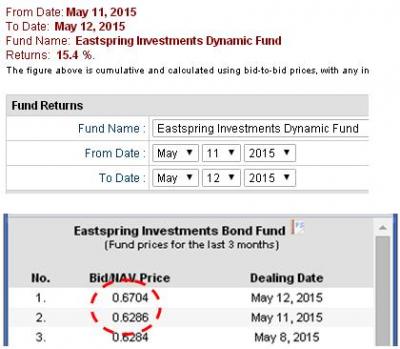

QUOTE(wongmunkeong @ Oct 23 2015, 03:37 PM) er.. bro, 15% increase in NAV overNIGHT... that's a statistically VERY IMPROBABLY HIGH movement, thus, yes please sell & lock in profits. However, realistically have U ever seen such in a UT or Mutual Fund's NAV, overnight or even 2 nights? Maybe during the ASEAN currency crisis after 2008's lowest plunge, then next day bleep up i believe. Just curious whether U've noticed it happening in reality or just a % to discuss when to divest.   > 15% overnight.....i remembered this one...i wrote to query and they replied "funds' NAV increase substantially due to recovery from previous defaulted bond paper". This post has been edited by yklooi: Oct 23 2015, 04:14 PM Attached thumbnail(s)

|

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 04:33 PM Oct 23 2015, 04:33 PM

|

|

QUOTE(dirtinacan @ Oct 23 2015, 04:00 PM) ya, i oso cannot believe when it happened to me  EASTSPRING INVESTMENTS ASIA PACIFIC SHARIAH EQUITY FUND 0.3277 in 16/4 - buy date 0.3708 in 18/6 - sell date but if held it until now, it is more untung-lah. haha  guess, we just don't know how it will goes.... just imagine this guy who took profit at 15% and the fund continue to.....for the whole year... it can be the other way too.... just do what pleased us most at that moment in time will do...  Attached image(s) Attached image(s) |

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 04:34 PM Oct 23 2015, 04:34 PM

|

|

QUOTE(alex_cyw1985 @ Oct 23 2015, 04:32 PM) Aberdeen Islamic World Equity Fund - Class A - 4.49% Affin Hwang PRS Moderate Fund - 100% CIMB-Principal Asia Pacific Dynamic Income Fund - 23.16% CIMB-Principal Global Titans Fund 2 - 13.03% Kenanga Growth Fund - 24.84% RHB Asian Total Return Fund - 16.05% RHB Big Cap China Enterprise Fund - 18.43 BRIC is?  thanks. total % of allocation added up is 200%? BRIC is Brazil Russia India China go to seek each individual fund factsheet...compile the % invested in each country and add them up......are you comfortable with the total allocation in that country...example...i think your China is very heavy.....if you are happy...then be it..it is just chicken me. This post has been edited by yklooi: Oct 23 2015, 04:42 PM |

|

|

|

|

|

SUSyklooi

|

Oct 23 2015, 04:55 PM Oct 23 2015, 04:55 PM

|

|

QUOTE(sunakujiro^^ @ Oct 23 2015, 04:46 PM) If I go through agent to do UT or banks, dump my money, and expecting profit in few years, and Fund Manager screw up, what would happen to me? Can I held them responsible for the loss? How would I know if i can trust them and if they're capable to generate profit? generating profits for themselves YES....but for you...i am not sure  What can cause you to lose money or reduce the returns on your investments? http://www.moneysense.gov.sg/Understanding...rusts.aspx#What can cause you to lose money or reduce the returns on your investments? General Risks of Investing in Unit Trust Funds Any investment carries with it an element of risk. Therefore, prior to making an investment, prospective investors should consider the following risk factors...... https://www.cimb-principal.com.my/Investor_...rust_Funds.aspxtherefore no you cannot held them responsible...unless, they gives you a black and white which state capital and returns guarantee payable within a certain time frame too.....  try AMBANK FD promo at 4.6%.....PIDM protected too...else do self EPF contribution at abt 6% This post has been edited by yklooi: Oct 23 2015, 04:57 PM |

|

|

|

|

|

SUSyklooi

|

Oct 24 2015, 12:57 PM Oct 24 2015, 12:57 PM

|

|

QUOTE(Kaka23 @ Oct 24 2015, 11:58 AM) FSM recommends Greater China more than 2 years already...   with an average of about > 20% pa ROI in these 3 funds in the last 3 years....  Attached thumbnail(s) Attached thumbnail(s)

|

|

|

|

|

|

SUSyklooi

|

Oct 24 2015, 08:16 PM Oct 24 2015, 08:16 PM

|

|

QUOTE(dummies @ Oct 24 2015, 01:47 PM) anyone heard and invested in the RHB-OSK Pre-IPO Fund 3 which is a close ended fund with 5 years locked down period (no redemption within 5 years) ? minimum investment = Rm 100K  QUOTE(dummies @ Oct 24 2015, 05:10 PM) it is worth to invest since the response is good here ? from an article for RHB-OSK Pre-IPO & Special Situation Fund 2 from FSM......I think it should be similar..... Conclusion In short, private equity investments could enhance the returns of investors’ portfolios and diversify overall portfolio risk with its unique approach of investing in unlisted assets. Investors should take note that the RHB-OSK Pre-IPO & Special Situation Fund 2 is illiquid in nature with its investments in off-market securities and its lock in period of 5 years, indicating that investors will need to stay invested throughout the period and are not being able to liquidate their investments during the lifespan of the fund. Nevertheless, the fund intends to distribute income received or realized profits (on a quarterly basis) during the investment period and distribute both the profit and principal of exited investments over the subsequent two years, which could be a mitigating factor for the illiquidity that investors faced. Thus, the key deciding factor here will be illiquidity and we strongly suggest investors who are interested in this fund to take this factor into serious consideration before making the decision of investing in this fund. . http://www.fundsupermart.com.my/main/resea...?articleNo=4845 |

|

|

|

|

|

SUSyklooi

|

Oct 24 2015, 08:20 PM Oct 24 2015, 08:20 PM

|

|

|

|

|

|

|

|

SUSyklooi

|

Oct 24 2015, 08:27 PM Oct 24 2015, 08:27 PM

|

|

QUOTE(sunakujiro^^ @ Oct 24 2015, 03:16 PM) ....... I read in a blog somewhere that he is generating 15k a month. How is that possible? How is UT long term investment if people can make thousand of cash in only weeks/months? below posts shows good illustrations of relativity....did the blogger said how much he invested? QUOTE(xuzen @ Oct 24 2015, 07:19 PM) Person A if capital is RM 1.5Milliom, in one mth fund price naik 1% only (very likely to happen) means profit RM 15k! Person B if capital is RM 15,000, fund naik even 50% in one mth (very unlikely to happen) still less than person A. That is why the rich can continue to be rich easily.... it is mathematical logic! Xuzen btw, FSM frequently updates the lists of top 5 best performers.....see how much returns it has.....if you managed to get into that......lump sum....HUAT-lah..... http://www.fundsupermart.com.my/main/fundi...formed=topFundsFSM frequently updates the lists of top 5 worst performers......see how much returns it has.....if you managed to get into that ...lump sum....POK KAI-lah.... http://www.fundsupermart.com.my/main/fundi...orst_Funds.svdoThis post has been edited by yklooi: Oct 24 2015, 08:34 PM |

|

|

|

|

|

SUSyklooi

|

Oct 24 2015, 08:52 PM Oct 24 2015, 08:52 PM

|

|

QUOTE(Ramjade @ Oct 24 2015, 08:33 PM) But if say you deposit rm1k/month and it didn't make loss, then at the end of 12 months, you will have >rm12k. Like that, it could fall to Rm9k right? YEs,....it could..... b'cos...the price of units and distributions payable, if any, may go down as well as up if one were to get this fund and top up monthly for > 2 years ....wondering how much is his "paper" losses and the emotional stress he had to endure, if he is not prepared or have the wrong impression/expectation of UT investment (thinking that there are "experts" to help monitor it and it "should be" safe or "from past performance track records" all the while were good) This post has been edited by yklooi: Oct 24 2015, 09:01 PM Attached thumbnail(s)

|

|

|

|

|

|

SUSyklooi

|

Oct 24 2015, 08:55 PM Oct 24 2015, 08:55 PM

|

|

What is the maximum amount you can lose? http://www.moneysense.gov.sg/Understanding...rusts.aspx#What is the maximum amount you can lose? |

|

|

|

|

) You invest in areas/segments which you think are under-represented in the portfolio. It may not be necessary to switch.

) You invest in areas/segments which you think are under-represented in the portfolio. It may not be necessary to switch.

Oct 22 2015, 04:38 PM

Oct 22 2015, 04:38 PM

Quote

Quote

0.0449sec

0.0449sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled