QUOTE(Vincent9696 @ Oct 14 2015, 12:13 PM)

Check back post Nos: 256 again for amendments. Thank you. Xuzen

Fundsupermart.com v12, Najibnomics to lift KLCI?

|

|

Oct 14 2015, 02:32 PM Oct 14 2015, 02:32 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

|

|

|

|

|

|

Oct 14 2015, 02:38 PM Oct 14 2015, 02:38 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(IvanWong1989 @ Oct 14 2015, 12:54 PM) all four funds also i have... LOL.... 1) In the long term, a good fund will give +ve ROI (all of them) - if lousy funds, the veteran investors here at LYN FSM thread would avoid it like the black plague and would have advised accordingly. although my nett is still -ve. but i can see diversification in action.. lol. one down the other balances. though... wanna ask.... if this +-+-+-, then means in the end also +- = 0? 2) In the short term, the +-+-+- will reduce (NB: cannot completely cancel) the portfolio ups and downs giving you a smoother ROI curve. A rational investor wants a smooth and upward rising curve. He/she will try to avoid a jagged saw-tooth curve. Xuzen |

|

|

Oct 14 2015, 02:58 PM Oct 14 2015, 02:58 PM

|

Senior Member

1,356 posts Joined: Dec 2006 From: Subang |

|

|

|

Oct 14 2015, 03:06 PM Oct 14 2015, 03:06 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Oct 14 2015, 03:23 PM Oct 14 2015, 03:23 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Oct 14 2015, 07:47 PM Oct 14 2015, 07:47 PM

|

Senior Member

1,356 posts Joined: Dec 2006 From: Subang |

tx bro 231

|

|

|

|

|

|

Oct 14 2015, 07:47 PM Oct 14 2015, 07:47 PM

|

Senior Member

1,356 posts Joined: Dec 2006 From: Subang |

tx bro 231

|

|

|

Oct 14 2015, 07:47 PM Oct 14 2015, 07:47 PM

|

Senior Member

1,356 posts Joined: Dec 2006 From: Subang |

tx bro 231

|

|

|

Oct 14 2015, 09:36 PM Oct 14 2015, 09:36 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

wanna believes... Downgraded US To 2.0 Stars "Unattractive" now same 2 stars rating as Thailand... Changes To Star Ratings 3Q 15: Lowered US, Holding Brazil & Thailand Over 3Q 15, we lowered our ratings on the US equity market, and kept ratings for Brazil and Thailand unchanged. iFAST Research Team ...... October 8, 2015 https://secure.fundsupermart.com/main/article/--10911 |

|

|

Oct 14 2015, 09:39 PM Oct 14 2015, 09:39 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(T231H @ Oct 14 2015, 09:36 PM) wanna believes... Downgraded US To 2.0 Stars "Unattractive" now same 2 stars rating as Thailand... Changes To Star Ratings 3Q 15: Lowered US, Holding Brazil & Thailand Over 3Q 15, we lowered our ratings on the US equity market, and kept ratings for Brazil and Thailand unchanged. iFAST Research Team ...... October 8, 2015 https://secure.fundsupermart.com/main/article/--10911 This post has been edited by David83: Oct 14 2015, 09:39 PM |

|

|

Oct 14 2015, 10:08 PM Oct 14 2015, 10:08 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

Pinky still believes in US market

|

|

|

Oct 14 2015, 10:27 PM Oct 14 2015, 10:27 PM

|

Junior Member

34 posts Joined: Dec 2006 |

may I know which bond fund do you recommend?

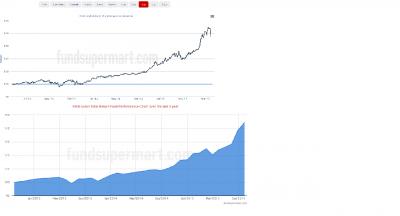

These are some of the funds recommended by fsm 1)RHB Asian total return fund --- the volatility seems to be very high 2) Eastspring investment bond ---- a spike in value (is it normal for a bond fund?) 3) RHB emerging market bond -- no comment? Actually how to read the performance chart posted on fsm?I thought it is actually the NAV , but it is no.... I think I may have misinterpreted reading the chart... and the chart appears to be different when i open using different chartcentre and factsheet *sorry the picture is unclear, I am using screenshot button + paint...i don know to screenshot picture other than using these Attached thumbnail(s)

|

|

|

Oct 14 2015, 10:36 PM Oct 14 2015, 10:36 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(larisSa @ Oct 14 2015, 10:27 PM) while waiting for Sifus to come and response,...I googled and found this...hope they can be of some help..Key Considerations When Investing In Bonds https://secure.fundsupermart.com/main/bond/...-in-bonds-10104 Bond Investing Myths https://secure.fundsupermart.com/main/bond/...ing-myths-10106 Investor Profile: Quick Start to Selecting a Bond for Investment https://secure.fundsupermart.com/main/bond/...nvestment-10408 |

|

|

|

|

|

Oct 14 2015, 11:04 PM Oct 14 2015, 11:04 PM

|

Senior Member

5,877 posts Joined: Sep 2009 |

|

|

|

Oct 14 2015, 11:09 PM Oct 14 2015, 11:09 PM

|

Senior Member

1,338 posts Joined: Sep 2012 |

|

|

|

Oct 14 2015, 11:10 PM Oct 14 2015, 11:10 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

Attached image(s)  |

|

|

Oct 14 2015, 11:13 PM Oct 14 2015, 11:13 PM

|

Senior Member

5,877 posts Joined: Sep 2009 |

|

|

|

Oct 14 2015, 11:16 PM Oct 14 2015, 11:16 PM

|

Senior Member

1,338 posts Joined: Sep 2012 |

QUOTE(guy3288 @ Oct 14 2015, 11:13 PM) I see GS US Equity already dropped quite alot from 0.85 to 0.78. For Titanic, If US market not doing well, fund manager can still move money to EU or JP. More diversified. Btw, don't buy funds because it is cheap. Need to see potential and risk also ma. Me also noobie. Hopefully Pinky don't bring me to Holland.Very tempting titanic got more potential? This post has been edited by ohcipala: Oct 14 2015, 11:18 PM |

|

|

Oct 14 2015, 11:20 PM Oct 14 2015, 11:20 PM

|

Senior Member

5,877 posts Joined: Sep 2009 |

|

|

|

Oct 14 2015, 11:24 PM Oct 14 2015, 11:24 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

sorry off topic...just read this....seems The 15 richest families in Malaysia control assets worth 76 percent of the entire gross domestic product (GDP) of the country Khazanah Research Institute Director Dr Muhammed Abdul Khalid said this at a Consumer Conference organised by the Federation of Malaysian Consumers Association yesterday. Read more: https://www.malaysiakini.com/news/315763#ixzz3oYXred1N |

|

Topic ClosedOptions

|

| Change to: |  0.0309sec 0.0309sec

0.72 0.72

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 04:23 PM |